🔻🧻 Labor Market Came In Soft as Charmin

Happy Sunday!

The market on Friday experienced a lot of turbulence and ultimately ended down because of the weak job reports we talk about in our Market Report section. The Fed leadership sees a 25bp cut as the base case for the September meeting but is open to 50bp cuts at subsequent meetings if the labor market continues to weaken.

In personal news, Rickie and I got back from VidSummit in Dallas Texas this past Friday…and are prepping for the week! Also on our travels next week is a trip to Switzerland to go to a Gold Factory to show you guys how raw-mined-gold is turned into a gold bar. That should be exciting and hopefully the conclusion of a busy month of travel!

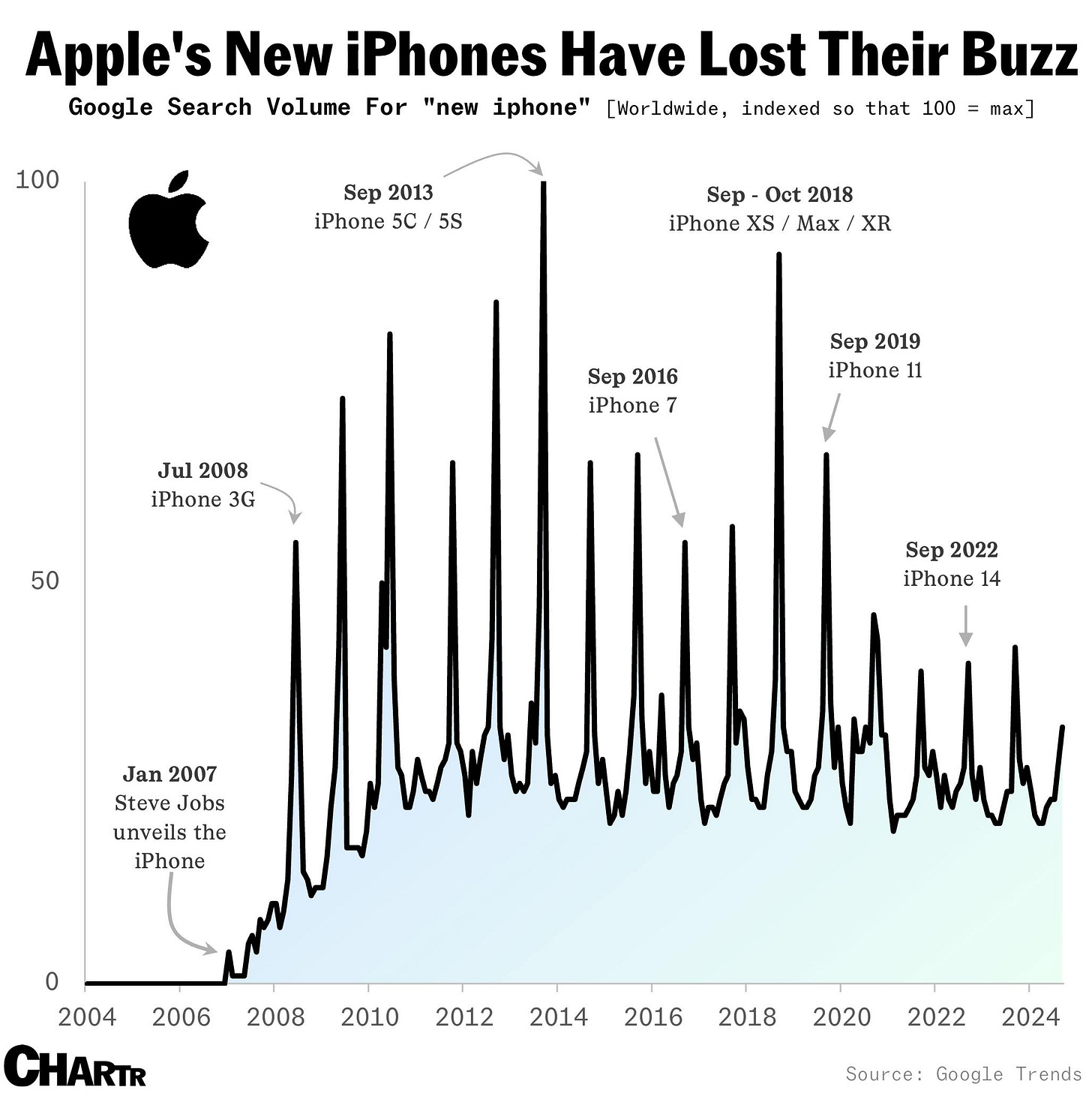

Hope you’re enjoying today and the NFL kickoff too. Tomorrow there’s another Apple Event with rumors of the new iPhone being announced (again? Felt like yesterday that we had one of these).

— Humphrey

Market Report

Weak Jobs Report Solidifies Rate Cut Coming Soon…

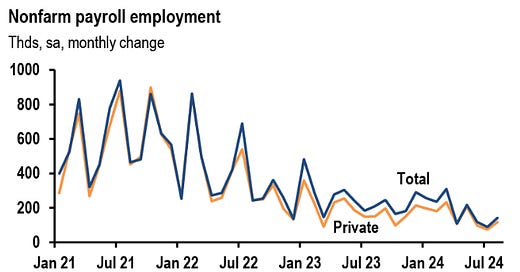

The U.S. economy added 142,000 jobs in August, falling short of analyst expectations of 165,000 and marking a slowdown in hiring compared to previous months.

The unemployment rate edged down to 4.2%, the first decline in five months. However, the three-month average for job gains is now at its lowest since mid-2020, indicating a softening labor market.

Key sectors like manufacturing, retail trade, and information saw job losses, while education and healthcare hiring slowed significantly.

These figures, along with downward revisions to previous months' data, have intensified debates about the Federal Reserve's approach to interest rate cuts.

Fed Governor Waller and New York Fed President Williams’ both spoke last Friday, suggesting that the Fed leadership sees a 25bp cut as the base case for the September meeting but is open to 50bp cuts at subsequent meetings if the labor market continues to deteriorate.

The Fed Fund futures market is currently pricing a 70% chance of a 25 bps cut in September and a 30% chance of a 50 bps cut. If the futures market is accurate, we could see up to 125 bps worth of cuts over the next 3 FOMC meetings.

