🔥 CPI Rises More Than Expected, Q3 Earnings Season Commences!

Happy Sunday,

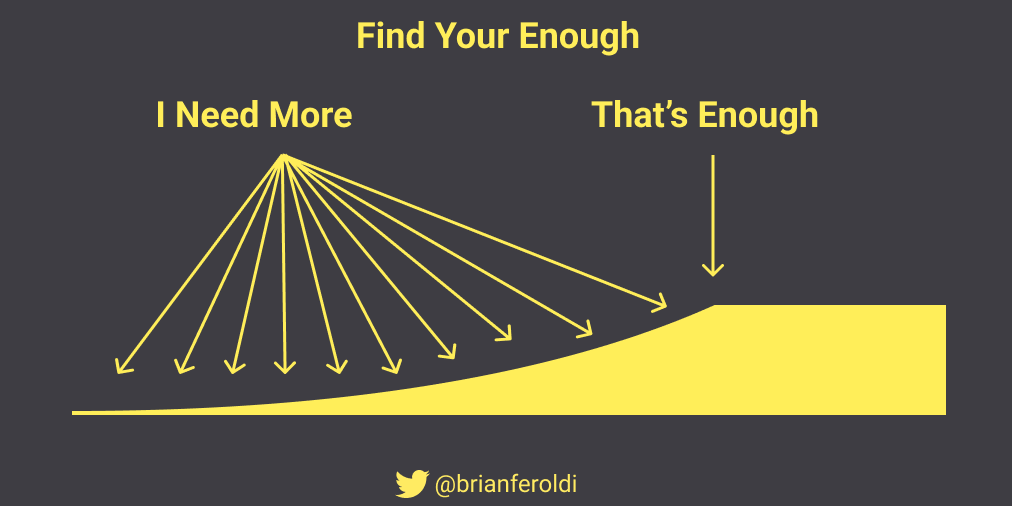

I wanted to start off this newsletter with a lesson from my father, who I recently saw and had a nice chat with last week. One thing he has always taught me to focus on was to stay humble & save as much as possible. Even as your income increases throughout your life, try to live well below your means. You want to be rich, not just look rich.

If you watch the channel, some of the videos that resonate the most with you all are those types of videos - reinforcing the idea that by living well below your means, you live a much more free life, with added peace of mind.

Now of course, there will come a time in which you need to shift from saving and investing mode to ‘spending’ mode, but until that time comes - you will always benefit from saving. Every dollar you save then has the responsibility to go out there and try to make you more money. That’s the mindset I try to approach it with.

Also, we wanted to make known that we made a typo in last week’s Newsletter. The subject line should have read: “1.8T”, not “1.8M”. Thanks to all the readers who pointed this out.

Enjoy this Sunday’s newsletter.

