Happy Sunday,

The markets delivered some predictable—but no less significant—news this past week. November’s CPI data came in as expected, keeping inflation firm but without unwelcome surprises. This stability has all but solidified market bets on a Federal Reserve rate cut, with odds of a 25-basis-point reduction now at 99%. Meanwhile, signs of cooling shelter costs and a modest boost in purchasing power suggest a steadying economy—but are these improvements enough to overcome lingering inflationary pressures?

From unexpected jobless claims surging post-Thanksgiving to Costco thriving with record-high membership renewals, there’s plenty to dissect. Are we on the verge of a meaningful labor market shift? And what does Costco’s resilience say about consumer behavior in an era of tightened wallets?

Let’s dive into the key stories shaping the week ahead.

- Humphrey & Rickie

Market Report

US CPI Brings No Surprises, Solidifying Fed Rate-Cut Bets

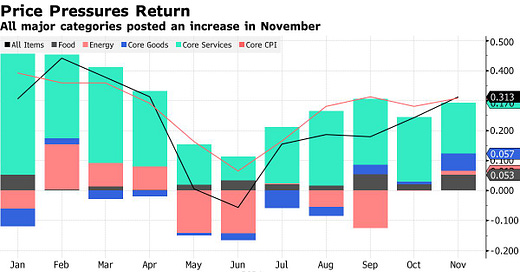

In November, CPI data showed that inflation remains firm but in line with expectations. The core CPI, which excludes volatile food and energy costs, increased by 0.3% for the fourth consecutive month, resulting in a 3.3% year-over-year increase. The headline CPI rose 0.3% month-over-month and 2.7% year-over-year.

While shelter costs, a persistent source of inflation, showed signs of cooling, they still accounted for nearly 40% of the overall advance.

The inflation report strengthened the likelihood of the Federal Reserve cutting interest rates at their upcoming meeting, with market odds now at 99% for a 25bps cut.

There were signs of easing in some areas, with homeowners' equivalent rent and actual rent indices showing the smallest monthly increases since 2021. Other notable changes included increases in vehicle prices and food costs, while energy prices saw a slight monthly rise but remained down annually.

Despite the persistent inflation, real average hourly earnings increased by 1.3% year-over-year, showing some improvement in workers' purchasing power.

US Jobless Claims Rises to Two-Month High After Thanksgiving

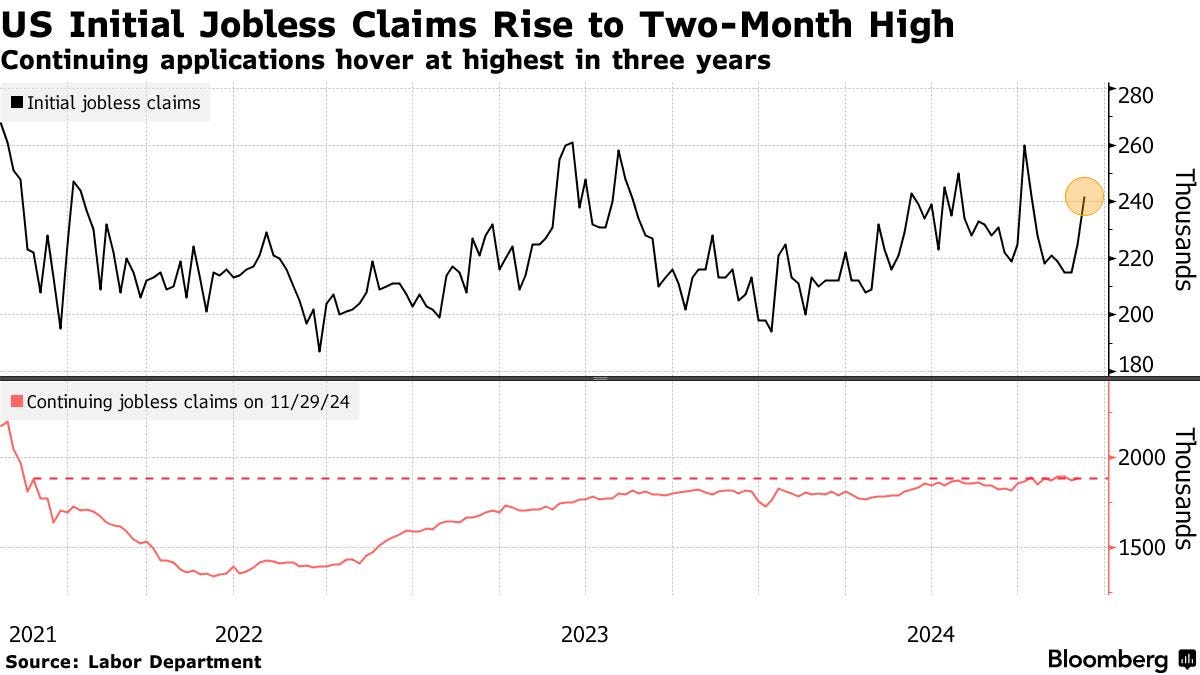

US unemployment benefit applications rose unexpectedly to a two-month high, with initial claims increasing by 17,000 to 242,000, surpassing economists' forecasts of 220,000.

Continuing claims, representing those receiving ongoing benefits, rose to 1.89 million in the previous week. While some analysts attribute the jump to seasonal volatility related to Thanksgiving, the data suggests a broader cooling in labor market conditions.

Unadjusted claims reached their highest level since January, with California, Texas, and New York seeing the largest increases.

The rise in claims, coupled with the November jobs report showing an increase in long-term unemployment and the overall jobless rate reaching 4.2%, shows that it may be taking longer for unemployed people to find new jobs.

Costco Profit Beats Estimates on Healthy Consumer Spending

Costco reported strong quarterly results, with earnings of $4.04 per share exceeding analyst expectations. Costco saw an increase in members during the quarter, with a high 90% renewal rate, and reported growth in comparable sales of 7.1% excluding gasoline and currency impacts.

Costco raised membership fees earlier this year and has also been installing scanners for membership cards in more locations to discourage shoppers from sharing them.

The company also noted growth in online sales and increased shopper traffic on a same-store basis. Despite consumers being more selective in their purchases, Costco's ability to offer new and affordable items has kept customers engaged, with a notable shift in spending towards food and groceries and away from restaurants.

The Fed would surely deny it but it does seem like they’re abandoning the 2% inflation target. Trump’s proposed policies are inflationary and if they don’t have the stomach to raise rates now they’re not going to have the stomach a year or two from now with Trump breathing down their necks.