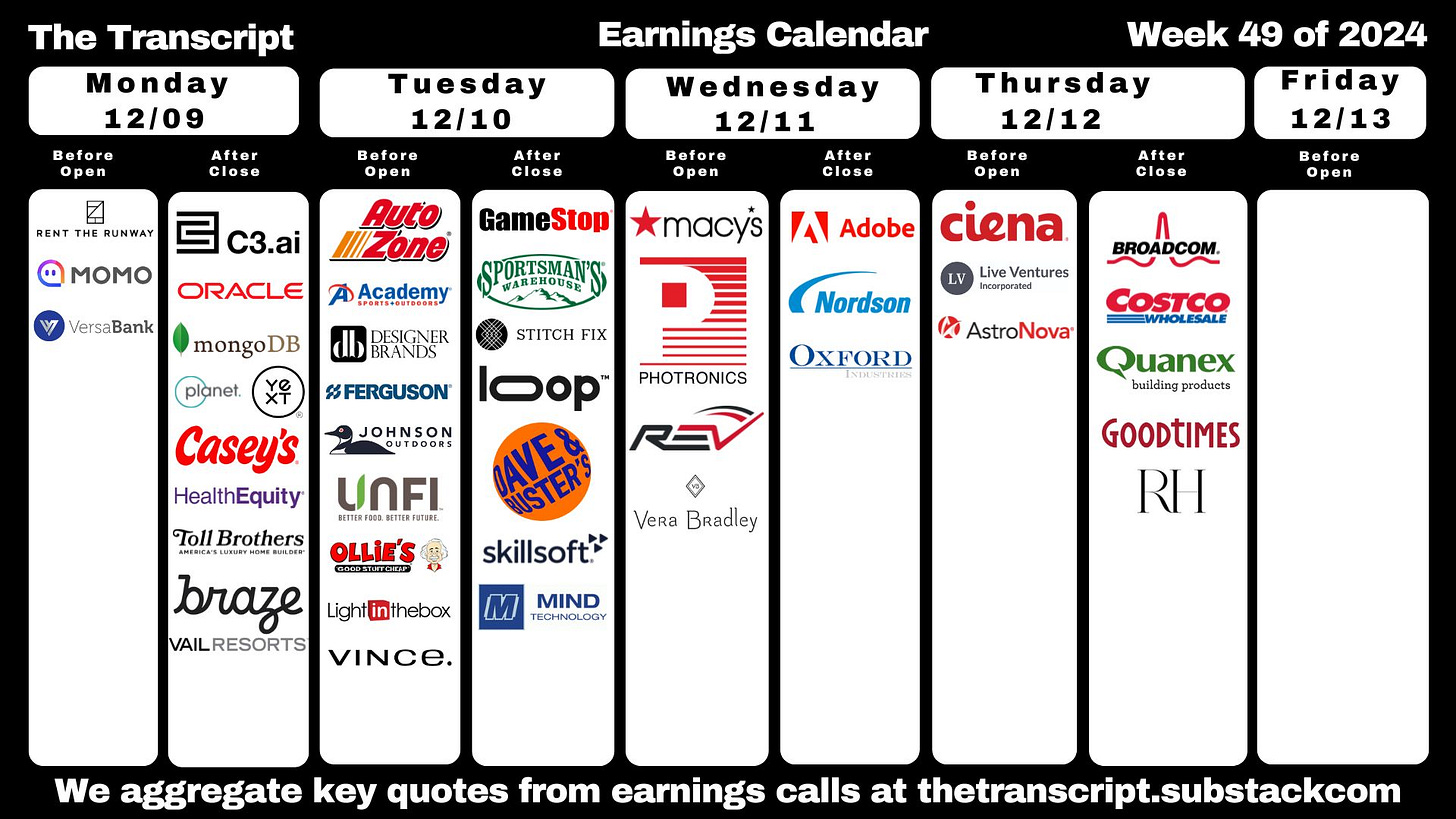

🏦✂️ Fed Inching Towards Cut, Awaiting Inflation Data

Happy Sunday,

November’s job growth nudged the Fed closer to a potential rate cut, but lingering inflation challenges keep markets on edge ahead of this week’s CPI report. Meanwhile, US consumer sentiment climbed to a five-month high, showing a mix of optimism and inflation concerns as holiday spending ramps up.

On the earnings front, Ulta Beauty and Lululemon made headlines with standout performances, defying market pressures and raising their full-year outlooks. Yet, analysts remain cautious about whether these gains can be sustained in an evolving retail landscape.

Dive into the details and explore what’s ahead in the markets this week.

- Humphrey & Rickie

Market Report

Jobs Report Nudges Fed Toward a Cut, But Inflation Test Remains

US employers added 227,000 jobs in November following a slower October affected by weather and strikes. While this increase nudged the Federal Reserve closer to potentially lowering interest rates in December, it didn't definitively confirm such a move.