— Humphrey

Market Report

US CPI Rises More Than Forecast, Stalling Inflation Progress

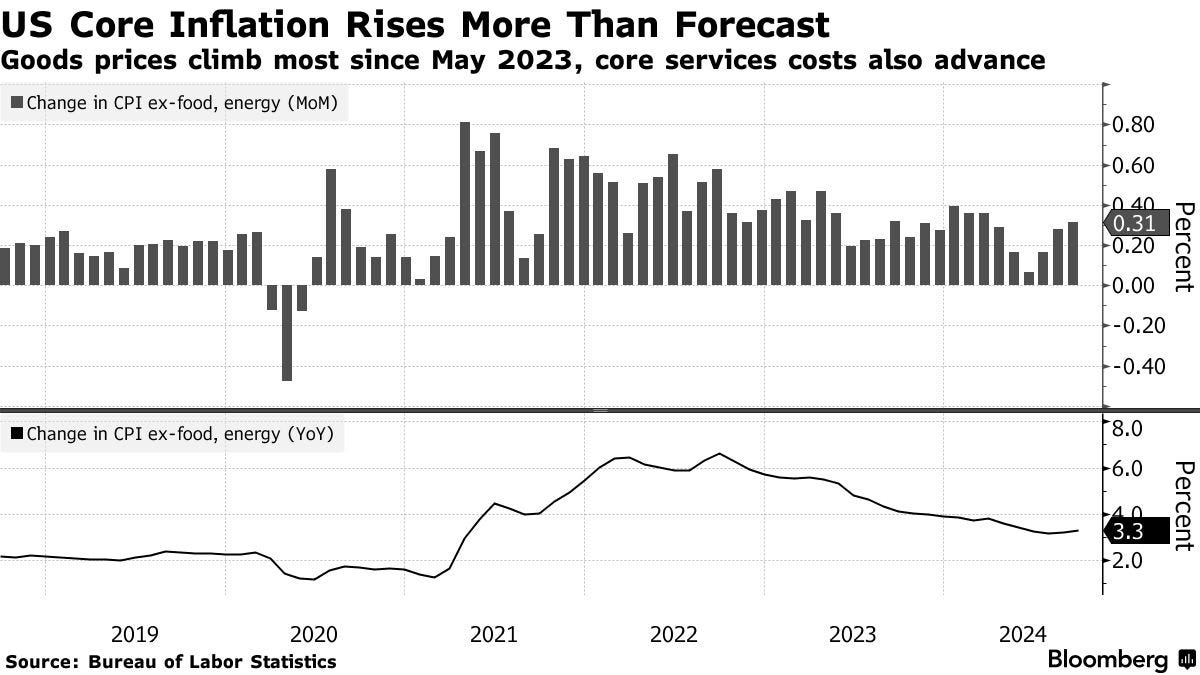

Inflation in September rose more than expected as core CPI, which excludes volatile food and energy costs, increased 0.3% from August and 3.3% from a year ago.

This marks the second consecutive month of 0.3% growth, disrupting a string of lower readings.

Overall CPI rose 2.4% year-over-year, slightly higher than the anticipated 2.3% but lower than August's 2.5% increase.

While the Fed reduced rates by 0.5 percentage points in September, the first cut since March 2022, the latest inflation figures could influence whether they opt for another small cut in November or pause after the large September reduction.

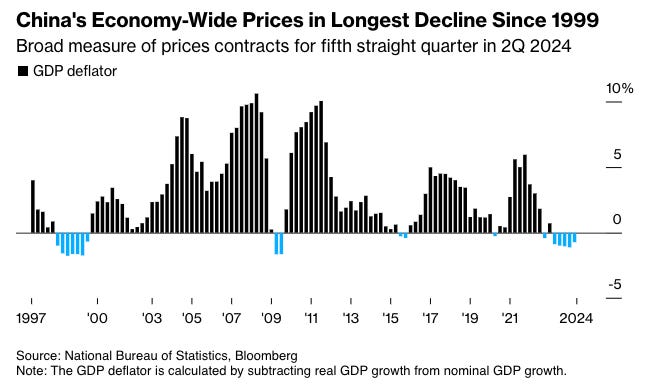

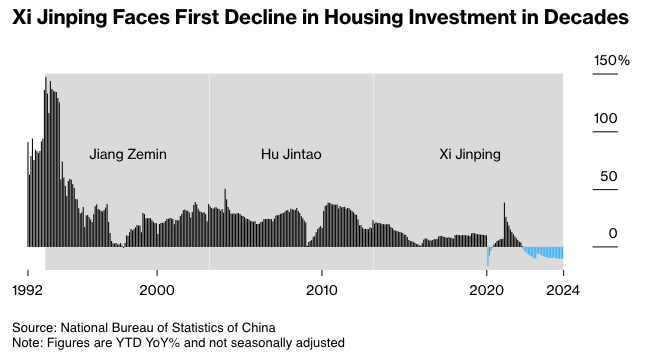

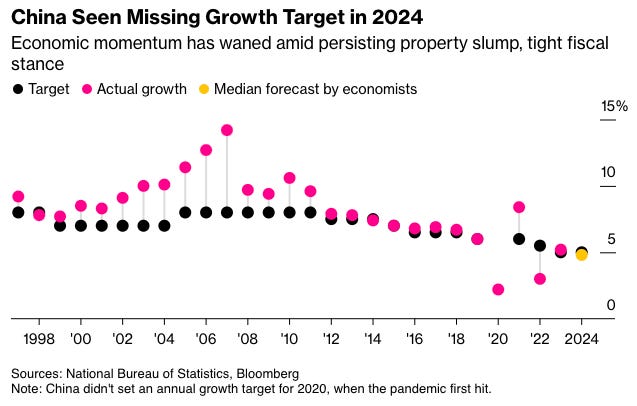

China Continues To Launch Initiatives to Combat Deflation

China is intensifying its economic support measures, particularly for the struggling property sector and local governments.

