👾🚀 Global Arms Race for Chips Intensifies + Mother's Day

Happy Sunday & Happy Mother’s Day,

An important lesson that I frequently talk about is the mistake of not staying invested in the market. That’s because the majority of gains in your portfolio will come from a few select days in the market. Take a look at this bar chart:

You can see that if you stay invested - all the days, your balance would be over $1,080,000 dollars. If you miss JUST the 5 best days in the market in the time period, your gains would be 38% less, thats a huge impact for just not being invested. And the data doesn’t lie: missing the best 10 days of the market loses you 55% of your hypothetical gains, missing 30 of the best days loses you 83% of your gains, and missing 50 of the best days in the market loses you 93% of your gains.

Obviously, not being invested at all is probably the worst decision, but the impact of being invested is influenced heavily by being invested on the best performing days of the market. You cant afford to lose those best days, because a lot of the gains for your portfolio will be from staying invested. Most of the time, the stock market is boring. Some days you’re up 0.5%, some days you’re down 0.5%, and you might see long stretches of flat-performance. But over time, your portfolio will grow - and not missing the best days is a huge reason for that.

The lesson is to be more systematic and less emotional when it comes to investing. Timing the market isn’t also going to be your friend. The easiest thing to do is just to set your investments, and forget it.

I hope this helps! Have a great week ahead.

— Humphrey, Tim, and Rickie

Market Report

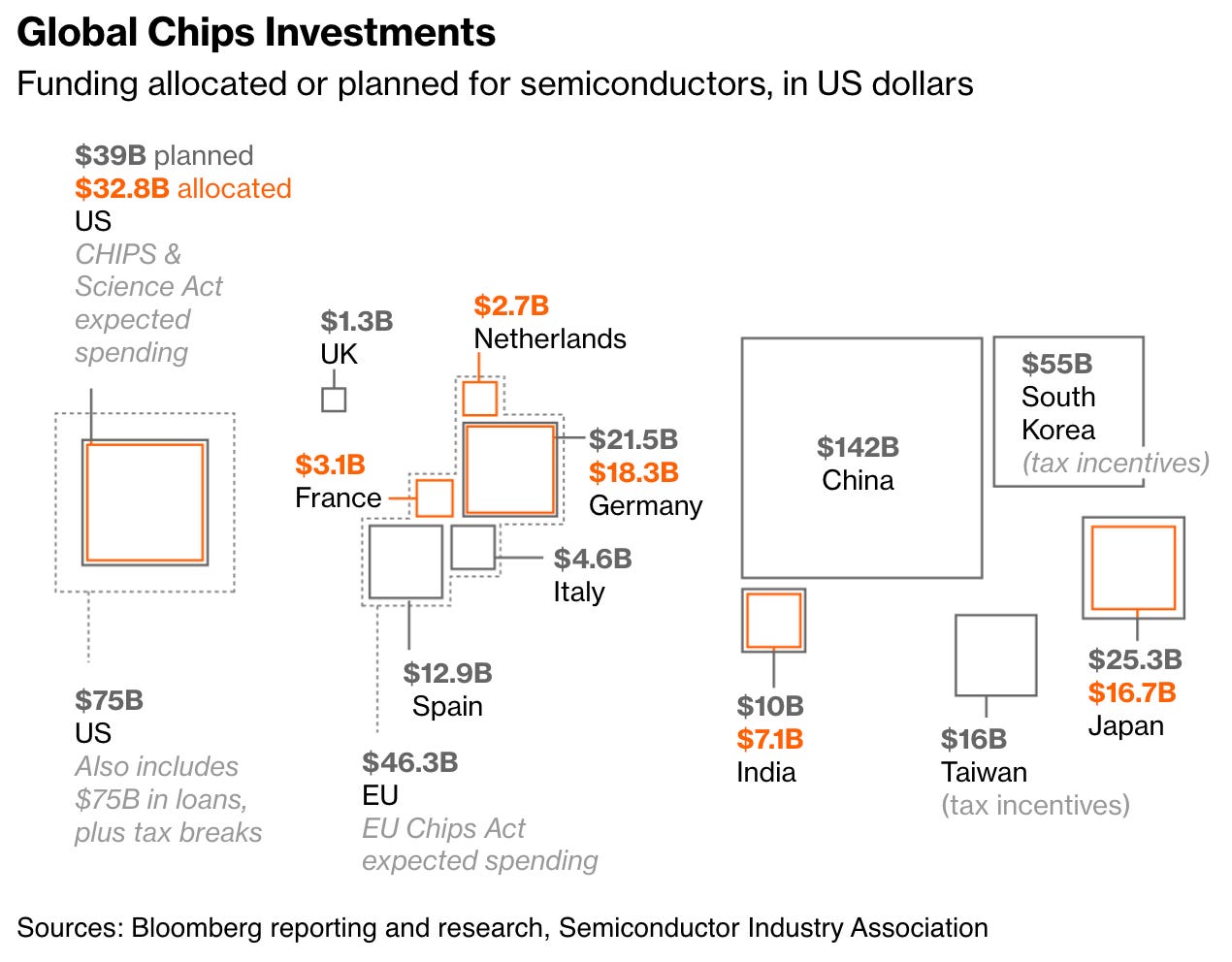

Global Chips Battle Intensifies With Surge in Subsidies

The US and European Union, alongside other nations, are investing billions in semiconductor production, intensifying the technological rivalry with China. The US, through President Biden's initiatives like the Chips and Science Act, has earmarked close to $380 billion, with $39 billion in grants and additional funding.

China is on track to spend more than $142 billion, with over 200 semiconductor firms in the country. China now has more semiconductor plants under construction than anywhere else in the world, building production of legacy chips.

The looming risk of a Chinese invasion of Taiwan, a key hub for semiconductor production, is a major driver behind the global push to boost chip manufacturing capacity.

Taiwan, home to TSMC and a supplier of 90% of the world's most advanced chips, faces the threat of disruption to chip supplies in the event of an invasion. The Semiconductor Industry Association forecasts that the US could eventually capture 28% of this market by 2032, making it the second-largest producer after Taiwan.

Chicken Wings Are the New Inflation Hedge

The rising price of beef has led to a surge in chicken consumption among Americans, with sales volumes of all U.S. chicken products up about 3% compared to the prior year.

This shift is driven by consumers seeking cheaper alternatives as the share of their incomes spent on food hits a three-decade high.

As consumers flock to chicken, restaurants are also boosting chicken options to drive sales. Fast-food chains are seeing increases in chicken sales, with Wingstop reporting a 21.6% increase in domestic same-store sales in its latest quarter.

Despite the current surge in chicken consumption, industry officials warn that chicken prices may not remain depressed for long, as demand increases and supplies thin, leading to rising wholesale chicken prices.

Dividend Payouts Are Latest Sign of Big Tech’s Financial Muscle

Tech firms, after years of focusing on growth, are now embracing dividends as a way to return excess cash to shareholders, signaling their financial strength.

Companies like Alphabet, Meta Platforms, and Salesforce have recently introduced dividends, leading to significant stock price rallies.

Despite their small yields, dividends are seen as a way to encourage long-term ownership and can add up over time. Microsoft’s yield is around 0.7%, but that has added up. Over the past 20 years, shares have climbed about 1,500%. Including dividends, however, the rally tops 2,400%.