My personal perspective (Tim) is that it is highly unlikely the Fed will cut 50 bps and it seems that the market is pricing too many cuts for this year (avg. ~40 bps a cut). The last time the Fed cut 50+ bps was Covid and before that, 2008. Unless there is an immediate emergency that calls for large cuts, the Fed will likely cut 25 bps and lean towards conservatism unless there is a urgent issue that requires larger cuts.

The State of America’s Wallet

Americans are experiencing a complex financial landscape, with overall income levels rising since 2019, even after adjusting for inflation, yet many do not feel financially better off due to the impacts of the pandemic, inflation, and rising interest rates.

While average 401(k) balances have increased, and cash in wallets has also risen, the savings rate has dropped significantly.

Credit card debt has climbed, with average balances now higher than pre-pandemic levels, and rising interest rates make carrying this debt more costly.

Additionally, the costs associated with car ownership and housing have surged, with homeowners benefiting from increased equity while renters face escalating prices.

Companies Are Racing to the US Debt Markets

U.S. corporations are borrowing at a record pace despite the Federal Reserve's benchmark interest rate remaining at a two-decade high.

In early September 2024, companies sold nearly $80 billion in new bonds over just a few days, with an additional $28 billion in leveraged loans.

This surge in borrowing is driven by expectations of imminent Fed rate cuts, which have already lowered borrowing costs for investment-grade companies to around 4.8%, down from 6.4% in October 2023.

Companies are seizing this opportunity to refinance existing debt, extend maturities, and fund mergers and acquisitions, rather than waiting for potentially lower rates in the future.

While this borrowing spree might seem risky, it appears to be focused on refinancing rather than accumulating new debt, which should help address concerns about future defaults if economic conditions worsen.

