😲✂️ Fed Cuts Rates by 50bps!

Happy Wednesday all,

Currently writing this from the hotel in Lugano, Switzerland where Rickie and I have stayed for the past few days. It’s a really interesting part of Switzerland because it’s in the Italian speaking part so most of the time, it doesn’t even feel like I’m in Switzerland - everything is Italian. Nothing wrong with that but I don’t think I can eat any more Italian food. Surprisingly, Chinese food is hard to come by here.

Here’s a picture from our lunch today!

Enjoy this week’s Hump Days!

- Humphrey & Rickie

The Weekly Brief

Chair Jerome Powell Defends Central Bank’s Decision to Go Big With First Cut

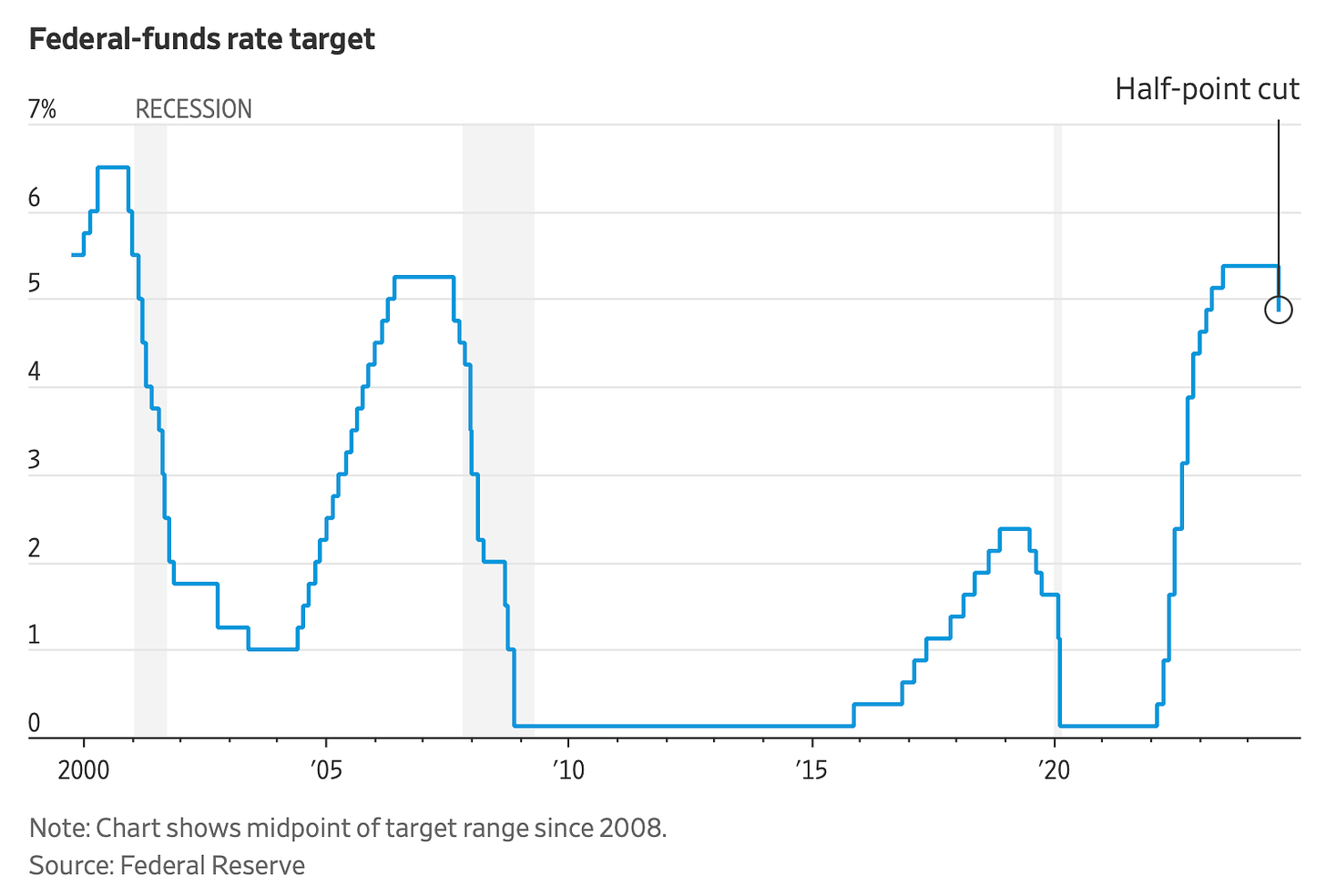

The Federal Reserve surprised Wall Street with a half-point rate cut on Wednesday, bringing its target range to 4.75% to 5.00%.

The decision was not unanimous, as Fed Governor Michelle Bowman called for a quarter-point cut instead.

