Elon Calls it Quits! 🤡

Happy Sunday everyone! Elon Musk had quite the week: from canceling his Twitter deal to reportedly having twins with an executive, it’s clear he’s been keeping his hands full.

A small update: we published our fourth video on the Out of Office channel. This video dives into the reason why Gas Prices Have Not Come Down yet, despite crude oil prices being the same as in 2011-2014. The mission of the channel is to make videos on how the business world works - no matter the scale. If you are interested in this type of content, make sure to subscribe to the new channel and turn notifications on so you can get notified whenever we drop new videos there.

This week, we saw:

Tesla deliveries fall nearly 18% in second quarter following China factory shutdown

Tesla to expand its US Supercharger network to other EVs in late 2022

New report shows Elon Musk had twins with top Neuralink executive

Elon Musk Calls Off Twitter Deal

Well, it looks like Elon is finally calling it quits on purchasing Twitter. After hinting for a while that he no longer wanted the company, Elon’s legal team is now taking steps to end his $44 billion bid to buy Twitter.

In a letter from Musk’s legal team to Twitter’s chief legal officer, they wrote:

“Mr. Musk is terminating the Merger Agreement because Twitter is in material breach of multiple provisions of that Agreement, appears to have made false and misleading representations upon which Mr. Musk relied when entering into the Merger Agreement, and is likely to suffer a Company Material Adverse Effect.”

For a long time now, Elon has been concerned that Twitter was misleading its investors about the number of fake accounts and bots on its platform, which the company has long estimated to be under 5%. Elon did not believe this to be accurate. When Elon requested more information on this matter, Twitter declined.

Musk’s legal team goes on to claim that Twitter hasn’t given him sufficient access to its data. The letter also stated that Twitter told Musk in a phone call that the company includes suspended accounts in its monetizable daily active user (DAU) numbers, which is incredibly important when advertisers are deciding between platforms to advertise on.

“Mr. Musk reiterated his request for ‘access to the sample set used and calculations performed, as well as any related reports or analysis, to support Twitter’s representation that fewer than 5% of its mDAUs are false or spam account’… Although Twitter has provided certain summary data regarding the mDAU calculations, Twitter has not provided the complete daily measures as requested.”

“Instead, we understand, based on Twitter’s representations during a June 30, 2022 call with us, that Twitter includes accounts that have been suspended—and thus are known to be fake or spam—in its quarterly mDAU count even when it is aware that the suspended accounts were included in mDAU for that quarter.”

While these allegations could be legitimate, Elon didn’t seem to have any issues or concern with Twitter’s bot count before making the buyout offer. In fact, he actually previously mentioned that he would take on Twitter’s spam problem as its new owner.

Here’s our hypothesis:

Elon probably wants out of the deal because his initial offer price looks way too pricey after markets plummeted shortly after the terms of the deal were agreed upon. Elon’s original offer in April was $54.20, causing the stock to shoot up to around $50 back then. Since the announcement of the deal, Twitter’s stock has gradually come down to the mid-30s.

Whatever the true reason is, Twitter isn’t having any of it.

Bret Taylor, the chairman of Twitter’s board of directors, responded to Musk’s letter by stating that Twitter’s intentions was to see the deal through.

While it’s unclear whether or now Elon’s skepticism of Twitter’s active user numbers will be a valid reason to end the deal, it’s clear that Twitter isn’t done with this deal just yet. I have a feeling we’re going to hear a lot more about this case as Elon Musk and Twitter fight it out in court over the next few months.

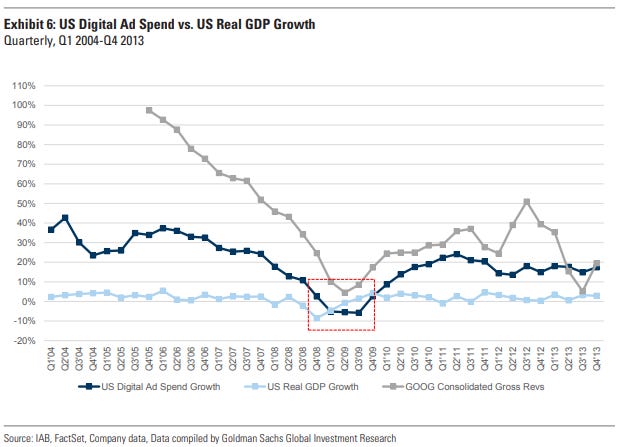

Chart of the Week

Goldman Sachs wrote that:

“In terms of the risk of a recessionary environment and the resulting impact on digital & total media spend, we’d note that advertising spend tends to be more of a lagging economic indicator (by ~1-2 quarters)… We believe [the second half of 2022] presents almost all advertising companies with easier YoY revenue comparisons, which could still produce flat to accelerating revenue trends even with macro-driven headwinds.”