🤝🏦 Fed Announces Rate Hike 'Unlikely'

Happy Wednesday all,

I got back from Dallas yesterday and am feeling refreshed! I am starting to work on some new video concepts and think about how I can build our YouTube business more effectively moving forward. I am still having a really great time focusing on video, and have been working on a new website that is going to be a place where I give you my thoughts in written format on certain investment products, bank accounts, credit cards, etc. Personally, I’m excited for it, as I don’t really have a web presence right now :)

The best thing I had in Dallas? I went to a sushi restaurant called Namo in Uptown. Great, fresh fish. Did I have barbecue, you ask? No. I didn’t. But this was also my 7th-8th+ trip to Dallas so I wasn’t trying to hit all the famous spots. I did attend the Mavericks-Clippers game on Sunday, though, where Dallas lost late in the fourth quarter… RIP.

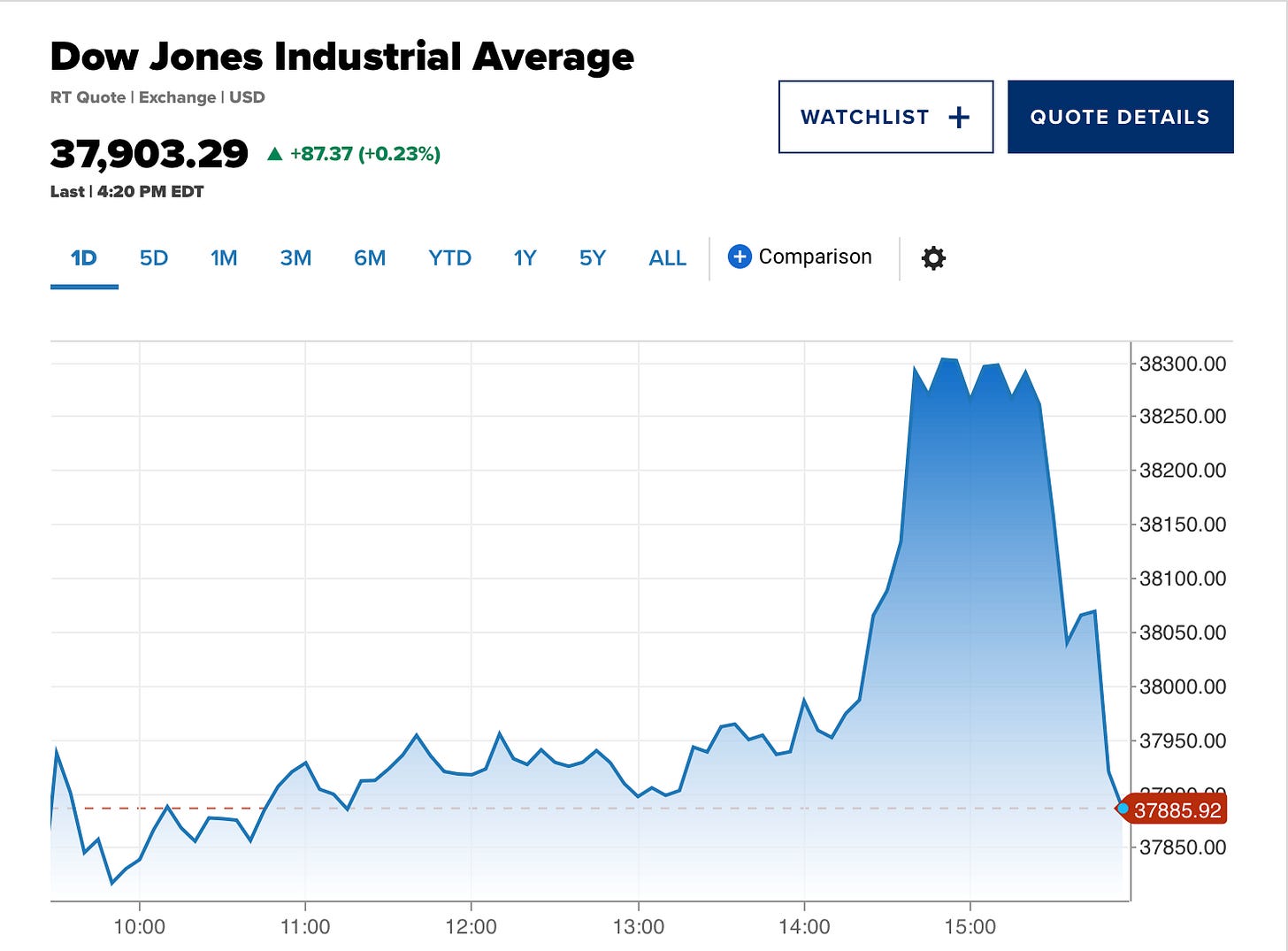

Pretty good news out of the Fed today. Markets rallied soon after Jerome Powell effectively ruled out a hike as the Central Bank’s next move. The jump was short-lived, however, with markets ultimately closing flat. More below.

Enjoy this week’s Hump Days!

