🤺🇺🇸 Let The Trade War Begin

Happy Sunday,

This week, we’re diving into a major shift in global trade as new US tariffs ignite economic tensions with Canada, Mexico, and China. We’ll explore how these policies could impact everything from grocery prices to the stock market and why investors are paying close attention. Plus, insights into currency movements, supply chain disruptions, and what history tells us about past tariff battles.

Let’s get into it.

- Humphrey & Rickie

Market Report

The North American Trade War Begins…

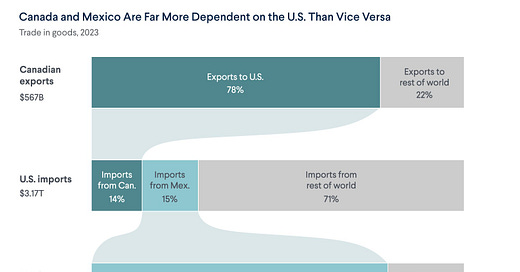

Over the weekend, President Donald Trump initiated a significant trade conflict by imposing new tariffs on major US trading partners: 25% on imports from Canada and Mexico, and 10% on Chinese products.

In response, Canada has announced retaliatory 25% tariffs on C$155 billion worth of US goods, while Mexico and China have also pledged countermeasures. Trump implemented these tariffs through the International Emergency Economic Powers Act, citing concerns about undocumented migration and illegal drugs, though energy imports from Canada will face a reduced 10% tariff to minimize impact on US fuel prices.

The economic implications of these tariffs are expected to be substantial. Bloomberg Economics estimates they will raise the average US tariff rate from 3% to 10.7%, potentially reducing US GDP by 1.2% while increasing core inflation by 0.7%.

The measures are particularly concerning for industries with integrated supply chains across North America, such as the automotive sector. The tariffs also eliminate the previous $800 de minimis exemption for small parcels from these countries, which could significantly impact online retail.