During a recent briefing, Finance Minister Lan Fo’an announced plans to allow local governments to use special bonds for purchasing unsold homes and to relieve their debt burdens.

Analysts suggest that while these policies aim to stabilize the housing market and support local governments, they may only shift existing debts without generating new economic growth.

The overall sentiment indicates a cautious approach from Chinese authorities, with calls for a shift towards boosting domestic consumption rather than relying on debt-fueled investments, as the traditional methods of stimulating growth have become less effective in the current economic landscape.

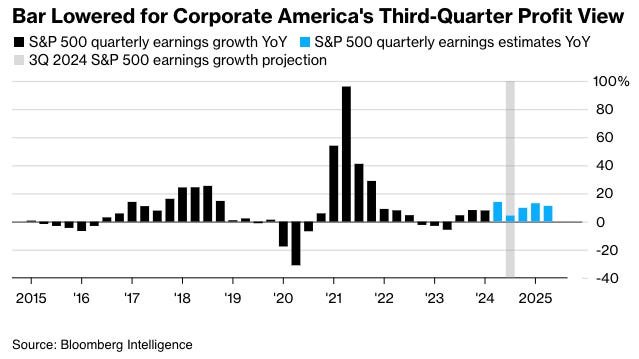

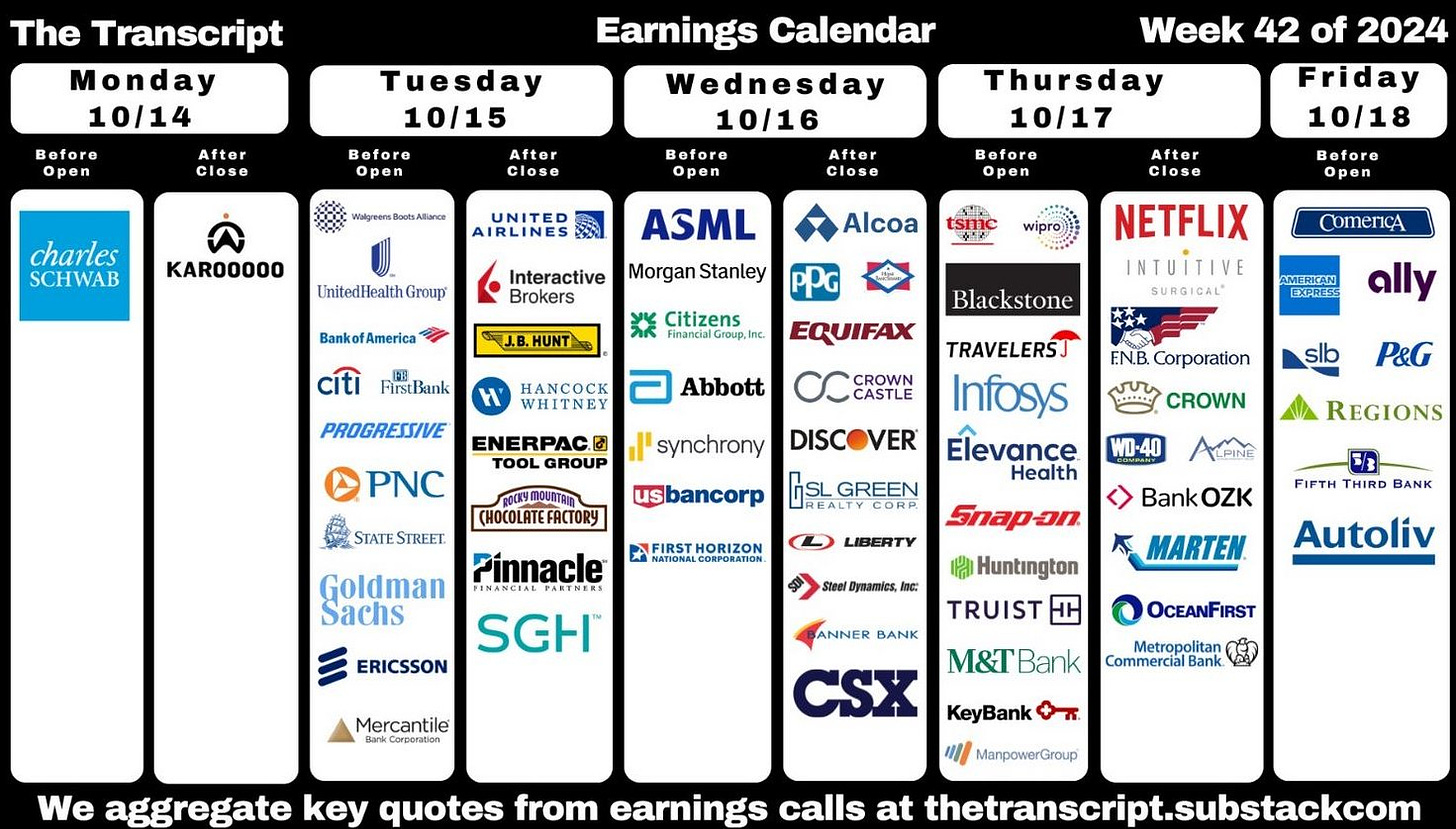

Q3 Earnings Reports: Growth Expected to be Lowest in the Past Year

As the Q3 2024 earnings season begins, analysts are projecting a 4.6% year-over-year earnings growth rate for S&P 500 companies, marking the weakest performance in the past four quarters.

This is a significant decrease from earlier projections of 8.4% growth and the 14% growth seen in Q2.

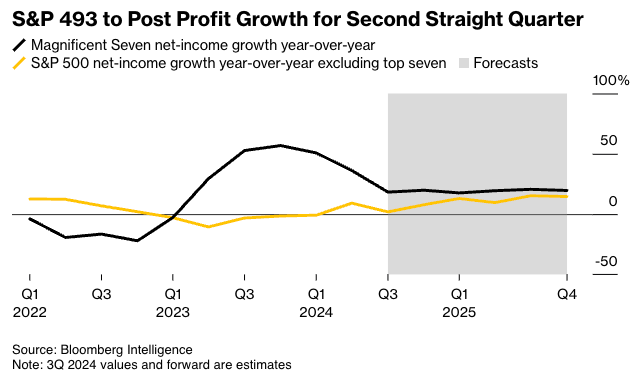

While the "Magnificent Seven" tech companies are expected to post 18% profit growth, down from over 30% in 2023, the rest of the S&P 500 is projected to see a modest 1.8% increase.

Three of the 11 S&P 500 sectors — technology, communication services and health care — are expected to post profit growth of more than 10%.

