💸 📉 Fed Signals One Rate Cut This Year, Down From Three

Happy Thursday all,

I realize this is not a Wednesday edition, so technically it is not a true “Hump Day” newsletter - but I did want to make sure I got a full story on the Federal Reserve Interest Rate decision as of yesterday before releasing. You can read that full story below! I also came out with a Part 2 of the series where I review my subscribers’ investment portfolios, that is now up on YouTube and also linked at the end of this newsletter - we do hope you check that out.

In personal news, I booked a vacation to London and Scotland July 31-August 10th, and it is going to be my first real vacation in a few years. Excited! Will fully unplug and definitely not play Chess from my hotel room at every single location.

Speaking of Chess, I’ve raised my Elo to 730 lately, but I am still awful. Alright, I’ll catch ya in the next one. Peace.

Enjoy this week’s Hump Days!

- Humphrey, Rickie & Tim

👀 Eye-Catching Headlines

🎮 Servers for GameStop annual shareholder meeting crash due to overwhelming interest (CNBC)

🇨🇳 Can China’s Export Machine Run Without the West? (WSJ)

👕 From dying mall brand to Wall Street winner: How Abercrombie & Fitch pulled off retail’s biggest comeback (CNBC)

⏳ Stung by Past Mistakes, a Wary Fed Takes Its Time (WSJ)

🚔 Executives From ADHD Startup Arrested, Charged With Fraud (WSJ)

📈 Private Lenders Storm Public Bond Markets at Record-Setting Pace (BBG)

⛏️ Deadly and Wildly Profitable, Uranium Fever Breaks Out (BBG)

The Weekly Brief

Fed Signals One Rate Cut This Year, But Keeps Door Open to Two

Federal Reserve officials adjusted their expectations for interest rate cuts in 2024, reducing the anticipated reductions from three to one, while maintaining an open stance for potential further cuts.

Fed Chair Jerome Powell emphasized the conservative nature of these new forecasts.

Despite signs of easing inflation, the Federal Open Market Committee opted to keep the benchmark rate steady at 5.25% to 5.5%, the highest level in over two decades.

The Fed's decision comes as inflation shows signs of cooling, with the Bureau of Labor Statistics reporting a second consecutive month of declining core inflation.

Some officials see the need for higher long-term rates due to the economy's resilience, while others believe current policies are on track to reduce inflation to the Fed's target.

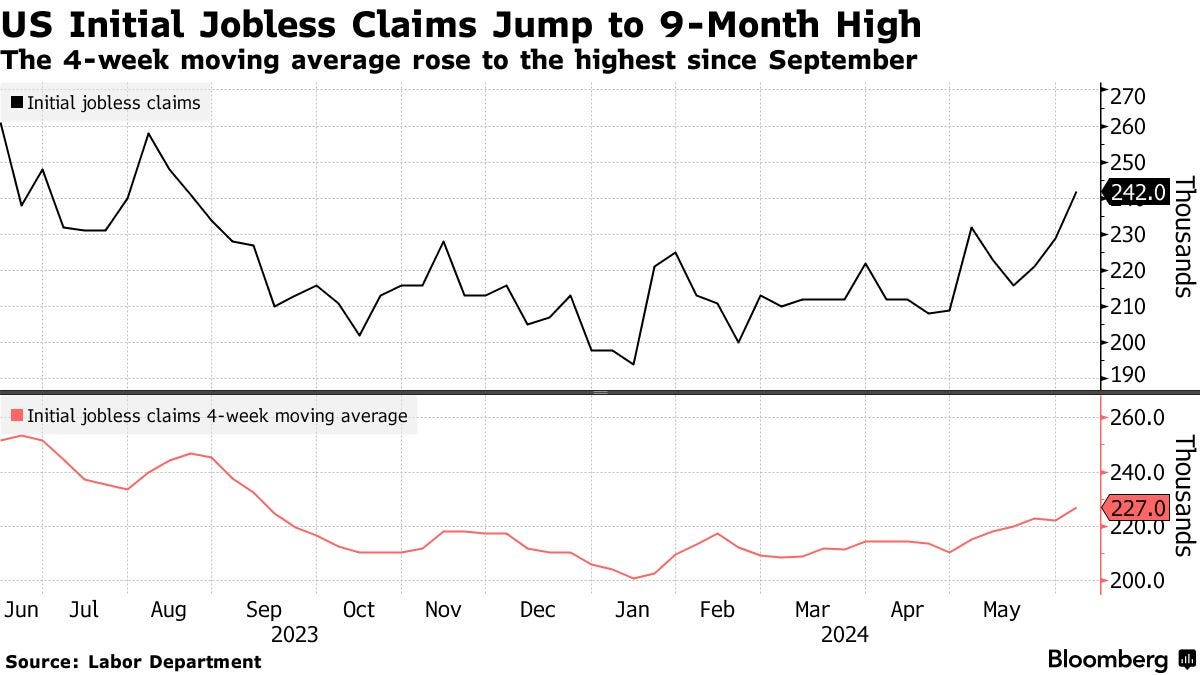

US Jobless Claims Rise to Highest in 9 Months, Led by California

Initial claims for US unemployment benefits rose to a nine-month high of 242,000 in the week ending June 8, driven by a significant increase in California and influenced by seasonal factors such as holidays and the end of the school year.

California's new $20 minimum wage for fast-food workers, which took effect in April, was estimated to result in significant job losses in the state.

Despite the increase, experts view this as potential seasonal volatility rather than an indication of increasing layoffs.

Internships Are Drying Up, Especially in Tech and Finance

The competition for college internships has intensified as companies reduce their summer intern hires, with listings on platforms like Handshake and ZipRecruiter dropping significantly and applications per internship rising sharply.

This decline, particularly in sectors like finance, consulting, and tech, has been driven by companies' focus on cost-cutting and efficiency amid industry-wide layoffs.

Red Sea Attacks Drove 90% Decline in Container Shipping

Houthi attacks on commercial vessels in the Red Sea have caused a 90% decline in container shipping through the area from December to February, according to US intelligence.

The attacks affected 65 countries and forced 29 major energy and shipping companies to reroute around Africa, adding 11,000 nautical miles and about $1 million in fuel costs per journey.

Despite repeated US and UK airstrikes and financial sanctions aimed at curbing the Houthis' activities, the group remains undeterred, exacerbating global maritime shipping stress and delaying humanitarian aid to Sudan and Yemen.