While the labor market appears to be in a decent spot with slowing but still solid growth, the bounce-back also came with an increase in the unemployment rate and higher-than-expected wage growth.

The Fed's decision on interest rates remains contingent on upcoming inflation data, particularly the CPI report this Wednesday.

Some Fed officials, including Governor Michelle Bowman and Cleveland Fed President Beth Hammack, have expressed caution about rate reductions, preferring a gradual approach.

Investors now see a 90% chance of a rate cut in December, but the Fed's projections may imply fewer cuts in 2024 due to the still-solid labor market and stalling progress on inflation.

US Consumer Sentiment Rises To Five-Month High

The University of Michigan's consumer sentiment index rose to 74 in December, the highest since April and beating economists' expectations. This increase was accompanied by a rise in year-ahead inflation expectations to 2.9%, a five-month high.

Interestingly, the survey revealed a stark political divide in sentiment, with Republicans' confidence reaching a four-year high following Donald Trump's election victory, while Democrats' sentiment dropped to a two-year low.

The survey also showed that consumers viewed current buying conditions for durable goods as the most favorable since April 2021, with a quarter of respondents mentioning that purchasing big-ticket items now would avoid future price increases.

Ulta Beauty and Lululemon Surge on Strong Rebounding Sales Growth

Ulta Beauty exceeded expectations in its Q3 earnings causing shares to surge double-digits. The company reported earnings per share of $5.14, significantly beating the estimated $4.53, and demonstrated stronger-than-expected comparable sales.

This performance defied concerns about increased competition from other retailers and potential impacts of early holiday discounts.

As a result of these positive results, Ulta Beauty narrowed its full-year outlook, now projecting net sales between $11.1 billion and $11.2 billion, up from the previous lower bound of $11 billion.

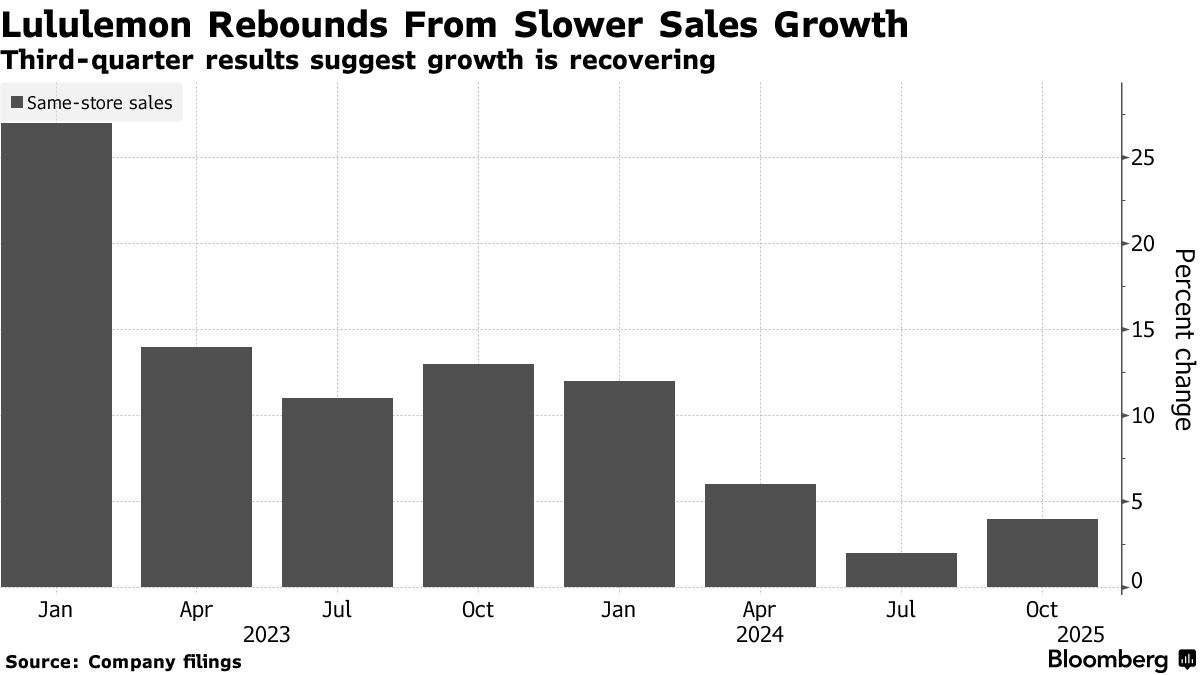

Lululemon experienced its largest single-day stock surge since 2018, with shares jumping 16% on Friday following a strong quarterly report. The company's performance exceeded expectations, with revenue rising 9% to $2.4 billion and comparable sales growing 4% in the third quarter.

Despite a 2% decline in Americas sales, international markets saw a 25% increase, with China's sales surging 39%.

The company raised its full-year outlook, now projecting revenue between $10.45 billion and $10.49 billion.

However, analysts caution that future growth could still be challenging due to increased competition and potential shifts in consumer preferences away from Lululemon's core offerings.