Happy Wednesday all,

This week is packed with shifts across markets and industries. Walmart’s strong holiday outlook is bolstering its stock, while the EV market faces uncertainty as President-elect Trump considers ending federal tax credits. Meanwhile, Bitcoin continues to break records, crossing $80,000 amidst a crypto-friendly shift in Washington.

And on the tech front, Google’s Chrome browser may soon face a forced sale as antitrust measures ramp up—a decision that could shake up its $20 billion valuation. From surging consumer sentiment to major corporate moves, let’s dive into the stories shaping this week!

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

SpaceX completes sixth Starship flight, splashes down both booster and spacecraft (CNBC)

Mike Tyson, Jake Paul fight was the most-streamed sporting event ever, Netflix says (CNBC)

Russia says Ukraine attacked it using U.S. long-range missiles, signals it’s ready for nuclear response (CNBC)

American Companies Are Stocking Up to Get Ahead of Trump’s China Tariffs (WSJ)

Things Are Quiet in Consumer Credit. Too Quiet. (WSJ)

Comcast to Spin Off Cable-TV Channels Like MSNBC, USA (BBG)

Blackstone Agrees to Acquire Sandwich Chain Jersey Mike’s (BBG)

The Clandestine Oil Shipping Hub Funneling Iranian Crude to China (BBG)

The Weekly Brief

Walmart Raises Outlook on Strong Spending From Value-Seekers

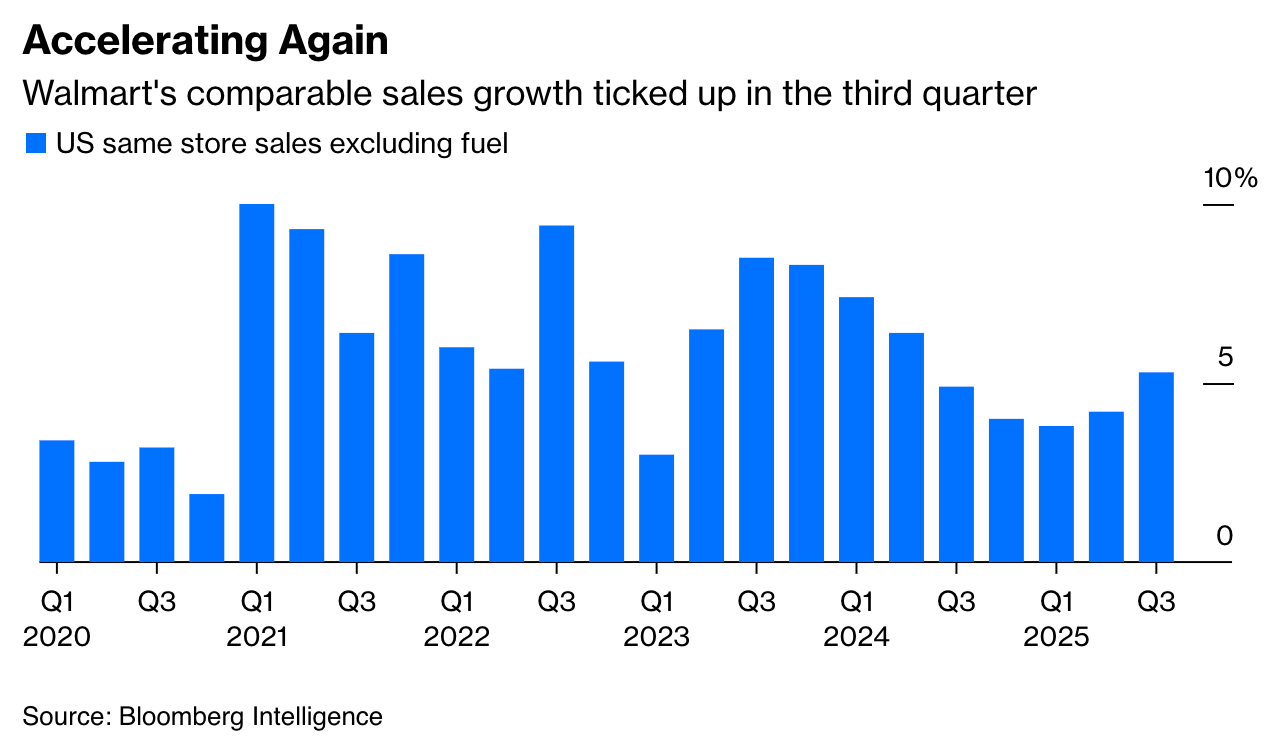

Walmart raised its outlook for the year after a strong start to the holiday season and robust demand from U.S. consumers seeking value. The company now expects net sales to increase by 4.8% to 5.1% for the year, up from its previous guidance of 3.75% to 4.75%.

This positive forecast, along with stronger-than-expected sales, led to a significant boost in Walmart's share price. Walmart shares are up nearly 65% year-to-date, significantly beating the S&P 500 Index.

The company's success is due to several factors, including increased spending per transaction, particularly from upper-income households earning $100,000 or more per year.

