Happy Wednesday!

I’m currently en route to Baltimore, MD to go to my sister’s graduation at Johns Hopkins University, which takes place tomorrow. It’s an exciting time for my family, and I’m staying downtown with my Dad. I hear Baltimore has a great aquarium from my friend who is a fish-YouTuber, but other than that - the only time I’ve ever spent there was when I dropped my sister off Freshman year - so any recs are appreciated and you can reply directly to this e-mail.

We have some new formats on YouTube coming out shortly, including a video next week on the channel where I review my subscribers’ portfolios! It should be educational and somewhat entertaining (if you’re… you know… into that stuff). I’m putting all my creative brainpower into growing the YouTube channel this year, so if you have any suggestions or things you’d like to see, we’d love to hear from you.

I hope you’re having an amazing week, and I hope NVDA earnings exceed expectations so we can see more of a rally (hopefully) in the markets.

Enjoy this week’s Hump Days!

- Humphrey, Rickie & Tim

👀 Eye-Catching Headlines

🏈 College Sports Is About to Turn Pro. Private Equity Wants In. (WSJ)

🚗 Average U.S. vehicle age hits record 12.6 years as high prices force people to keep them longer (CNBC)

💻 Meta’s Zuckerberg Creates Council to Advise on AI Products (BBG)

👨🎓 Companies Want Fewer Grad Hires This Year (WSJ)

🛰️ Startups Vie to Break Up Musk-Bezos Commercial Space Duopoly (BBG)

👨💻 Why Microsoft Is Spreading Its AI Bets to PCs (WSJ)

🗳️ Half of Swing-State Voters Fear Violence Around US Election (BBG)

The Weekly Brief

Federal Reserve meeting minutes from their May 1 meeting highlighted the disappointing inflation data from the first quarter and a belief that achieving the 2% target will take longer than anticipated.

Officials considered further tightening if necessary, but also discussed holding rates steady if inflation doesn't show signs of declining or easing policy if the labor market weakens unexpectedly.

Economic growth remained solid but showed signs of moderation, and officials noted rising financial pressures on low- and moderate-income households.

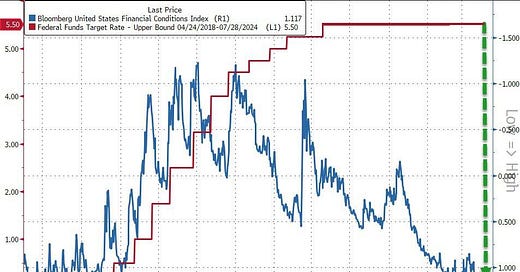

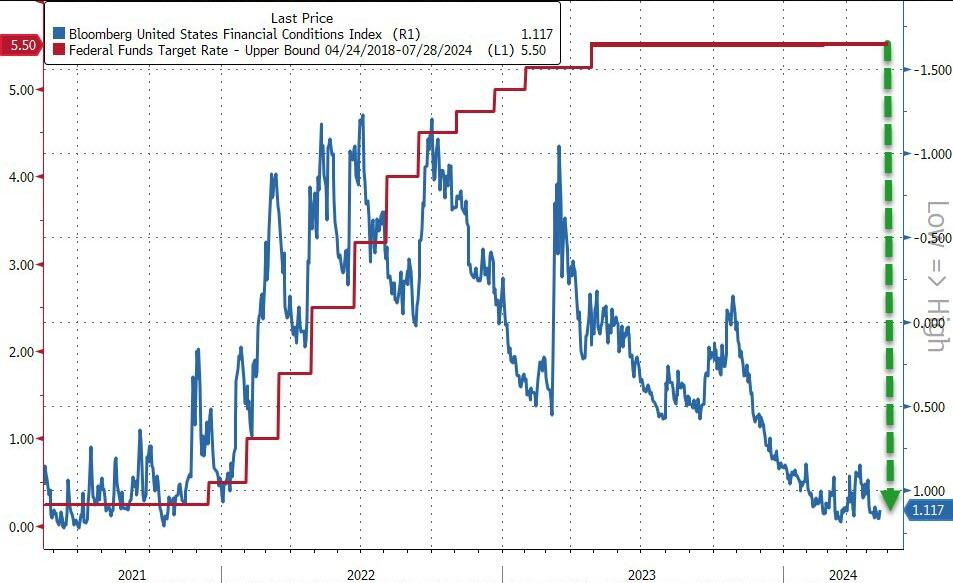

Even though the fed funds rate has been held at the 5.5% range, financial conditions (Bloomberg’s index) has loosened dramatically.

US Existing-Home Sales Fall While Prices Stay High

Sales of existing homes in the US fell for the second consecutive month in April, decreasing by 1.9% to an annualized rate of 4.14 million, below economists' expectations of 4.23 million.

High borrowing costs and near-record prices continue to challenge buyers, with mortgage rates remaining above 7%.

The median selling price reached a record $407,600, rising 5.7% from a year ago, further straining affordability.

Target Sales Decline as Discretionary Spending Remains Tepid

Target shares experienced their largest drop since November 2022, falling ~8% after the retailer reported a 3.7% decline in comparable sales for the fourth consecutive quarter, in line with Wall Street estimates.

Despite a boost from digital sales, brick-and-mortar traffic lagged, leading to earnings slightly below expectations.

Executives expressed cautious optimism about returning to growth, but highlighted challenges such as high interest rates, social and political divisiveness, and cautious consumer spending.

Beauty products and exclusive items performed well, though discretionary spending remained subdued, particularly in home products and appliances.

I think they will end up increasing the inflation target to 3%.