💳✉️ Credit Series: Understanding Your Credit Score

Your credit score is extremely important for many of life’s big transitions and decisions. Whether you’re going to be renting an apartment, taking out a loan for a car or home, or applying for a credit card, a common theme throughout our articles is that you’ll need to have a good credit score to get the lowest interest rates and to be allowed to borrow.

But what factors go into a credit score, and how can we ensure we’re constantly climbing the ladder of good credit? This multi-article series will show you the ropes of credit so you can understand your score, establish and repair your credit, and learn how to use credit to your advantage.

What Is a Credit Score?

A credit score is your own individual rating of creditworthiness. This three-digit number gives lenders a snapshot of how trustworthy you are and how likely you are to pay back the money you’re given based on your history. Simply put, lenders want to make sure that when they give you money for something, you’re going to be able to pay them back on time, every time. Your credit score gives them a good idea of this level of risk.

There are two credit bureaus that have slightly different parameters of credit scores. They are:

FICO® Score

VantageScore

Both bureaus have credit scores ranging from 300-850, but you can see that some of the ranges vary slightly. No matter the scale used, the bottom line is that the higher the score, the better your creditworthiness. This will give you an advantage if you’re applying for any kind of loan or trying to rent an apartment/house because you’ll get the best interest rates and the highest odds of approval.

Some situations that might require a credit check include:

Applying for a credit card or any type of loan (mortgage, car, etc.): Your score usually determines your interest rate. Remember: higher credit score = better rate!

Renting a house or apartment: Landlords often request a credit check as part of their vetting process because they don’t want to let you rent their place if you have a bad track record of making payments.

Jobs: Some employers run a credit check on candidates before hiring, but this is usually for jobs where handling money is in the description (accountants or bankers, for example).

Now that you understand what a credit score is and why it’s important to have a good one, let’s talk about all the factors that actually go into the calculation of your score.

What Affects Your Credit Score?

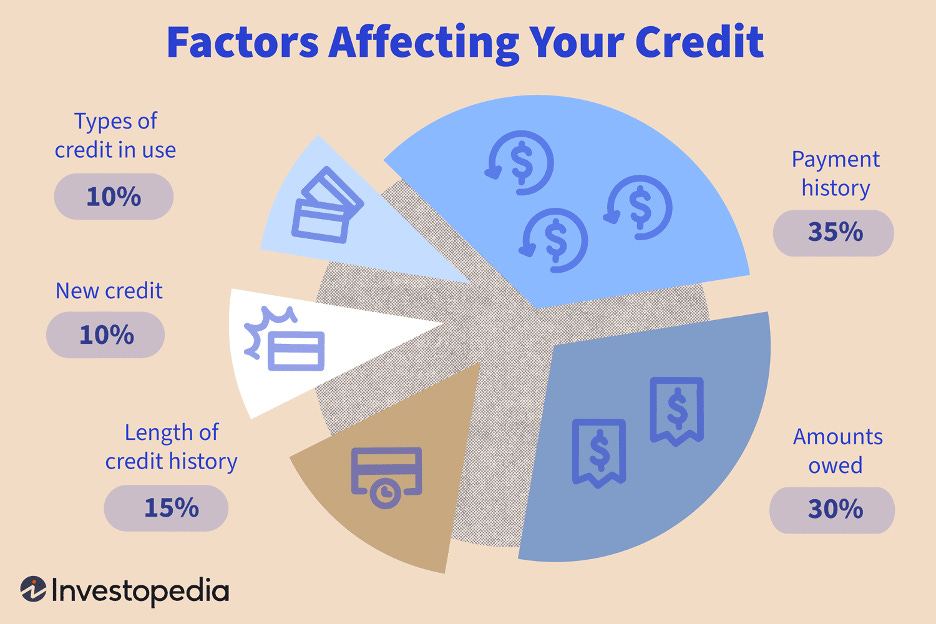

Think of your credit score as a pie, where each factor makes up a slice. However, each factor impacts your score differently, so all of the slices are different sizes. Here’s each factor, or slice of the pie, in order from biggest to smallest impact:

Payment history

How much you owe

Length of credit

New credit

Different types of credit

Let’s dive deeper into each slice of the credit score pie:

Keep reading with a 7-day free trial

Subscribe to Hump 🐪 Days to keep reading this post and get 7 days of free access to the full post archives.