🇺🇸💸 JPow Offers Up Crucial Guidance: Read More

Hi all and happy Sunday!

In today’s edition we’re going over the latest Fed meeting, as well as showing you some statistics about the unemployment rate and inflation rate as of late.

While there are a lot of memes and controversies about the banking system as of late, FDIC insurance is still proving to be the one thing we can count on. So if you are depositing within a bank, make sure you are not keeping too much cash in excess of the FDIC insurance provided to you ($250k normally). Some of the online banks with high-yield savings will have higher FDIC insurance coverage through multiple partner banks - and in those cases, you are going to be just fine as well. Lastly, if you have deposits at a big four bank (Wells Fargo, Chase, BofA, Citi) you’re fine too. Here’s an FAQ about FDIC insurance if you’re curious.

Let’s not waste any time and get straight into the primer for this week!

— Humphrey, Tim, Rickie

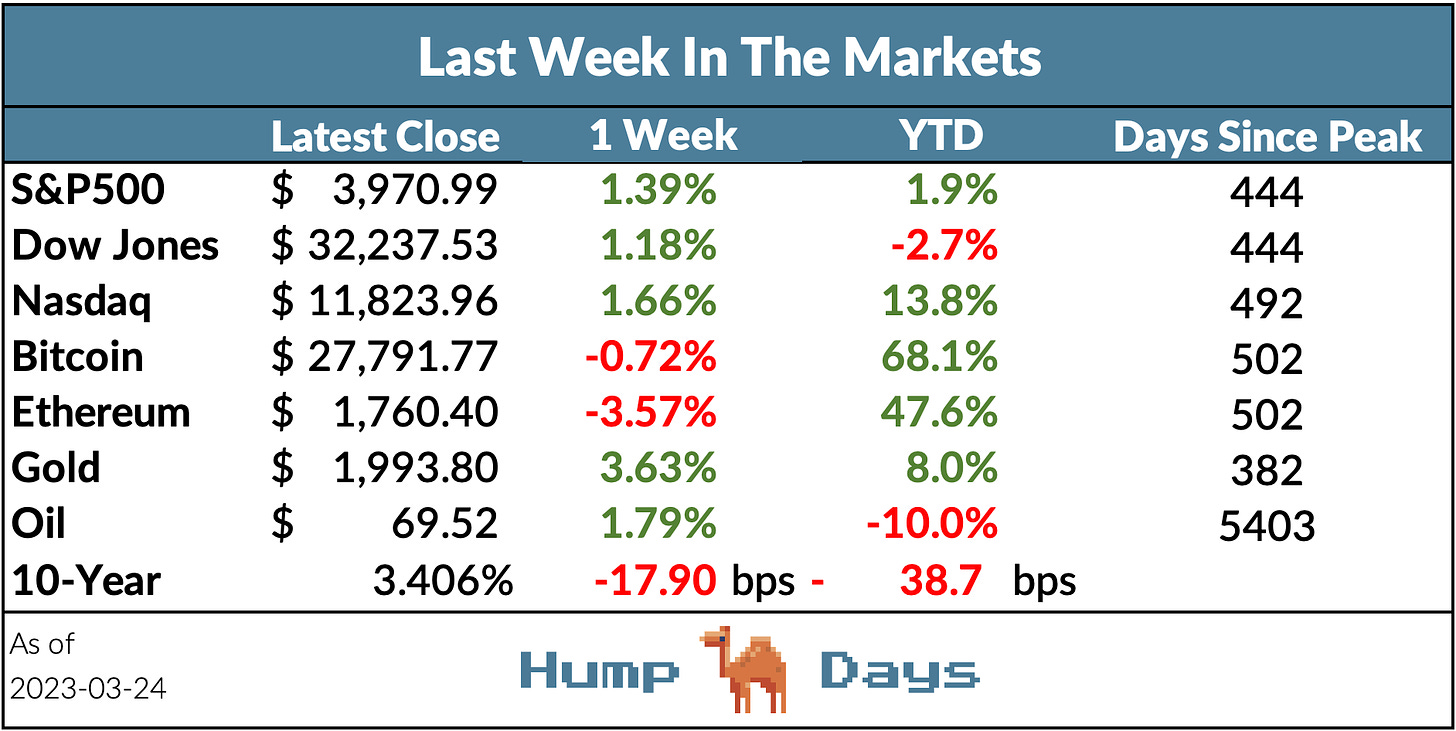

Market Report

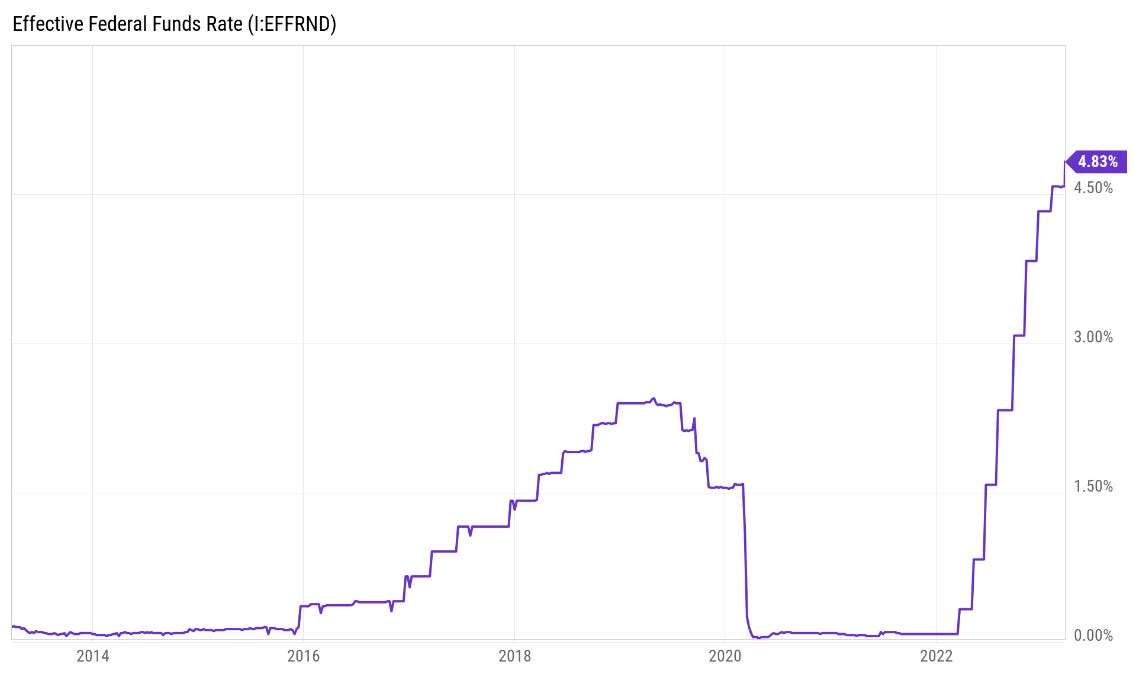

This past week, amidst the fears of a banking crisis, the Fed raised rates by 25 bps to 4.75% - 5.00%. The majority of Fed officials believe that there will be just one more 25 bps rate hike this year before a pause. However, the market believes that the Fed will not raise rates again and will cut rates 4 times this year.

In Jerome Powell’s remarks to reporters, it was very clear that the banking crisis was top of mind and that they weren’t too sure how the crisis would develop.

“We believe, however, that events in the banking system over the past two weeks are likely to result in tighter credit conditions for households and businesses, which would in turn affect economic outcomes. It is too soon to determine the extent of these effects and therefore too soon to tell how monetary policy should respond.”

“We will closely monitor incoming data and carefully assess the actual and expected effects of tighter credit conditions on economic activity, the labor market, and inflation, and our policy decisions will reflect that assessment.”

“Such a tightening in financial conditions (referring to tighter credit conditions due to recent banking stress) would work in the same direction as rate tightening. In principle, as a matter of fact, you can think of it as being the equivalent of a rate hike or perhaps more than that".”

In regards to the decision to insure uninsured depositors, Jerome Powell stated that it was “really not about those specific banks, but about the risk of a contagion to other banks and to the financial markets more broadly”.

