🇺🇸🛍️ Consumers Carrying US Economy

Happy Sunday,

Hope you’re enjoying the last bits of summer as we head into the fall. College football is back, and the NFL is back this week too! I just drafted my Fantasy team and picked up Ja’Marr Chase with my first pick in a full PPR league.

This week, eyes shift from NVDA earnings to the Fed and how it will respond to the latest jobs data. There are 3 more rate decisions until the end of the year and the market is expecting in an interest rate cut in the next Fed meeting on September 18th. I’m making a video on how interest rate cuts affect stocks, and if you’re wanting a preview… just check out this chart below - which details how stocks, bonds, and cash-type investments perform in the 12 months following a rate cut. On average, the stock market returns 11% 12 months after the initial cut.

Rate cuts can benefit a lot of companies, such as smaller/mid cap companies or growth companies that leverage debt to help grow their business. As borrowing gets cheaper, that means companies in general, might be more inclined to get more capital to help grow their business.

I also filmed that Western White House Home Tour video this past Saturday, and so you can expect to see that video on the channel at some point in the next couple of weeks!

Hope you’ve all had a relaxing Labor Day weekend, and let’s get after the week.

— Humphrey

Market Report

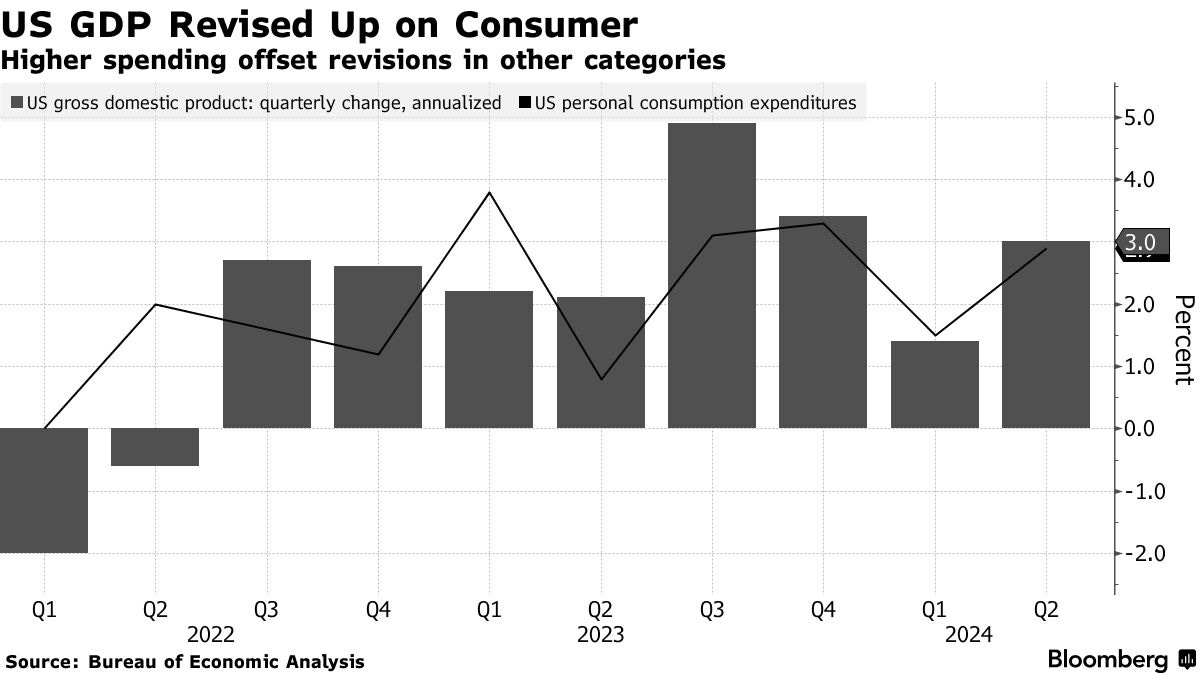

US Economy Expands at Revised 3% Rate on Resilient Consumer

The US economy grew at a 3% annualized rate in the second quarter of 2024, slightly higher than the previous estimate of 2.8%, driven by an upward revision in consumer spending.

Personal spending, the main engine of growth, advanced 2.9%, up from the initial 2.3%, with notable increases in health care, housing, and recreation.

Despite this positive revision, other areas such as business spending, inventories, and residential investment saw downward adjustments.

Economic growth has moderated in 2024 due to high borrowing costs, and while the Federal Reserve is expected to begin lowering interest rates as inflation slows, this may only partially offset the challenges facing sectors like housing and manufacturing.

