🤯💵 Economy Shrinks, Consumers Keep Spending

Happy Wednesday all,

The economy shrank for the first time since 2022—but Americans are still spending. Tariffs are distorting trade flows, companies are pulling forecasts, and hiring is stalling. This week, we break down how short-term reactions to long-term uncertainty are shaping markets, policy, and consumer behavior.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

China’s factory activity drops to a near two-year low in April as trade tariffs bite (CNBC)

GLP-1s can help employers lower medical costs in 2 years, new study finds (CNBC)

Trade-War Uncertainty Prompts Wave of Companies to Yank Forecasts (WSJ)

China’s Export Orders Plunge, Hit by Trump’s Trade War (WSJ)

Inflation Fear Is Making Some People Spend More—and Others Less (WSJ)

Ukraine Ready to Sign US Resources Deal in a Matter of Hours (BBG)

The Weekly Brief

US Economy Contracts for First Time Since 2022 on Imports Surge

In the first quarter, the US economy saw its first contraction since 2022, with GDP falling by an annualized 0.3%.

This downturn was largely driven by a significant surge in imports as businesses rushed to acquire goods ahead of anticipated tariffs under the Trump administration's trade policy.

Higher import activity subtracted nearly 5 percentage points from GDP, the most on record.

While consumer spending growth slowed to 1.8%, it exceeded economists' forecasts, and a measure of underlying domestic demand showed solid growth, boosted by the strongest business equipment investment since 2020.

US Firms Add Smallest Amount of Jobs Since July in ADP Data

Hiring by US private companies slowed down considerably in April, marking the weakest pace in nine months, according to ADP Research.

Payrolls increased by only 62,000, falling short of all economist forecasts, indicating reduced demand for workers amid economic uncertainty.

Several sectors, including education, health services, and professional services, experienced job losses. This hiring pullback in ADP data is occurring despite other data showing that layoffs remain relatively low.

Wage growth presented a mixed picture, with those switching jobs seeing larger pay increases than those remaining in their positions. Other data indicated that overall employment growth moderated in the first quarter.

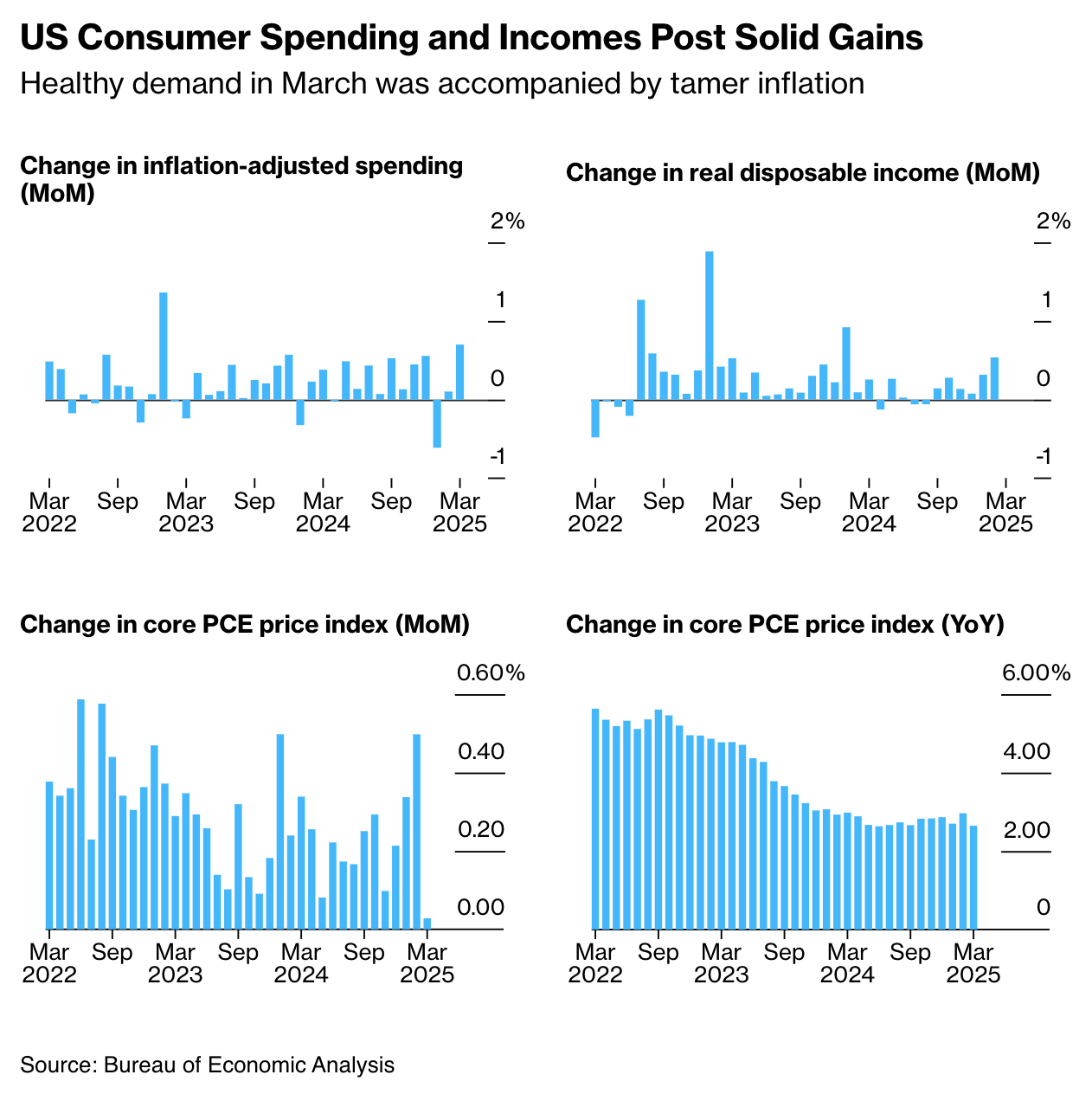

Consumer Spending Jumps While Key Inflation Tracker Slows Down

In March, US consumer spending jumped, increasing 0.7% after adjusting for inflation, the strongest monthly gain since early 2023.

This surge suggests that households may have increased their purchases in anticipation of price increases resulting from impending tariffs.

At the same time, a key inflation gauge watched closely by the Federal Reserve, the PCE price index, remained unchanged from the previous month, marking the first time it hasn't increased in nearly a year.

The core PCE index, which excludes volatile food and energy costs, was also flat, its weakest reading in almost five years.

A strong rise in real disposable income also supported the March spending increase, particularly on vehicles and dining out. However, economists widely anticipate that the tariffs will soon lead to renewed inflationary pressures, potentially slowing consumer spending in the future.

Companies are already signaling potential price hikes or acknowledging the need to absorb some tariff costs due to consumer sensitivity to prices.