Walmart has also seen growth in its e-commerce division, with online sales now representing about 18% of the company's business.

Despite economic uncertainties and cautious consumer behavior, Walmart has managed to maintain strong performance, beating Wall Street forecasts for comparable sales throughout the year.

The Clock Is Ticking for Cheap EVs After Trump’s Win

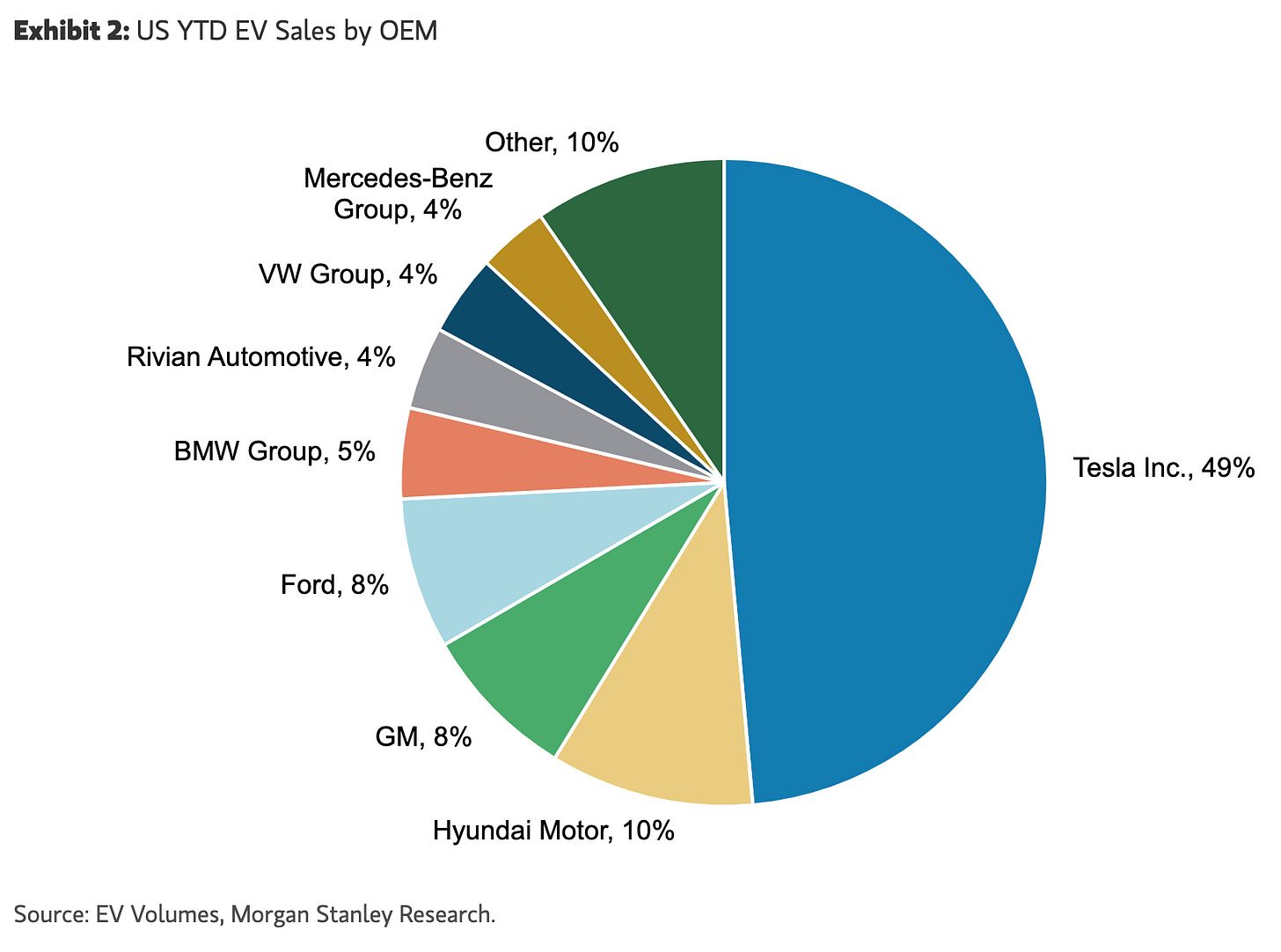

President-elect Donald Trump is considering the elimination of the $7,500 federal tax credit for electric vehicle purchases, a move that could significantly impact the EV market and traditional automakers.

Reports indicate that Trump's transition team plans to revoke this incentive, which was part of the Inflation Reduction Act enacted by President Biden in 2022.

Elon Musk, CEO of Tesla, has expressed support for abolishing the credit, arguing that it would benefit Tesla by disadvantaging competitors like Ford and General Motors, who rely more heavily on such incentives to sell their vehicles.

Currently, Tesla is the only automaker profiting from its EV sales in the U.S., while legacy automakers struggle with losses in this sector due to lower sales volumes and production inefficiencies.