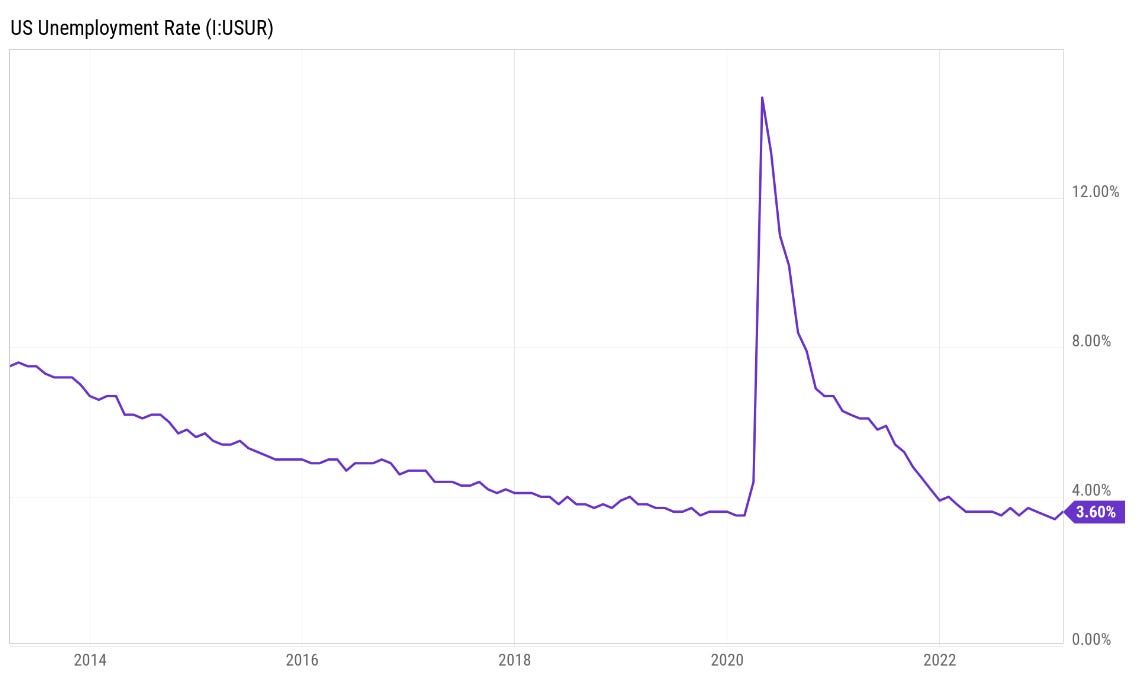

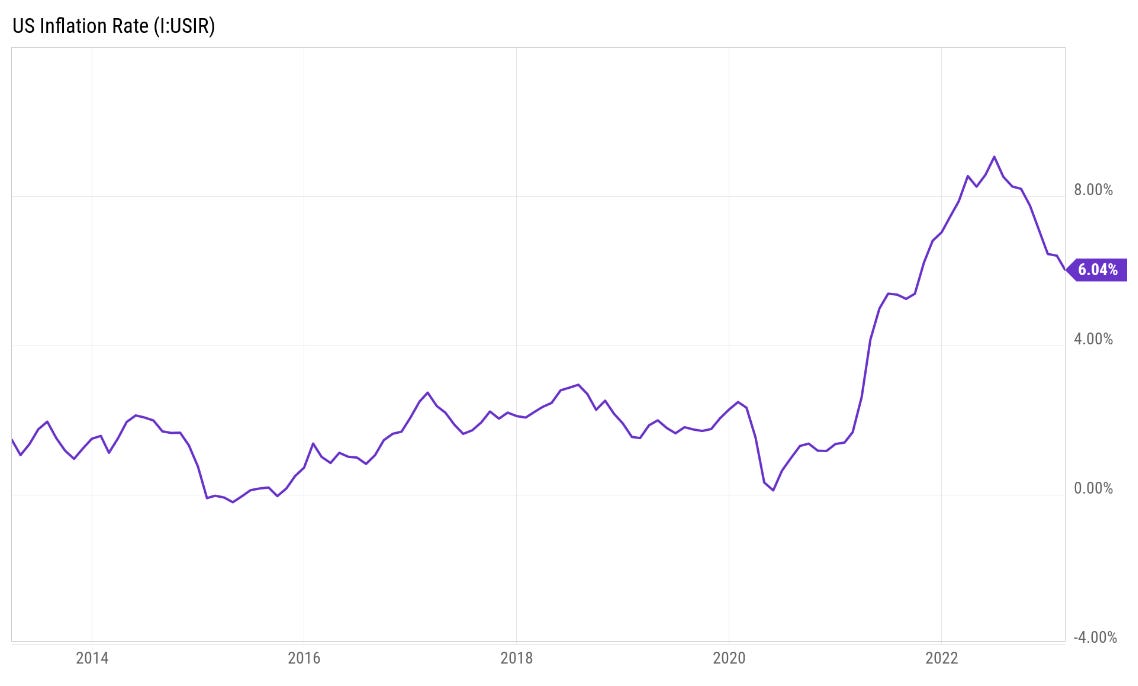

Jerome Powell also emphasized that bringing down inflation would likely require a slowdown in economic growth and a softer labor market. He’s been saying this for quite some time though - so nothing new here. Below are the latest unemployment and inflation numbers.

Silvergate Bank, Silicon Valley Bank, Signature Bank, Credit Suisse, and now PacWest Bank?? The California-based bank has lost 20% of its deposits since the start of the year and has borrowed over $15bn from the federal government in order to shore up liquidity.

Like Silicon Valley Bank, PacWest is exposed to tech startups and venture capital, which explains why its stock has declined by about 65% over the past two weeks.

“As we look ahead, we have continued confidence in the strength of PacWest and are encouraged by the stability we have seen in our deposits and liquidity over the past week. Additionally, we continue to be encouraged by the clear message from government officials, regulatory agencies, and industry leaders, including Secretary Yellen’s recent remarks regarding the protection of smaller bank depositors.” - PacWest President and CEO

