🏦✂️ Fed Holds Rates, Cuts to Come

Happy Wednesday all,

The Fed is holding rates steady while inflation forecasts tick up and growth projections cool. Unemployment claims remain stable, but the pace of hiring is slowing as job openings tighten. Meanwhile, regulators are considering adjustments to capital requirements that could reshape liquidity in the $29 trillion Treasury market.

Each decision carries implications not just for markets, but for how risk, credit, and growth will be managed in the second half of the year. Here’s a closer look at where things stand.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Los Angeles Lakers owners sell majority stake in the team at $10 billion valuation (CNBC)

Berkshire shares drop double digits as ‘Buffett premium’ disappears, and some expect more selling (CNBC)

Global Banks Increase Fossil-Fuel Funding as Climate Pledges Crumble (WSJ)

Walmart and Amazon Are Exploring Issuing Their Own Stablecoins (WSJ)

Auto Tariffs Seen Hiking Car Prices by Nearly $2,000 Per Vehicle (BBG)

Social Security Warns of 23% Benefit Cut by 2034 Without a Fix (BBG)

The Weekly Brief

Fed Officials Hold Rates Again, Still See Two Cuts by Year End

The Federal Reserve voted on Wednesday to maintain the federal funds rate at 4.25%-4.5%, a decision made unanimously by the FOMC.

This decision comes alongside updated economic forecasts that paint a picture of weaker growth, higher inflation, and increased unemployment for 2025, largely influenced by the anticipated impact of expanded tariffs.

While officials expect tariffs to weigh on economic activity and drive up prices, the Fed is holding off on policy adjustments until the effects of these tariffs become clearer.

Despite the unanimous vote to hold rates steady, a growing divide among policymakers is emerging regarding future interest rate cuts. Ten officials anticipate at least two rate cuts by the end of 2025, while seven foresee no cuts this year, and two others expect just one.

The Fed's new economic projections reflect a challenging balancing act: growing inflationary pressures typically call for higher rates, while weakening growth suggests the need for lower rates.

The updated forecasts show an increased median estimate for inflation at 3% by the end of 2025 (up from 2.7%) and a reduced forecast for economic growth at 1.4% (down from 1.7%). The unemployment rate is also projected to rise slightly to 4.5%.

