🇪🇺😟 From Job Gains to Euro Pain

Happy Wednesday all,

US job openings are defying expectations with a strong rebound, signaling steady labor demand, while the euro inches closer to parity with the dollar, stirring debates about trade and inflation in Europe. At the same time, higher education faces mounting pressure as a new report warns of an impending surge in college closures.

From headline-making moves like BlackRock’s $12 billion acquisition to Amazon’s ambitious leap in AI, this week’s stories highlight shifts shaping industries and economies alike. Dive into the details and stay ahead of the curve.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

What to know about South Korea and the martial law declaration (AP News)

Intel’s Chief Executive Is Out Amid Chipmaker’s Struggles (NYT)

Breaking Down Trump’s Tariffs on China and the World, in Charts (WSJ)

Amazon Announces Supercomputer, New Server Powered by Homegrown AI Chips (WSJ)

What Trump’s Immigration Plans Mean for America’s Job Growth (WSJ)

BlackRock Buys Credit Firm HPS in $12 Billion All-Stock Deal (BBG)

The Weekly Brief

US Job Openings Pick Up to 7.7 Million as Labor Demand Steadies

US job openings increased to 7.74 million in October from 7.37 million in September, beating economists' expectations of 7.52 million, according to the Bureau of Labor Statistics' JOLTS report.

The rise in openings was primarily driven by the professional and business services sector, as well as accommodation and food services.

In addition, layoffs decreased to their lowest level since June, while quits increased to the highest since May, suggesting workers are feeling more confident about their job prospects.

Despite recent job cuts and announced layoffs by companies like Boeing, General Motors, and Cargill, there is still little evidence of a widespread increase in layoffs.

Why the Euro Is Closing in on Parity With the US Dollar Again

The euro has been slowly approaching parity with the US dollar recently due to more concerns surrounding Donald Trump's proposed tariffs on US imports, weak economic growth in the eurozone, and lower interest rates compared to other developed economies.

At least 10 banks are predicting a weaker euro, with some forecasting a move below the 1:1 threshold in 2025.

A weaker euro could have mixed effects on the European economy. While it may boost exports by making them more competitive, this benefit could be diminished if the US imposes tariffs. It could also lead to higher inflation by making imports more expensive, potentially complicating the European Central Bank's efforts to control price pressures.

For consumers, a weaker euro would increase the cost of imported goods and international travel outside the eurozone, though it might benefit the tourism sector by attracting more visitors from the US.

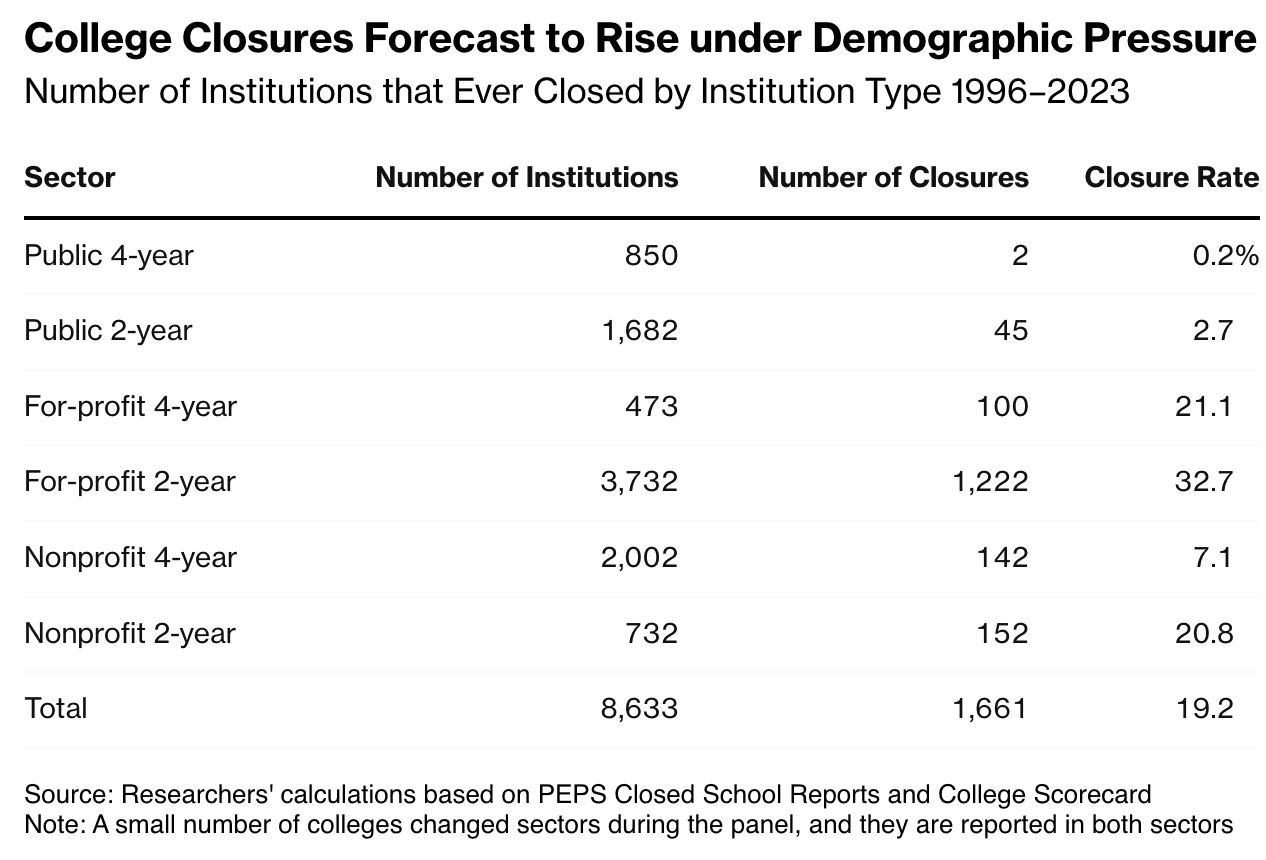

US College Closures Are Expected to Soar, Fed Research Says

A new paper from the Federal Reserve Bank of Philadelphia found a significant increase in college closures due to declining student enrollment.

In a worst-case scenario assuming a 15% drop in prospective students, 80 additional colleges could shut down, affecting over 100,000 students and nearly 21,000 staff members.

If this decline were to occur over five years, annual closures would increase by about 4.6 institutions.

Higher education has been under pressure in recent years due to declining birth rates during the Great Recession, leading to fewer prospective college students.

Additionally, more students are questioning the value of traditional college degrees as tuition costs rise and student debt increases. Between 1996 and 2023, over 1,660 institutions closed, primarily private for-profit colleges.