- Humphrey, Rickie & Tim

👀 Eye-Catching Headlines

🚗 The New Math of Driving Your Car Till the Wheels Fall Off (WSJ)

📱 AI Startup Anthropic Debuts Claude Chatbot as an iPhone App (BBG)

🚀 Elon Musk vs. Jeff Bezos Is America’s New Moon Race (BBG)

🏦 Why hundreds of U.S. banks may be at risk of failure (CNBC)

🤖 AI Is Helping Automate One of the World’s Most Gruesome Jobs (BBG)

📈 Private payrolls increased by 192,000 in April, more than expected for resilient labor market (CNBC)

The Weekly Brief

Fed Flags Lack of Inflation Progress But Signals Hikes Unlikely

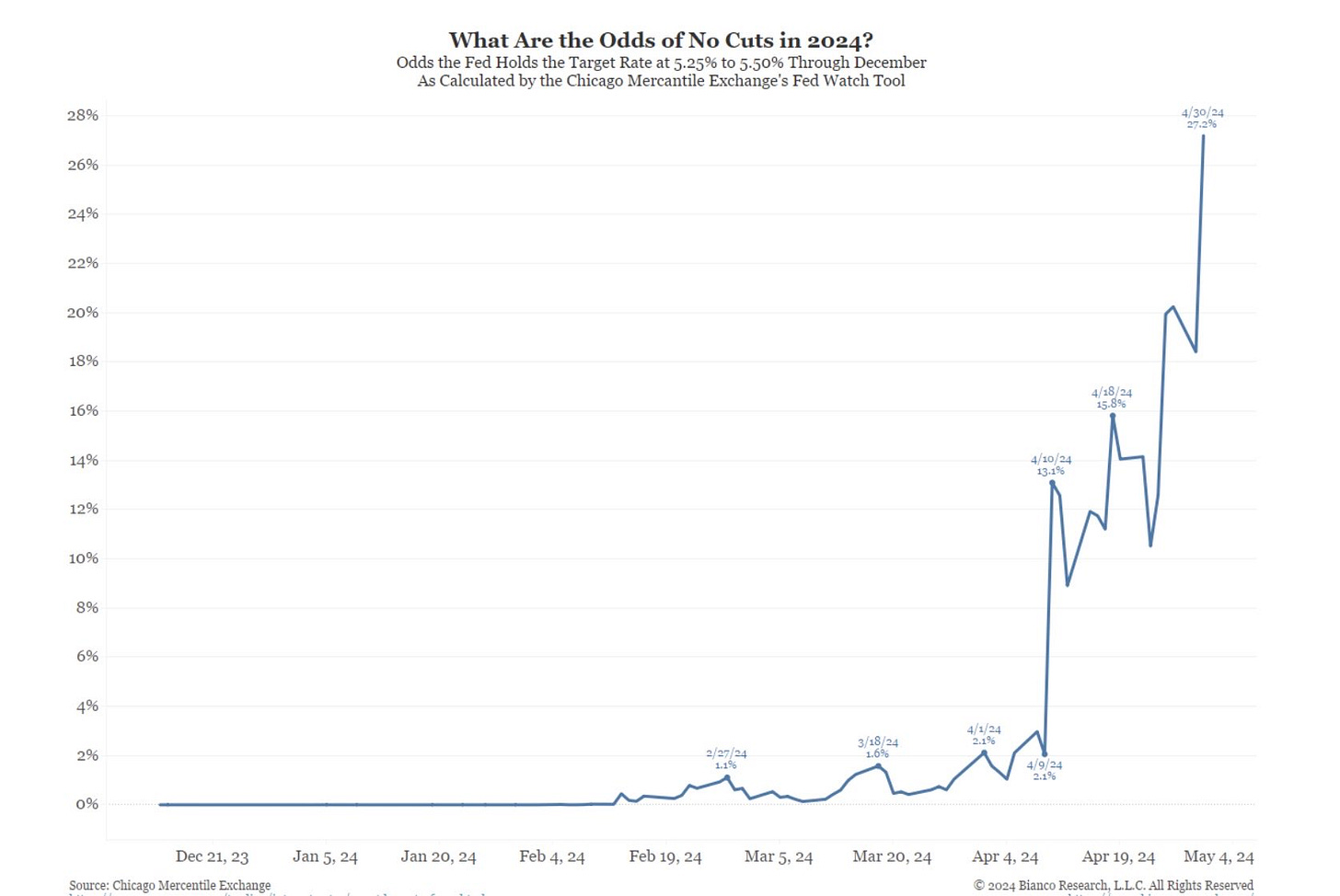

The Federal Reserve decided to maintain its benchmark federal funds rate at 5.25% to 5.5%, signaling concerns over persistent inflation and indicating that rate cuts are unlikely soon.

Despite a robust economy and strong job market, recent inflation data have been higher than expected, challenging the Fed's goal of reducing inflation to 2%.

Fed Chair Jerome Powell noted that more confidence in inflation cooling is needed before considering rate reductions. Additionally, the Fed plans to slow the reduction of its asset portfolio to mitigate financial market risks.

In-Demand Workers Are Staying Put as US Labor Market Cools

The U.S. labor market is seeing a significant drop in the rate of workers transitioning directly from one job to another, according to data from the Federal Reserve Bank of Philadelphia.

A decline in job openings and the lowest rate of voluntary job-leavers since 2020 is showing that the broader labor market is cooling down.

Contributing factors include employer labor hoarding post-pandemic and the rise of remote work, leading to decreased attrition and potentially aiding the Federal Reserve's efforts to manage inflation through a more stable employment environment.

Amazon Posts Biggest Cloud Sales Growth in Year on AI Demand

Amazon's cloud division, Amazon Web Services (AWS), showcased robust sales growth of 17%, reaching $25 billion, marking the strongest growth in a year and surpassing analyst expectations.

Despite this success, Amazon's overall sales forecast for the upcoming quarter was below analyst predictions, reflecting concerns about slowing growth in its core e-commerce sector.

In response to the e-commerce slowdown, Amazon is shifting focus to other revenue streams such as advertising, which saw a 24% increase to $11.8 billion, boosted by new video ads on Prime Video.

Strategic adjustments are coming as Amazon plans considerable capital expenditures, primarily to enhance AWS capabilities in response to increased AI demands, with expectations to invest over $150 billion in data center expansions in the coming years.