US Jobless Claims Stabilize at Highest Levels This Year

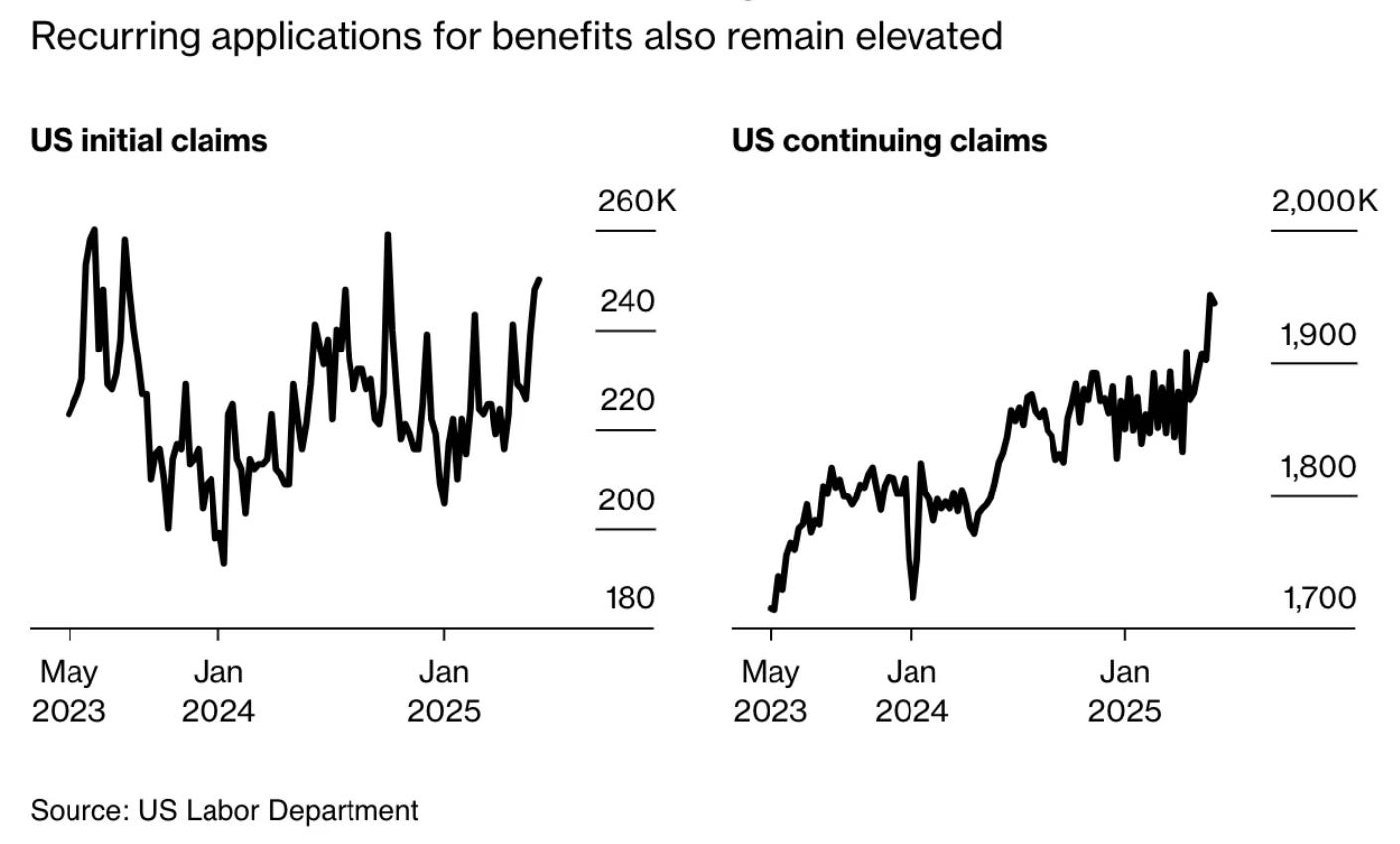

Applications for US unemployment benefits stayed flat last week, stabilizing near the highest levels in eight months. Initial claims decreased by 5,000 to 245,000 in the week ended June 14, which was in line with economists’ expectations.

Continuing claims, a proxy for the number of people receiving benefits, also fell slightly.

It's taking longer for unemployed individuals to find new jobs as hiring has slowed down, and recurring unemployment claims are near their highest levels since late 2021.

According to Bloomberg Economics, “The current labor market environment is not about mass layoffs but rather fewer job openings, fewer new hires, and longer unemployment.”

US Plans to Ease Capital Rule Limiting Banks Treasury Trades

Big US banks might soon get a break on how much cash they need to keep on hand, which could make it easier for them to buy and sell US government bonds (Treasuries).

Regulators like the Federal Reserve are looking to lower a key capital requirement called the enhanced supplementary leverage ratio (eSLR).

Banks currently have to keep a certain percentage of their assets, including super safe Treasuries, as a kind of safety cushion. This rule has made it harder for them to deal in the massive $29 trillion Treasury market.

The proposed change would essentially reduce that required safety cushion for the biggest banks. For example, where they currently need to hold 5% of their assets as capital, that could drop to 3.5%-4.5%. This idea isn't entirely new; similar changes were considered in 2018.

The hope is that by freeing up some of this capital, banks will be more willing to step in and facilitate trading in the Treasury market, especially during bumpy times. This could, in turn, even lead to lower borrowing costs for the government.

Some experts are skeptical that banks will actually use this extra flexibility to buy more Treasuries. In the past, when similar rules were temporarily eased, banks often used that extra room to pay out dividends to shareholders instead of investing more in government bonds.