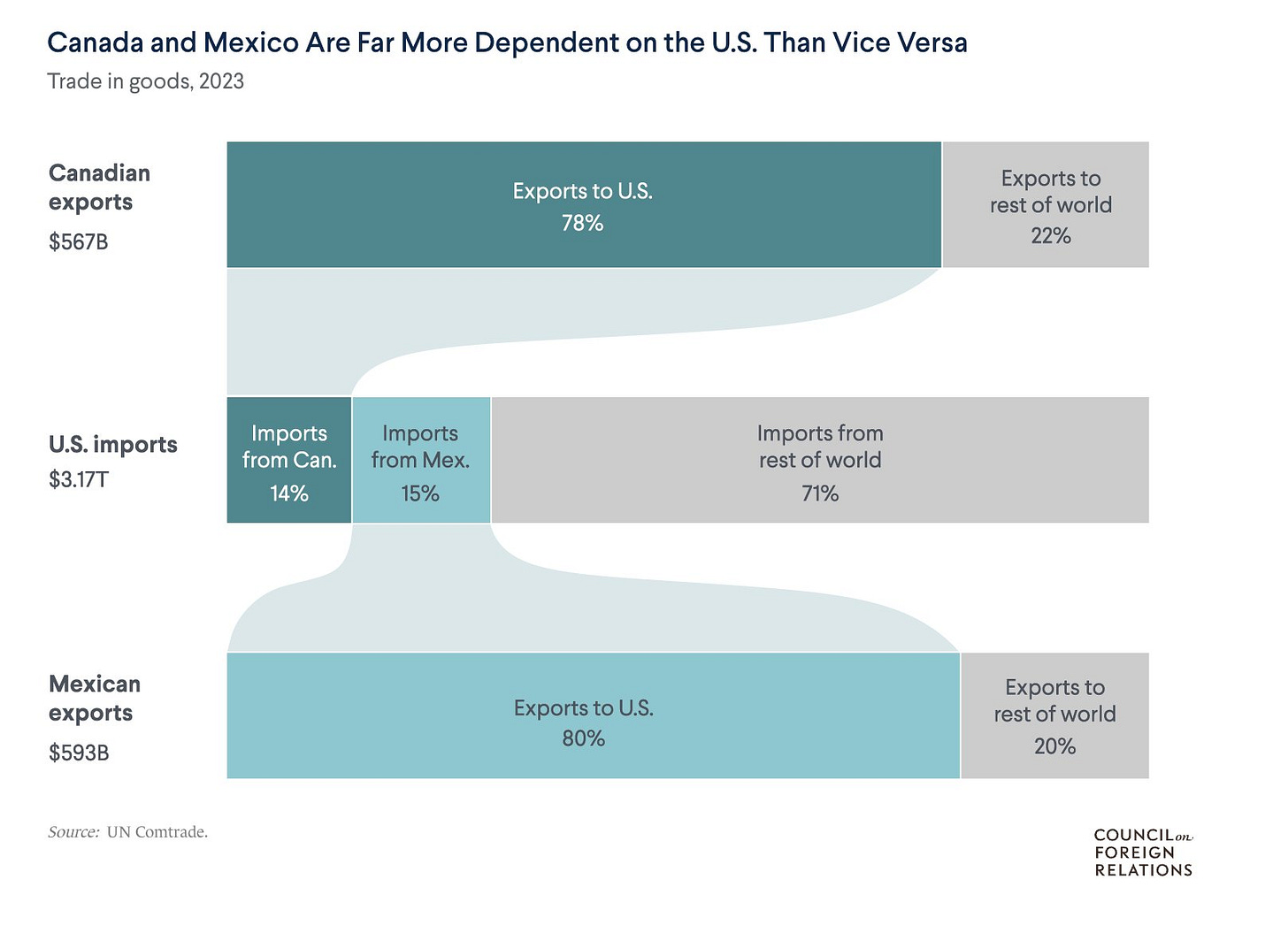

These actions have already affected currency markets, strengthening the US dollar while weakening the Mexican peso and Canadian dollar.

Both Canada's Trudeau and Mexico's Sheinbaum have strongly criticized the measures, with Trudeau specifically encouraging Canadians to buy local products and avoid US vacations.

How Tariffs Could Affect Products We All Buy and Use

In a worst case scenario, if the full cost of tariffs is passed on to consumers with no substitution to US-made goods, ING believes the impact could reach approximately $835 per person or $3,242 for a family of four.

About half of vegetables and 40% of the fruits the US imports are from Mexico. Mexico also supplies 90% of the avocados we eat.

Four in five beers that enter the US internationally comes from Mexico, so does half of all hard liquor the country imports. Canada is also a top supplier of distilled spirits including whiskey.

Almost half of the US imports of auto parts come from Canada and Mexico. Half of US imports of assembled cars come from Canada and Mexico.

China accounts for 30% of all US apparel imports.

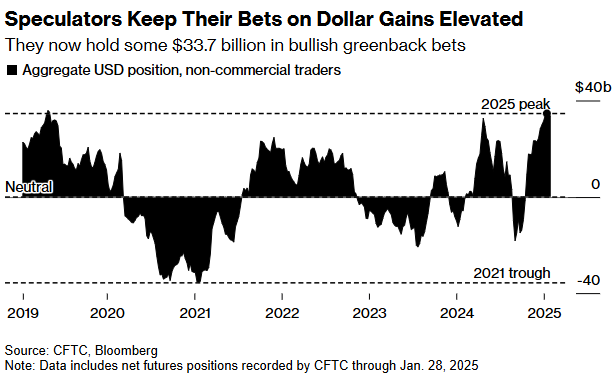

How Tariffs Could Affect the Stock Market

In order to figure out how these tariffs could affect markets, we went back and took a look at Trump's first administration, when similar tariffs occurred. In 2018, tariffs contributed to profit margin pressures and stock market declines, affecting both foreign and US companies.

During the previous tariff era (2018-2019), operating margin estimates fell by 70 basis points globally, though interestingly, non-US companies with high US revenue exposure outperformed their counterparts by 760 basis points.

The current situation could potentially present greater risks than in 2018, as international companies now have increased exposure to the US market. The 200 largest non-US companies (excluding financials and utilities) now earn an average of 27.4% of their revenue from the US, up from 24.9% in 2017.

Adding to these concerns is the strength of the US dollar, which has risen about 8% from its September low. There has historically been a negative relationship between mega-cap sector earnings like tech and the US dollar, which could pose major risks to markets in 2025.

Since 2010, consumer staples, communications, and tech have had the largest negative correlation between earnings growth and changes in the dollar.

Forecast Ahead

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day, you can support the channel and get access to a private community with other like minded investors.