🔍🔥 Google’s Ad Empire Under Fire

Happy Wednesday all,

Hope you are well. If you read the previous newsletter, I wrote that my dad was in the hospital so I had admittedly been not working as much and was distracted. I’m happy to report that he is progressing and improving nicely since Sunday, and on a slow road to recovery. He’s been in the hospital since last Wednesday, the doctors are keeping a good eye on him and we have family members with him every day. For all those that wrote to me via email, or just reached out - thank you. I’ll continue to keep you updated - and fingers crossed we don’t run into any setbacks!

Let’s get back into the normal swing of things in today’s edition. The Fed just announced that they will hold rates steady as it notes rising uncertainty and stagflation risk, but we have a bunch of other headlines in today’s edition too.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

AMD beats on earnings but will take $1.5 billion hit to revenue from chip restrictions to China (CNBC)

China announces sweeping measures to ease policy in bid to shore up trade-war hit economy (CNBC)

India says it carried out military strikes against Pakistan as tensions spiral after Kashmir killings (CNBC)

U.S. Trade Deficit Hits Record as Companies Front-Load Pharmaceuticals (WSJ)

WeightWatchers Files Bankruptcy to Adapt to Chemically Induced Weight-Loss Future (WSJ)

Disney Raises Profit Forecast on Strong Parks, Streaming (BBG)

The Weekly Brief

China Cuts Rates To Boost Economy As US-China Trade Talks To Start This Week

In response to increasing economic pressures by the trade war with the US, China's central bank reduced its seven-day reverse repurchase rate from 1.5% to 1.4% and announced a 0.5 percentage point cut to the reserve requirement ratio for lenders.

These measures are designed to lower borrowing costs and inject approximately 1 trillion yuan ($139 billion) in long-term liquidity into the financial system.

These monetary easing actions coincided with an announcement that China and US officials will hold their first trade talks since the US imposed tariffs of up to 145% on most Chinese goods, to which Beijing responded with tariffs of 125%.

US Treasury Secretary Scott Bessent and US Trade Representative Jamieson Greer are set to meet with Chinese Vice Premier He Lifeng in Switzerland to discuss de-escalating the tariff standoff.

While the US expressed a desire for "fair trade" rather than decoupling, China urged the US to "show sincerity" and resolve concerns through equal consultation.

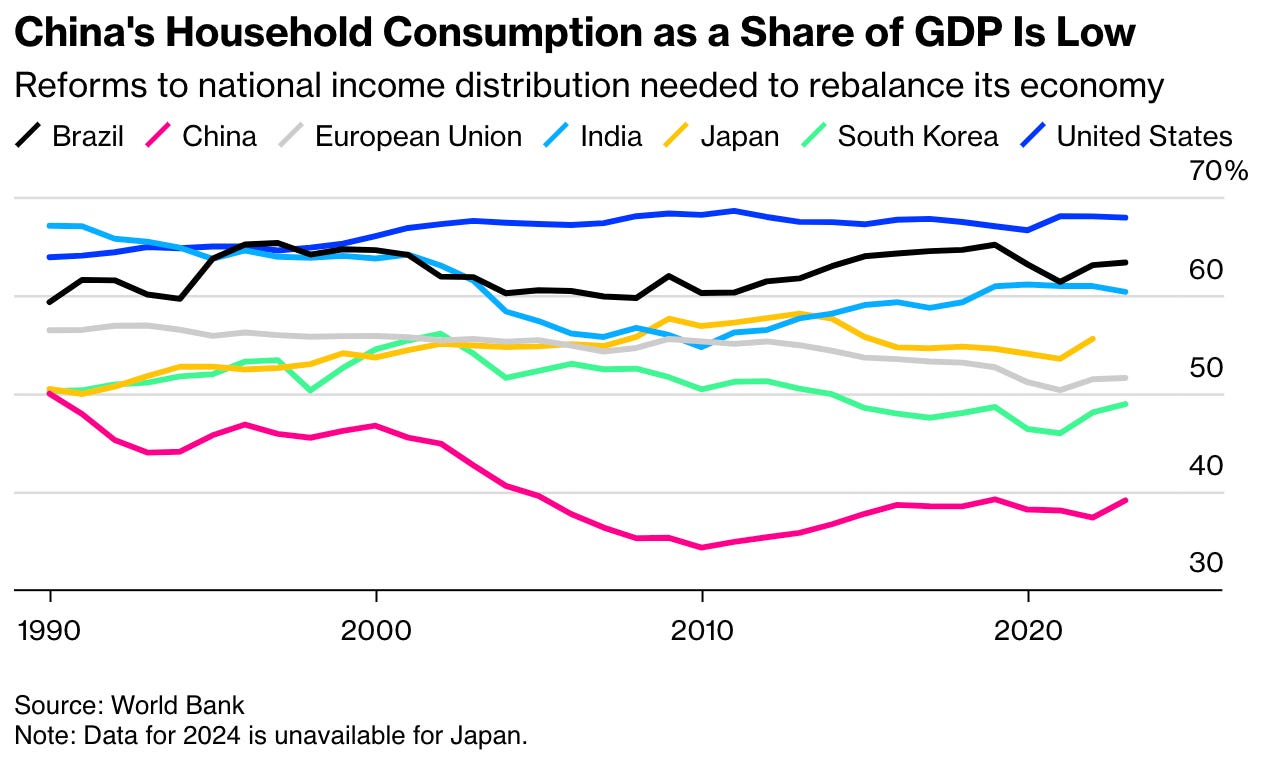

The trade tensions and tariffs are creating significant uncertainty, particularly for Chinese businesses and consumers. Factory activity has seen its sharpest contraction since December 2023, and there are concerns about widespread job losses, potentially affecting millions in export-oriented sectors.

Despite government efforts to boost domestic consumption through subsidies and financial aid, many Chinese citizens are reportedly tightening their belts due to worries about job security and future income.

U.S. Trade Deficit Hits Record as Companies Stock Up

In March, the U.S. trade deficit surged by 14% to a record $140.5 billion, largely driven by businesses stockpiling imported goods, particularly pharmaceuticals, computer accessories, and auto parts.

The value of imported goods reached $346.8 billion, with pharmaceutical products accounting for a substantial portion of the $22.5 billion rise in imported consumer goods.

This rush to import goods also contributed to a record goods deficit of $163.5 billion for the month, which was partially offset by a $23 billion surplus in services trade.

Economists believe this surge in imports and the resulting record deficit are likely temporary effects of "front-running" the tariffs, and anticipate that the trade deficit will narrow in April as cargo shipments from China slow.

While some businesses may have continued to stockpile in April during a 90-day pause on certain "reciprocal" tariffs, the overall expectation is that companies will start to draw down these inventories.

US Seeking Forced Sale of Google Ad Technology Products

Following a court ruling that found Google illegally monopolized markets for online advertising technology, the U.S. Department of Justice is urging a judge to compel Google to divest two key components of its ad business.

Specifically, the DOJ has requested the immediate sell-off of Google's advertising exchange, AdX, and a phased divestiture of its publisher ad server, which helps websites sell display advertising.

The agency argues that these sales are necessary to terminate Google's unlawful monopolies and address the "illegal scheme" through which they were obtained.

Google has contested this, proposing instead to make its ad exchange compatible with rival technologies and to operate under the supervision of a compliance monitor for three years, arguing that divestiture is not an appropriate remedy in this case.

The DOJ also seeking the divestiture of its Chrome web browser in a separate case alleging monopolization of online search. A hearing on the proposed remedies for the ad tech case is scheduled for September with a judge who previously ruled that Google violated antitrust law in the ad exchange and publisher ad server markets.