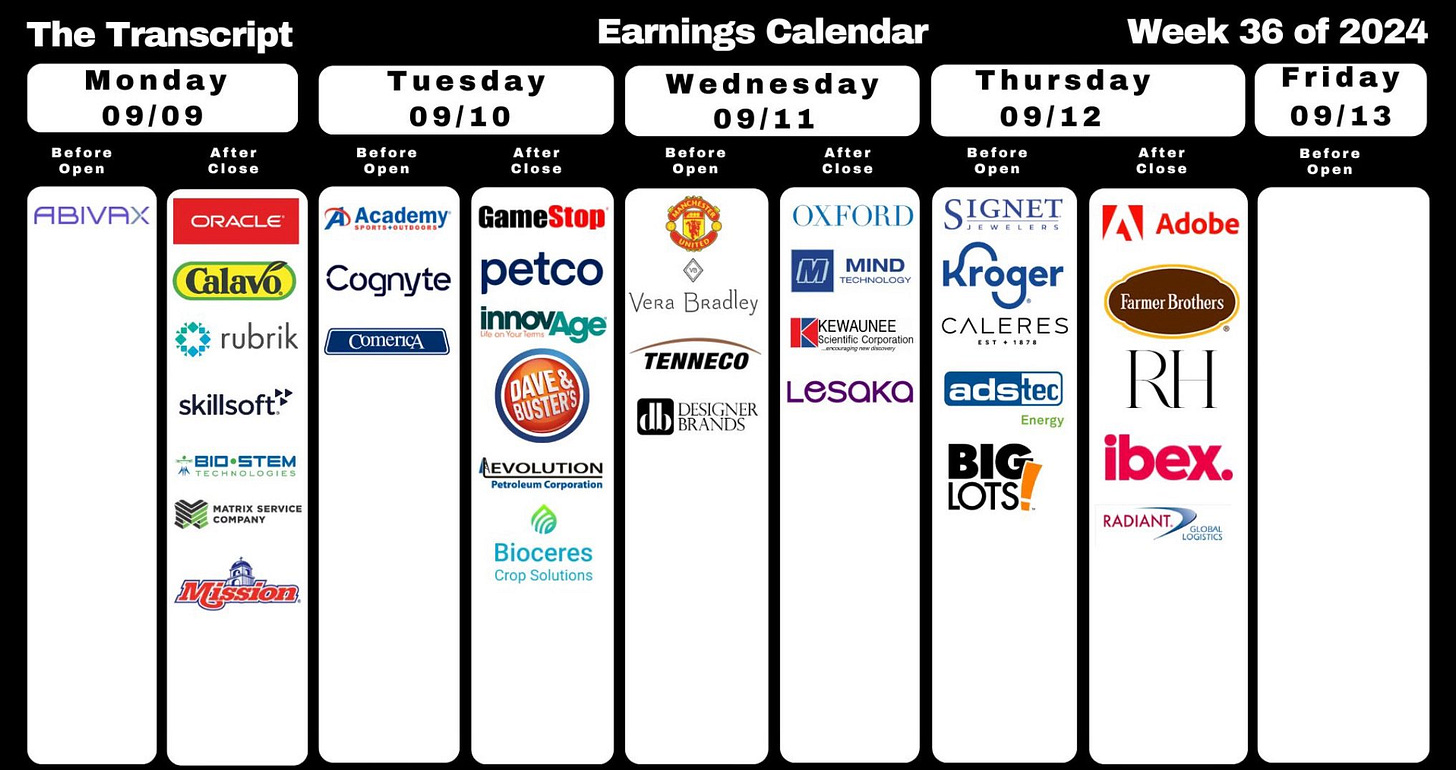

Forecast Ahead

“The labor market is on the front burner for Fed policymakers as price pressures have cooled. The August CPI report [this Wednesday] is expected to show a measure of core inflation, which strips out food and energy, rose by 0.2% for a second month. On a year-over-year basis, the core CPI probably increased 3.2%, matching the annual figure for July that was the smallest since 2021.” - Bloomberg

Other US data in the coming week include August producer prices, weekly jobless claims and the University of Michigan’s preliminary September consumer sentiment survey.