👨💻🐌 Job Market Slowed in June

Happy Sunday,

Hope you had a great holiday weekend!

This week, we have portfolio roast #3 coming out on the channel. This has been such a fun series to do and I hope you guys are getting great value in watching it as well.

Enjoy this week’s Sunday Primer!

— Humphrey, Tim, Rickie

Market Report

US Payroll Growth Slows and Jobless Rate Ticks Up to 4.1%

In June, U.S. hiring and wage growth slowed, with nonfarm payrolls increasing by 206,000, surpassing economists' expectations of 190,000.

The unemployment rate rose to 4.1%, its highest level since late 2021, as more people entered the labor force.

Average hourly earnings cooled, with wage growth continuing to decelerate. The report also included significant downward revisions of 111,000 jobs for the previous two months.

These developments, along with recent moderation in inflation, have strengthened expectations that the Federal Reserve may begin cutting interest rates in the coming months, possibly as soon as September.

Health care and government sectors saw the majority of job gains, while temporary-help employment saw a significant decline, and manufacturing payrolls decreased the most since February.

Big Banks Are Taking Hits From Commercial Real Estate

While news coverage regarding commercial real estate (CRE) has been focused on troubled small banks, recent data suggests that larger banks are currently experiencing more significant issues with CRE loans than smaller banks.

According to S&P Global Market Intelligence's Q1 analysis, banks with over $100 billion in assets reported a 4.4% delinquency or nonaccrual rate for non-owner-occupied CRE loans, compared to rates below 1% for smaller banks and owner-occupied loans.

This disparity is attributed to larger banks' greater exposure to properties intended for leasing, which are more sensitive to interest rate fluctuations and changing market conditions.

While smaller banks have higher overall exposure to CRE loans, larger banks seem to be facing more immediate challenges, particularly with office loans nearing maturity.

Tesla Beats Estimates With Less-Drastic Drop in EV Sales

Tesla's second-quarter deliveries for 2024 exceeded analysts' expectations, despite marking the company's second consecutive quarterly decline.

The electric vehicle maker delivered 443,956 vehicles, surpassing the average Wall Street estimate of 439,302.

Despite facing challenges such as an aging product lineup and increased competition, Tesla's resilience in the face of industry headwinds has impressed investors.

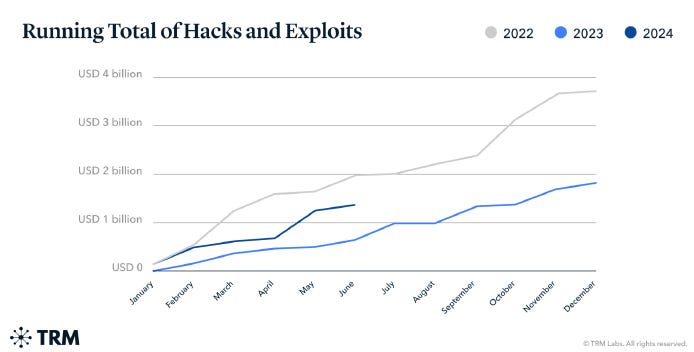

Crypto Stolen by Hackers Doubles to $1.38 Billion In First Half of 2024

Cryptocurrency thefts have surged in the first half of 2024, with hackers stealing $1.38 billion, more than double the amount stolen in the same period of 2023, according to blockchain intelligence firm TRM.

Five large attacks accounted for 70% of the stolen funds, consistent with the pattern observed in previous years. The primary methods used by hackers include gaining unauthorized access to private keys and seed codes.

The largest attack in 2024 so far targeted the Japanese crypto exchange DMM Bitcoin, resulting in the theft of over $300 million worth of Bitcoin.