🪑🤔 Insiders Staying on the Sidelines

Happy Sunday,

September’s job growth smashed expectations, but a lot of that came from some creative government adjustments. Seasonal tweaks and a low survey response rate mean the real picture might not be as rosy as it seems.

Meanwhile, despite a strong stock market, corporate insiders are staying on the sidelines, buying fewer shares than usual. And Google’s dominance in search is starting to feel the pressure from TikTok and new AI startups. Plenty to dig into this month, so let’s get started!

- Humphrey & Rickie

Market Report

Jobs Report Blows Out All Estimate, Boosted by Government Adjustments...

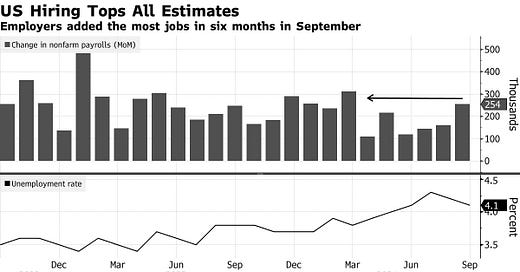

US job growth in September beat out all estimates as the unemployment rate declined and wage growth accelerated, but a lot of the jobs were actually just adjustments made by the government.

Nonfarm payrolls increased by 254,000 in September versus the estimate of 150,000, the most in six months, following an upwardly revised 72,000 over the prior two months.

The unemployment rate fell to 4.1% and hourly earnings increased 4% from a year earlier.

From Bloomberg: “The Bureau of Labor Statistics, which compiles the employment report, uses a model to fine-tune the raw change in payrolls to better account for seasonal factors, like summertime fluctuations when teachers are off, construction jobs are booming and restaurants hire additional staff. That way, the numbers are more easily comparable month to month.”

September’s seasonal factor, which is calculated by dividing the seasonally adjusted jobs number by the unadjusted number, was the largest for any September in records dating back to 2002.

Another factor that may have contributed to the abnormally high jobs number is the jobs survey’s response rate. Just 62.2% of businesses in the sample filed responses on time for the first estimate, the lowest for any September since 2002.

Corporate Insiders Are Sitting Out the 2024 Stock-Market Rally

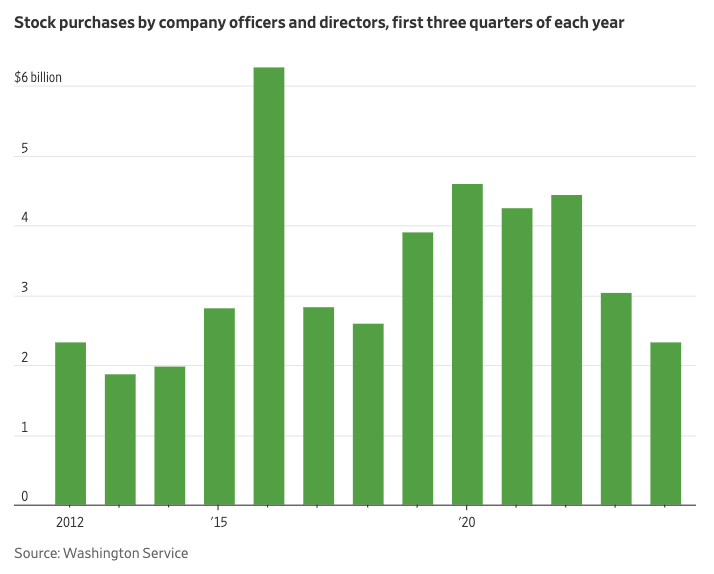

Markets have done great this year, notching the best first nine months of a year for the S&P 500 since 1997, but corporate insiders have been quiet.

Of all U.S. companies with a transaction by an officer or director in July, only 15.7% reported net buying of company shares, according to InsiderSentiment.com. This was the lowest level in 10 years.

Officers and directors of U.S. companies bought $2.3 billion of their companies’ stock this year through September, the lowest amount since 2014.

Last year, they bought $3 billion in the first nine months.

Google’s Grip on Internet Search Slips as TikTok and AI Startups Bring Challenges

Google's dominance in the search advertising market is facing increasing challenges from rivals and new technologies.

According to research firm eMarketer, the tech giant's share of the U.S. search ad market is expected to drop below 50% next year for the first time in over a decade.

Competitors like TikTok and AI-powered startups like Perplexity are introducing new ad products that directly target Google's core business. Meanwhile, Amazon continues to grow its share of product search advertising.

Forecast Ahead

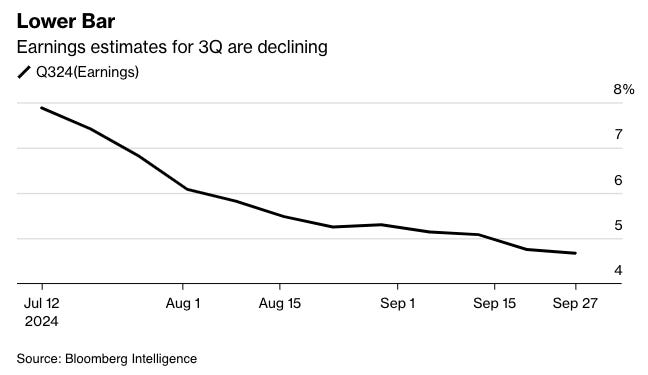

“Companies in the S&P 500 are expected to report a 4.7% increase in quarterly earnings from a year ago, according to data compiled by Bloomberg Intelligence. That’s down from projections of 7.9% on July 12, and it would represent the weakest increase in four quarters.” - Bloomberg