Fed Chair Jerome Powell did not signal to investors a promise to continue lower rates at future Fed meetings noting that the Fed will continue to make decisions meeting by meeting.

Federal Reserve Chair Jerome Powell does not expect the era of cheap money to return. “My own sense is that we are not going back to that,” Powell added.

The Fed’s goal now is to keep inflation stable while simultaneously ensuring jobless rates don’t tick higher, according to Fed Chair Jerome Powell.

S&P 500 Is Surviving Big Tech’s Slide as ‘Other 493’ Catch Up

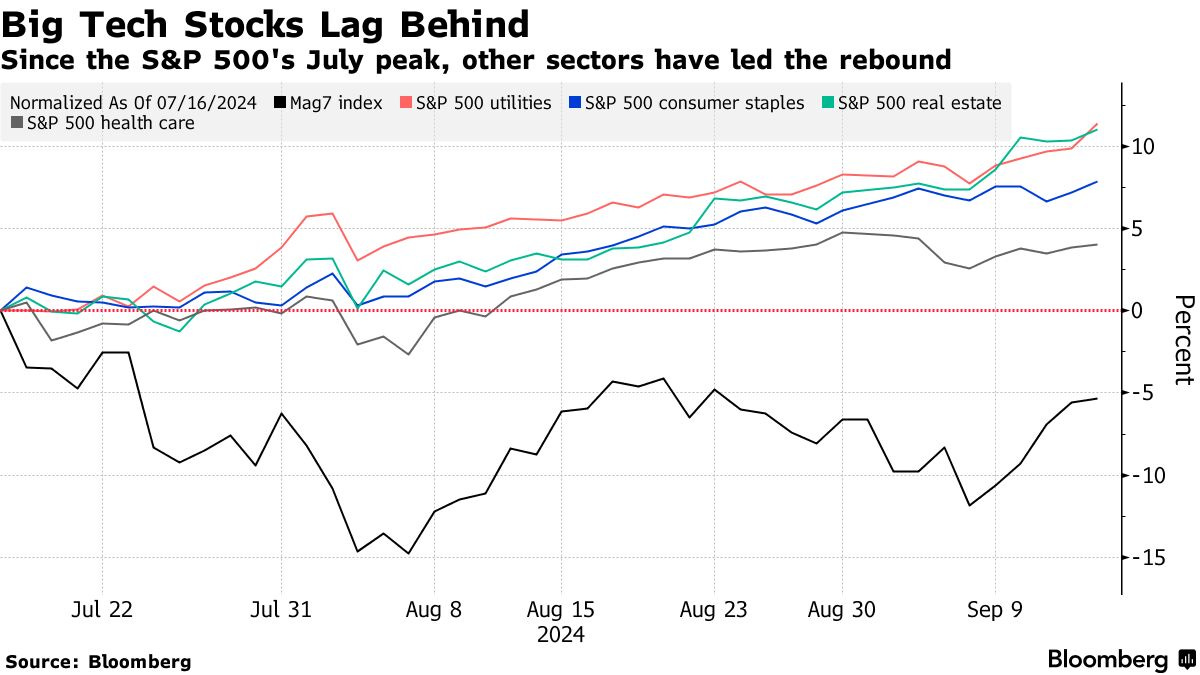

The stock market's recent recovery has been characterized by a shift away from the dominance of Big Tech stocks, particularly the "Magnificent Seven" (Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta, and Tesla), towards traditionally defensive sectors like real estate, utilities, and consumer staples.

This rotation has largely been driven by expectations of interest rate cuts, concerns about economic growth, and improving earnings outlooks in non-tech sectors.

While the Magnificent Seven have seen a 5.3% decline since mid-July, sectors like real estate and utilities have gained 11%.

Even though Big Tech earnings have been strong, they haven’t been able to match the rapid growth from the past couple of years. The Magnificent Seven posted profit growth of 36% in Q2, but is down from more than 50% in the prior three quarters.

Part of the selloff in Big Tech stocks last month was related to the companies’ heavy spending on gear used for AI computing.

Last quarter, Amazon, Alphabet, Microsoft and Meta Platforms poured more than $50 billion combined into capital expenditures.

Americans Are Falling Behind on Their Bills.

Recent statements from banking executives at a Barclays conference raised more concerns about the financial health of American consumers, particularly those in lower income brackets.

Credit card delinquencies have reached their highest level in over a decade, with 9.1% of balances becoming delinquent in the past year. Auto loan delinquencies are also at a 10-year high.

Executives from Citigroup, Bread Financial, Synchrony Financial, and Ally Financial all reported increased delinquencies, higher charge-off rates, and struggles with cost of living among their customers.

These trends are particularly pronounced among lower-income borrowers, who are facing challenges with high interest rates on credit cards (averaging 21.51%) and auto loans (averaging 8.2% for new cars).