The Briefcase is a newsletter offering comprehensive, easy-to-follow personal finance guides. Personal finance covers a wide array of topics, and the internet is filled with a lot of noise. Use The Briefcase to arm yourself with financial literacy without having to search far and wide for it.

Hi all! In today’s paid edition we are going through the differences between a high yield savings account and treasury bills. These are two of the safest places you can put your money, as high yield savings accounts are FDIC insured, and Treasury Bills are backed by the US Government.

HYSAs

How They Work

HYSAs are savings accounts that offer interest rates higher than a traditional savings account. They have an Annual Percentage Yield (APY), which is the amount of compounding interest in a year. Simply put, compound interest is interest on interest. It’s money that you get on top of your principal, usually every month. The higher the APY, the more your account will grow.

The best HYSAs are insured by the FDIC (Federal Deposit Insurance Corporation), meaning that if your bank fails, your money will be protected. Interest rates can change at any point with an HYSA but usually remain very competitive. Online banks usually offer the best HYSAs, like Discover, Ally, or SoFi, to name a few. With an HYSA, you can link your checking account and transfer money through your bank’s app or website.

Pros of HYSAs

Better returns than a traditional savings account

Act like a savings account, so you can continue to make deposits and grow your balance

Easily accessible because you can link your online HYSA to another bank or credit union to transfer and take out your money

Great for growing your balance short-term, like saving up for a down payment or vacation

Relatively risk-free, backed by the FDIC

Compare this to investing in the stock market, where your annual return could be higher than a HYSA, but it’s unpredictable.

Very flexible, meaning you can take the money out at any time without penalties

Cons of HYSAs

Not great for long-term goals or saving for retirement

This is because while you’re getting a high interest rate, it still won’t necessarily outpace the rate of inflation.

HYSAs can also have stricter requirements than a typical savings account, like minimum deposit or balance requirements.

Be sure to watch out for limits on withdrawals and deposits - some only allow 6 per month, so make sure you know your bank’s terms before getting dinged with extra fees. HYSAs are not created equal; look for ones without these requirements.

Rates fluctuate, so they can drop at any point.

The interest earned is taxed.

You’ll get a 1099-INT tax form at tax time for the interest you’ve received on the account.

Example of Using a HYSA for a Short-Term Goal

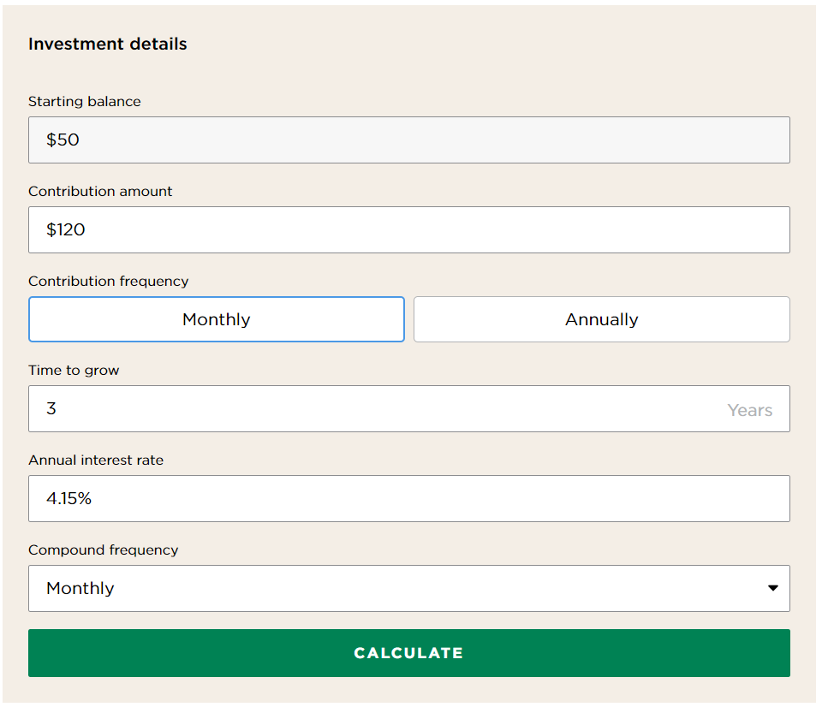

Let’s say you want to save up $4,500 to take a vacation in 3 years. You open up a HYSA, where the rate is 4.15% and compounds monthly. You start with an initial deposit of $50 and put away $120 per month.

In 3 years, you’ll have the $4,500 for your vacation, plus some extra due to the interest you’ve earned. Compare this to a traditional savings account that has a .49% rate. In 3 years, you wouldn’t have enough for the trip and would have to be depositing more per month to hit your vacation goal.

The difference between the two is simply which type of account you choose, making HYSAs a clear superior pick. Remember that the bigger the initial deposit and the more you can put away each month, the more interest you’ll rack up, and the faster you’ll reach your goal.

T-Bills

How They Work

T-bills are similar to HYSAs because they also earn higher-than-average returns, but they work very differently. They’re basically loans to the U.S. government, backed by the Department of the Treasury, so they’re considered to be safe, conservative investments with predictable returns. When you buy a T-bill, you’re giving the government money that they use to fund various public projects, like constructing schools or improving infrastructure. You essentially get an IOU from the government until the maturity date. T-bills mature in 52 weeks or less, so they’re very short-term investments.

How Do T-Bills Make You Money?

Keep reading with a 7-day free trial

Subscribe to Hump 🐪 Days to keep reading this post and get 7 days of free access to the full post archives.