Happy Sunday all,

As you read this I am most likely on the fourth 18-hole round of golf of my weekend. I got invited to play in a 4 Round weekend down in Monterey / Carmel with 18 other guys, and so far its been a blast even though I haven’t been playing that much this year. The best part about this weekend so far? My screen time is less than 1 hour per day.

We also just published a really cool video on whether college is still a good investment. It’s linked at the bottom of the newsletter if you haven’t seen it yet.

Hopefully, I don’t end up like Scottie Scheffler this weekend! Enjoy today’s Sunday Primer!

- Humphrey, Tim & Rickie

Market Report

Meme Stock Rally 2.0 Smaller Than the First

The brief revival of meme stocks like GameStop and AMC quickly fizzled after a surge at the start of the week, with most gains erased shortly after.

Unlike the prolonged frenzy of 2021, this resurgence was fleeting and lacked significant inflows from retail investors.

GameStop saw over 10 times its recent average trading volume, and AMC had 1.7 billion shares change hands, but these figures were still modest compared to the heights of three years ago.

Both companies used the brief rally to raise funds: GameStop arranged to sell up to 45 million shares, adding proceeds to its balance sheet, while AMC raised over $250 million through share sales and a debt-for-equity swap.

Labor Market Advantage Shrinks for Recent US College Graduates

The labor market advantage for recent college graduates over young workers without a bachelor's degree is at its smallest on record, according to data from the Federal Reserve Bank of New York.

The unemployment rate for recent college graduates averaged 4.7% in the first quarter of the year, compared to 6.2% for those without a degree, marking the narrowest gap since 1990.

The underemployment rate for recent college graduates has increased by about 3 percentage points since the end of 2022, with around 40% of young college grads working in jobs that do not require a college degree.

Consumers are putting off big purchases like pools and mattresses

Americans are delaying costly purchases as high inflation and interest rates strain their finances, impacting consumer spending on big-ticket items such as home improvements and electronics.

Corporate executives from companies like Sleep Number and Wayfair report declining sales as consumers prioritize essential spending and become more price-conscious.

The reluctance to spend on expensive items is also linked to the sluggish housing market, with high mortgage rates deterring both home buying and home improvement projects.

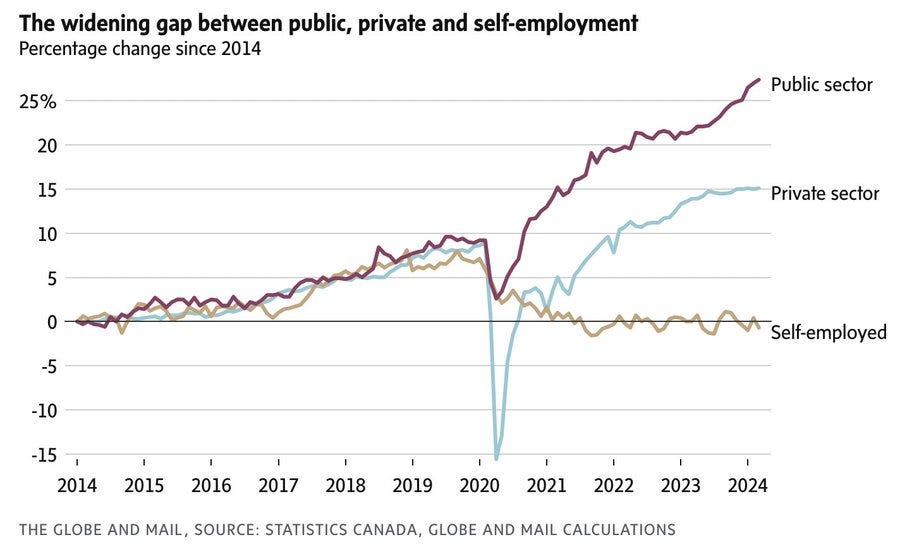

The section "big number" is missing information as to which country the graph refers to. Is it the US or Canada (since the source is Canada statistics)?

The Wall Street Journal had a short (literally like 2 seconds) excerpt from one of your videos in their own video on gold. Do they ask you when they do that?