🙅♂️🔻 Job Openings Hit Two-Year Low

Happy Wednesday all,

The holidays are just around the corner so hopefully you have gifts already picked out/are picking them out soon if you’re planning on exchanging gifts this season! I’m a little behind this year because we’re trying to get some more uploads out on the channel but I’m going to sort things out this weekend!

We have an interesting video coming up about leasing vs buying a car so keep an eye out for that upload.

Enjoy this week’s Hump Days!

- Humphrey, Rickie & Tim

👀 Eye-Catching Headlines

📱 Apple’s market cap closes above $3 trillion (CNBC)

🏥 Fitch and Moody’s diverge on financial future of hospitals (Bloomberg)

🇳🇱 Dutch chip company ASM to build $324M U.S. base in Arizona (Bloomberg)

🎵 Spotify to lay off 17% of staff, its third round of job cuts this year (WSJ)

🧠 Meta’s AI chief doesn’t think AI super intelligence coming anytime soon (CNBC)

👋 Ex-OpenAI director still doesn’t ‘fully know’ why board forced out Altman (CNBC)

🇨🇦 Bank of Canada holds its benchmark interest rate, says data show economy ‘no longer in excess demand’ (Yahoo!)

The Weekly Brief

1. Job Openings Hit Two-Year Low in Cooling to Be Welcomes by Fed (Bloomberg)

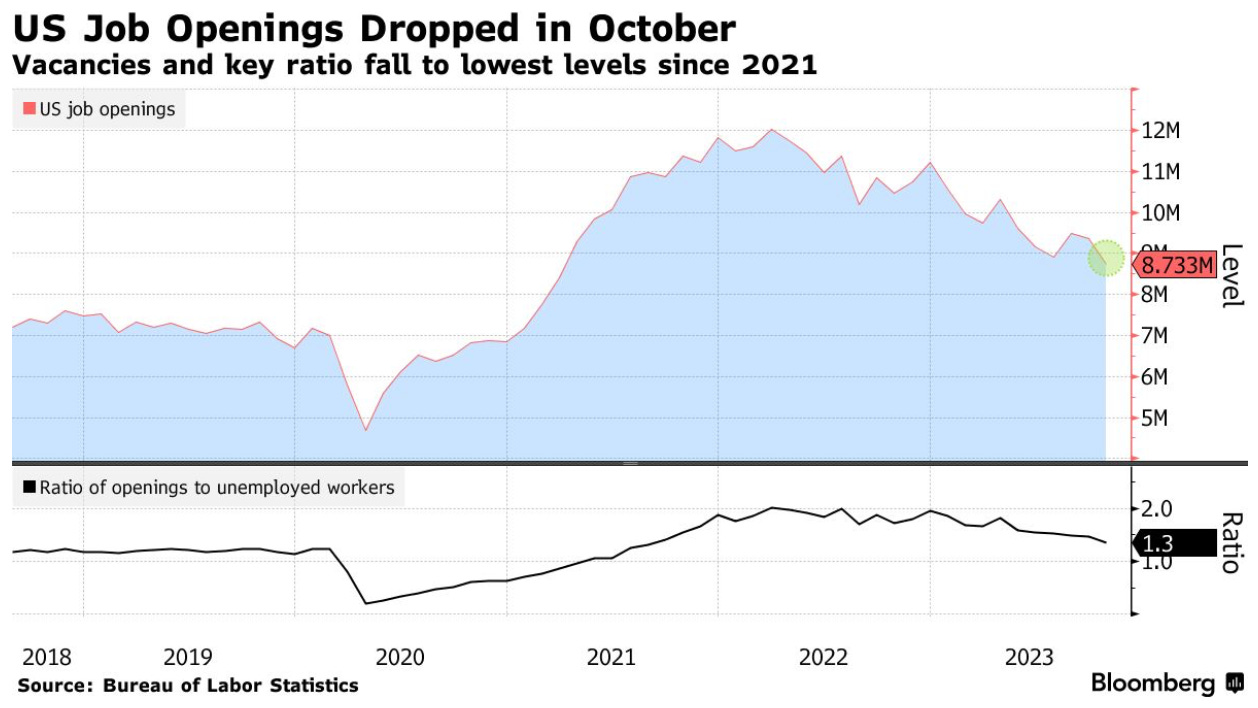

U.S. job openings pulled back in October to the lowest since early 2021.

Available positions decreased to 8.7M from 9.4M last month, according to data from the Bureau of Labor Statistics on Tuesday.

With interest rates remaining elevated to tamp inflation, the Fed is looking to soften the labor market by lessening demand for workers rather than employers cutting jobs.

The rate at which people quit their jobs is also stabilizing, and it has been at the lowest level since early 2021.

This is important because, at its peak, millions of Americans were quitting their jobs, reflecting confidence in their ability to secure new positions.

