👎🐥 Elon's X Takeover a Historically Bad Deal

Happy Wednesday all,

I am running a survey on what you like about the Newsletter and more - it’s 10 questions and should take you 3 minutes. Click here for the survey. My goal is to create better content and services moving forward, so every response will be read and considered. Thank you so so so much,

— Humphrey

👀 Eye-Catching Headlines

Alphabet's Waymo robotaxi unit doubles its paid rides in three months (Reuters)

Japan Trade Slips into Deficit, Yen’s Rise Clouds Export Outlook (WSJ)

Shein sues Temu over copyright infringement, alleges rival loses money on every sale (CNBC)

Kamala Harris Wants to Ban Price Gouging. What Do Economists Say? (WSJ)

A Natural-Gas Glut Is Forcing Drillers to Dial Back—Again (WSJ)

Gold Prices Set New Record on U.S. Rate-Cut Hopes, Geopolitical Concerns (WSJ)

The Weekly Brief

U.S. Payrolls Marked Down by Most Since 2009

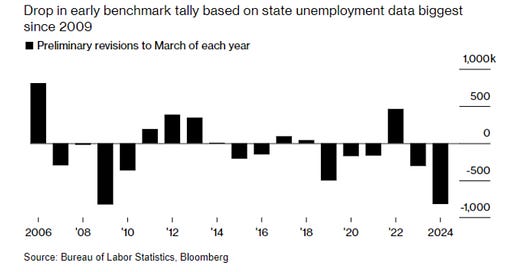

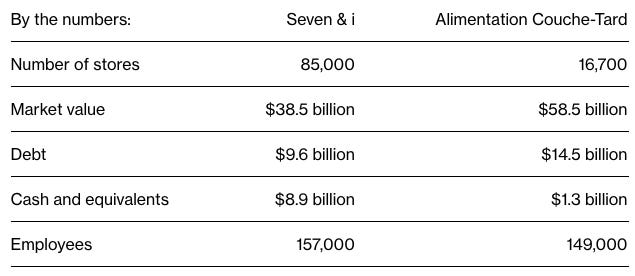

Recent data from the Bureau of Labor Statistics (BLS) indicates that U.S. job growth for the year ending in March was likely overestimated, with a potential downward revision of 818,000 jobs, or about 68,000 jobs per month.

This revision, the largest since 2009, suggests that the labor market may have moderated earlier than previously thought.

This adjustment could increase pressure on the Federal Reserve to consider cutting interest rates sooner, as the labor market appears weaker than initially estimated.

Couche-Tard Seeks to Buy $31 Billion Owner of 7-Eleven Chain

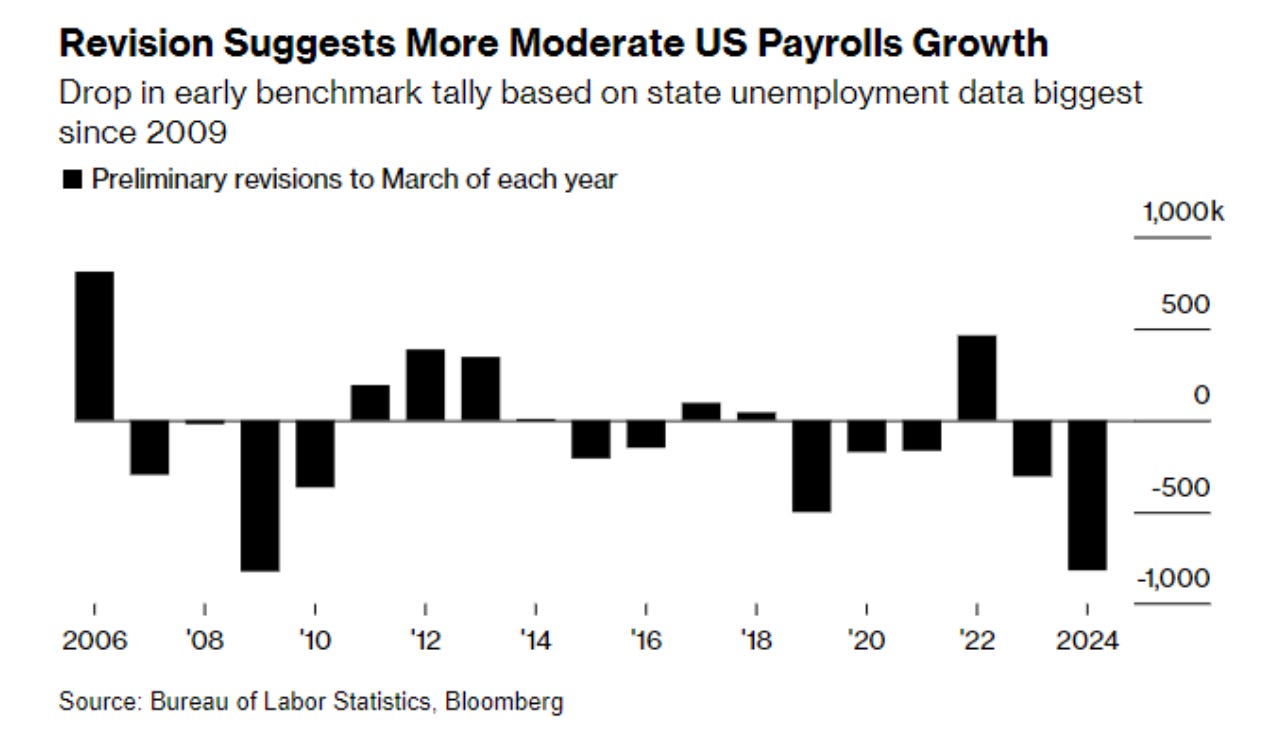

Alimentation Couche-Tard, the Canadian operator of Circle K, has made a preliminary, non-binding proposal to acquire Seven & i Holdings Co., the Japanese owner of 7-Eleven, in what could be the largest foreign takeover of a Japanese company.

The bid, which would create the world's largest convenience store operator with approximately 100,000 outlets, led to a 23% surge in Seven & i's shares.

The potential merger could face scrutiny from competition regulators, especially in North America, where both companies have a significant presence.

Elon Musk’s Twitter Takeover Is Now the Worst Buyout for Banks Since the Financial Crisis

Elon Musk's $44 billion acquisition of Twitter, now rebranded as X, has resulted in one of the largest "hung" deals since the 2008-09 financial crisis, leaving seven major banks—including Morgan Stanley and Bank of America—unable to offload $13 billion in loans.

The banks, who had hoped to quickly sell the debt to investors, are now facing significant write-downs due to X's weak financial performance.

The company's value has plummeted to around $19 billion, and with $1.5 billion in annual interest payments, the loans remain a burden on bank balance sheets.

Despite this, the banks continue to collect interest, holding out hope that X will eventually repay the principal, while at the same time facing challenges due to the company's declining revenue from advertisers.