If the tax credit is removed, consumers may need to act quickly to purchase or lease EVs before prices rise, as the credit has been a significant factor in making EVs more affordable.

According to Morgan Stanley, “The removal of the full $7,500 government tax credit of such would translate to a ~16 or 17% price increase felt by the consumer if not offset by Tesla incentives. We could see demand elasticity largely reflected in volume”.

Goldman Sachs notes that “the direct impact of the IRA credits to Tesla’s overall earnings in 2026 will be a mid-single digit to mid-teens percent”.

Google’s Chrome Worth Up to $20 Billion If Judge Orders Sale

The U.S. Department of Justice is preparing to recommend significant measures against Google following a federal judge's ruling that the company illegally monopolized the search market.

These proposals include potentially forcing Google to sell its Chrome browser, which could be valued at $15-20 billion, and implementing data licensing requirements.

The Justice Department also plans to suggest decoupling Google's Android smartphone operating system from its other products and imposing restrictions on how Google uses website content for its AI products.

The proposed sale of Chrome is particularly significant as it's a key component of Google's advertising business, allowing the company to collect user data for targeted promotions.

Google has criticized these proposals as a "radical agenda" that could harm consumers, developers, and American technological leadership.

The company plans to appeal the August ruling and argues that selling Chrome would reduce investment in the browser and potentially end its free availability.

The final decision on these remedies is expected by August 2025, following a hearing in April 2025.

You’ll Find This Interesting

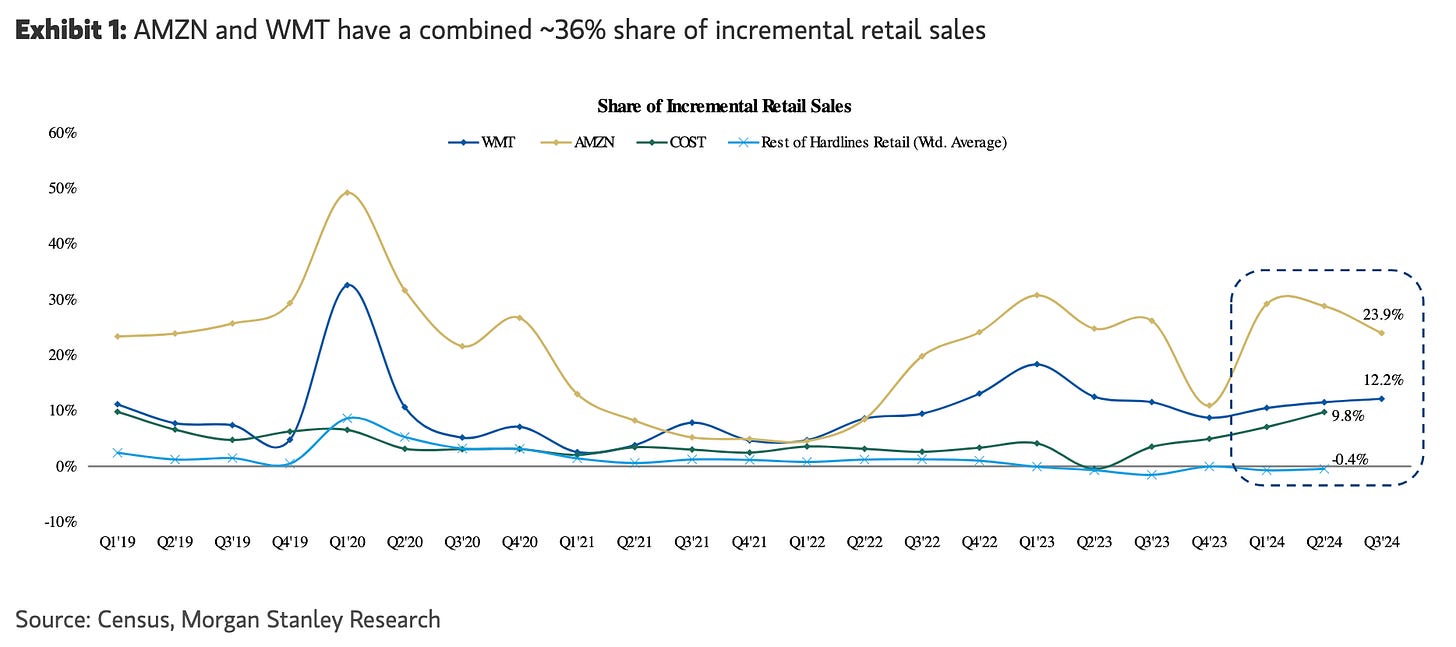

Per Morgan Stanley, Amazon and Walmart together capture around 36% of every incremental dollar in retail sales. Specifically, Amazon accounts for approximately 24% and Walmart for 12.2% of the growth in overall retail sales.

Both companies are also influential in the e-commerce space, driving around 73% of every incremental dollar in online retail sales.

In Q3 2024, Amazon led with a 55% share of incremental e-commerce sales, while Walmart followed with 18.3%.

Together, they generated about $14 billion of the $19 billion in incremental retail sales during that quarter.