2. Apple’s Ideal Credit Card Partner to Replace Goldman Sachs is Chase (Bloomberg)

Apple and Goldman Sachs are gearing up to split due to the strain the credit put on Goldman’s balance sheet, contributing to billions in losses.

This is compounded by engineering problems during development, complaints about gender discrimination on credit limits and approvals, and long customer service hold times.

Goldman already reported that it was winding down its consumer business, and Apple recently offered Goldman a deal to get out of their contract early.

During the initial pitch, JPMorgan, American Express, and Citigroup all passed, leading Apple to work with Goldman, which had little consumer product experience at the time.

However, the landscape has changed with millions of users using the Apple Card and more than $10B worth of deposits in related savings accounts.

3. Bond Market Euphoria Shifts to Debate Over How Low Fed Will Need to Go (Bloomberg)

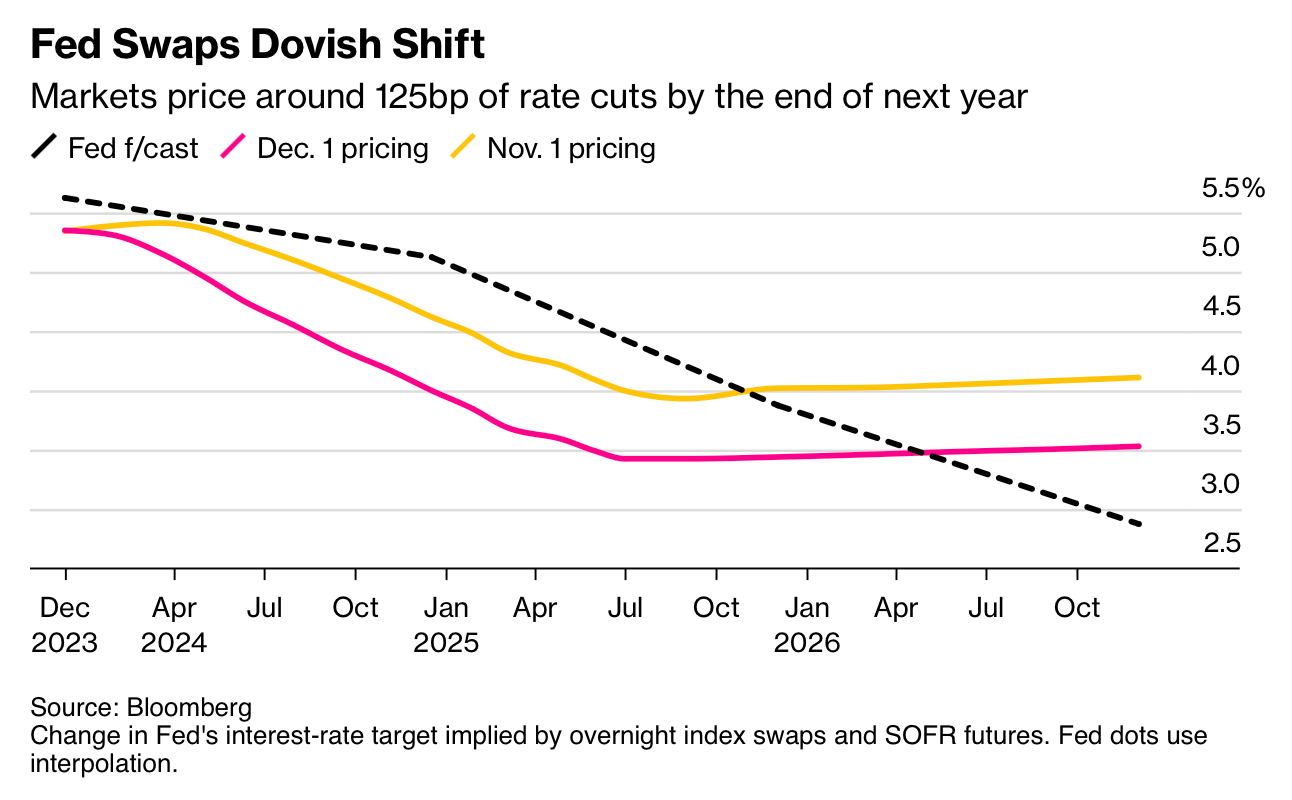

The bond market is convinced the Fed’s rate-rising cycle is over, turning the conversation to when cuts will start and by how much.

Current market expectations call for at least 1.25bps of easing next year.

Moving forward, we await the upcoming U.S. consumer inflation data and the start of the Fed’s final two-day meeting for the year.

Bloomberg Economics anticipates:

Unemployment approaches 5% by year-end, kicking off a mild recession.

The Fed will have enough clarity about the downturn to cut rates in March 2024.

The Fed likely will cut rates by a total of 125bps in 2024 and another 125bps in 2025.