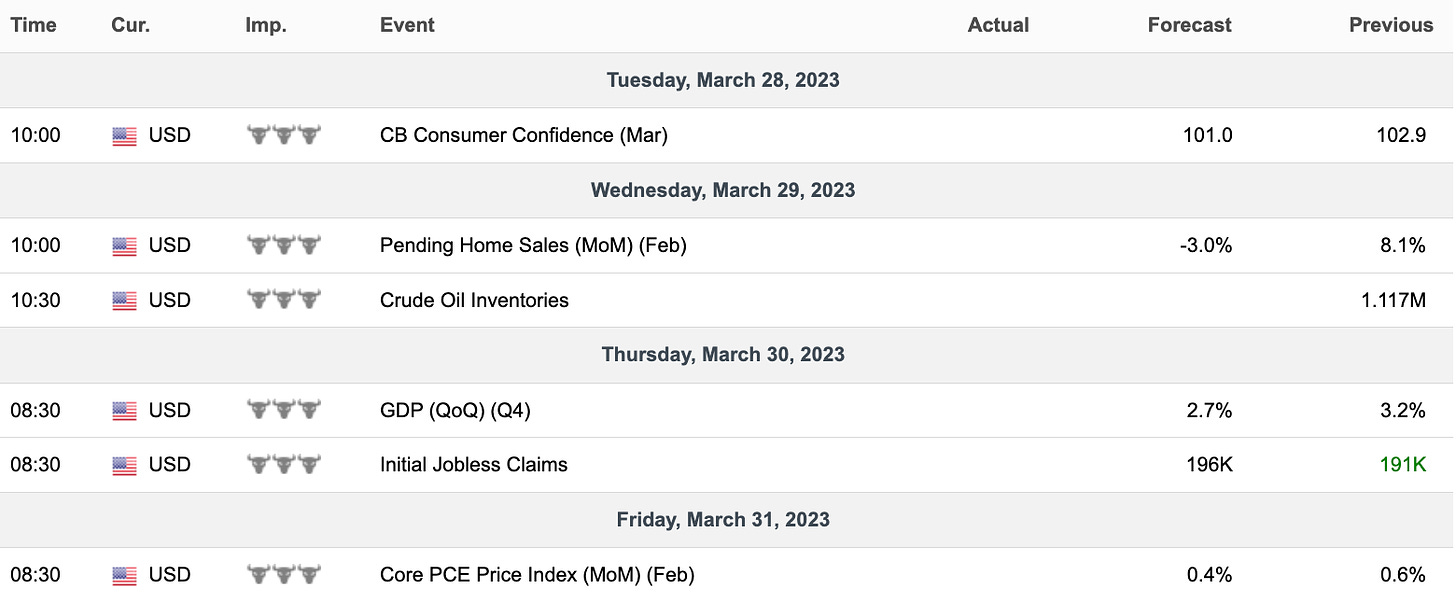

Forecast Ahead

Big Number

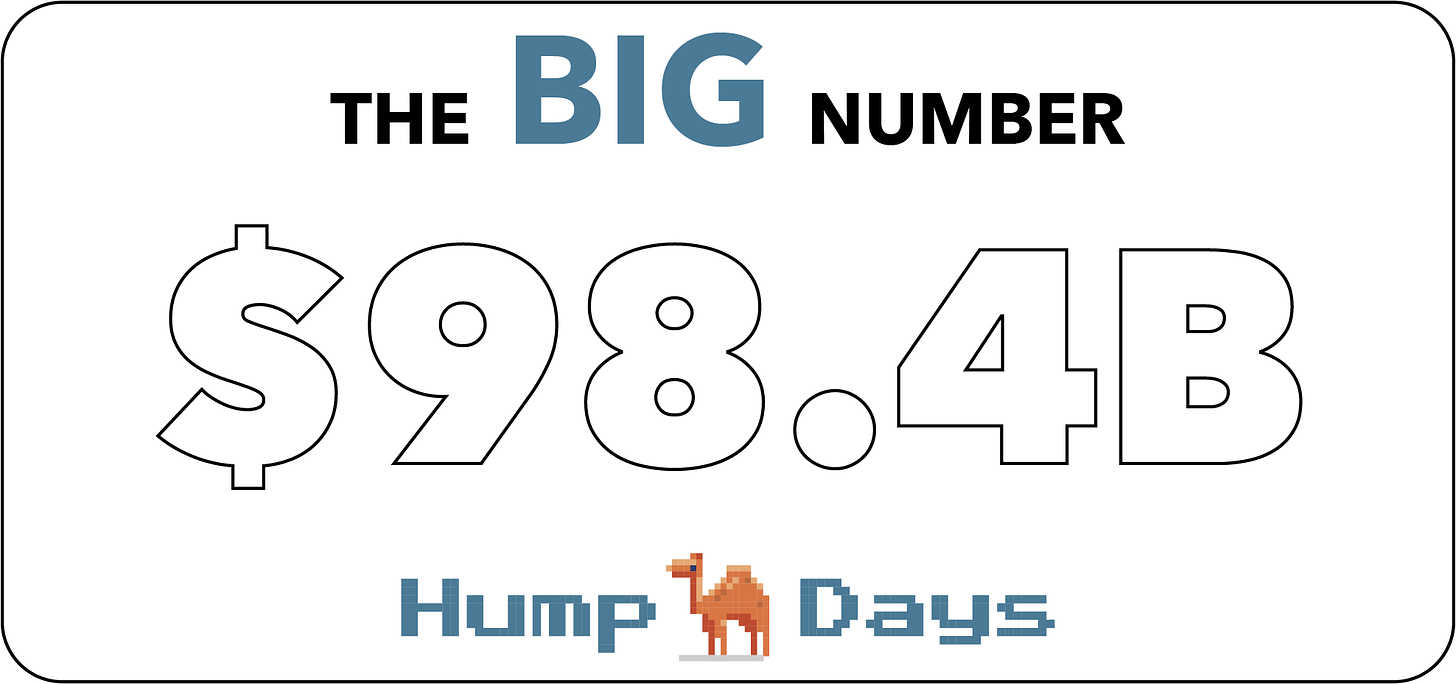

In the week ended March 15th, bank deposits fell by $98.4 billion to $17.5 trillion, the largest decline in nearly a year. What’s fascinating is that this decline was largely due to a flight from small banks. Deposits at small banks slumped $120 billion, while those for the 25 largest banks rose almost $67 billion. There’s clearly a fear that small banks have the highest risk of collapse.

Memes of the Week

Partnerships

If you are a brand looking to reach thousands of business leaders and investors through our two weekly newsletters, we would love to hear from you!