The energy sector, on the other hand, is expected to report a decline of more than 20%.

According to Bank of America, the options market is pricing in the biggest average post-earnings implied move at the single-stock level since 2021.

JP Morgan and Wells Fargo Earnings Boosted By Investment Banking Revenues

JP Morgan reported a surprise gain in net interest income and raised its guidance for interest income, despite interest rates expected to continue falling.

Net interest income increased 3% to $23.4 billion in Q3, beating analyst expectations who forecasted a slight decline.

Investment-banking operations also defied analysts’ estimates, fee revenue surging 31%, beating estimates for a 16% gain.

Wells Fargo also beat analyst estimates as a 37% surge in investment-banking fees helped offset a decline in lending revenue.

Net income for the quarter overall slipped 11% to $5.1 billion after the company recorded a $447 million loss on debt securities it holds as it repositioned its investment portfolio.

Forecast Ahead

Big Number

Overcome the Sunday Scaries

Got This Far and Want to Continue Building Wealth? Follow my Twitter!

Wow. You must be a die hard reader. Well lucky you - starting tomorrow, October 14th, you can expect daily Tweets from me on how to build your wealth: https://twitter.com/humphreytalks

It will be also be a place where I post more real-time news and live reactions to events.

Make sure you’re following. https://twitter.com/humphreytalks