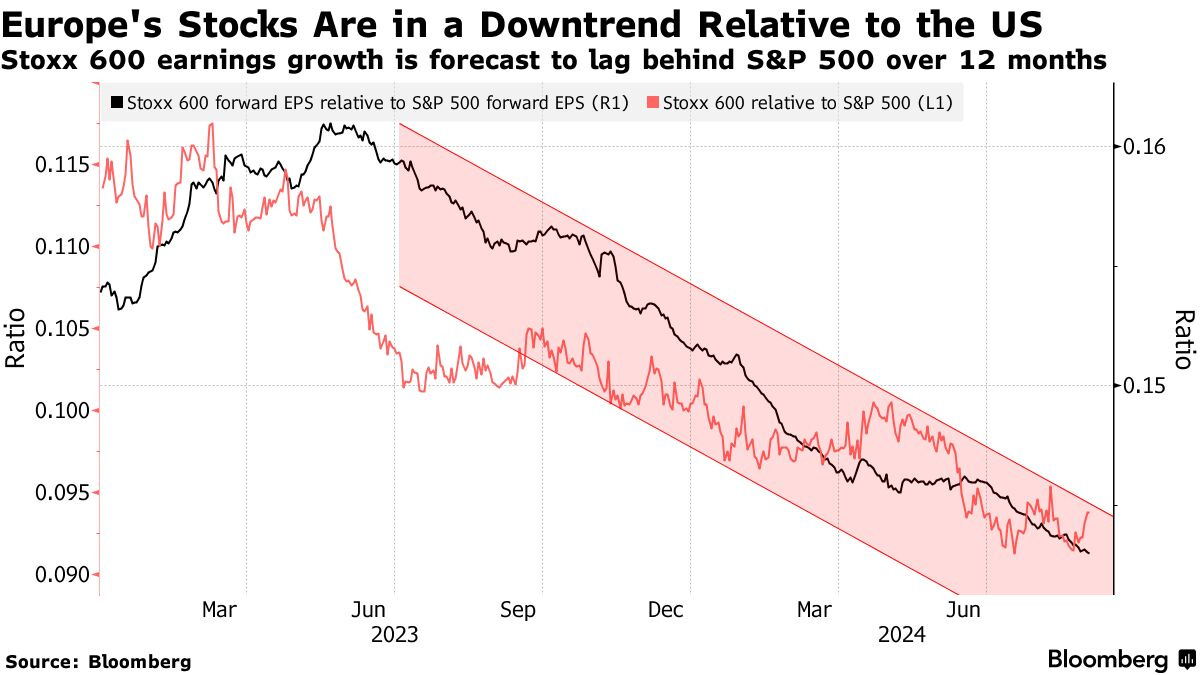

European Stocks Struggle Amidst Economic Slowdown

The initial optimism for European stocks gaining an edge over US markets is fading as concerns about an economic slowdown and disappointing earnings weigh on the outlook.

While the Stoxx 600 reached a record high, it underperformed the S&P 500 in August and has lagged by nearly 9 percentage points in 2024.

Investors are increasingly turning to undervalued sectors of the US market, driven by the resilience of the US economy and expectations of more aggressive Federal Reserve rate cuts.

Despite the valuation discount of European stocks, challenges like Germany's economic contraction and an uneven recovery in China are dampening growth prospects, leading investors to favor US stocks with higher earnings growth potential.

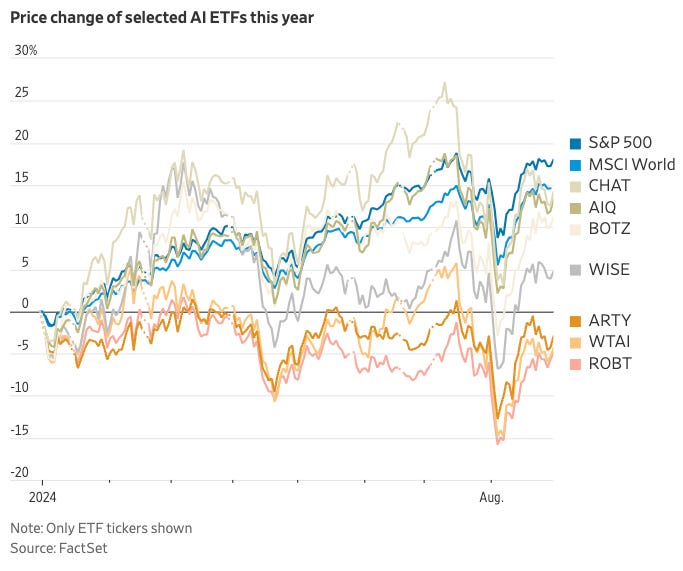

How to Lose Money Investing in AI This Year

Investors in AI-themed ETFs have faced challenges despite correctly predicting the rise of AI in the market. Many of these funds have underperformed, with some even losing money this year.

The issue lies in how these funds are structured, particularly their approach to diversification.

For example, funds that equally weight their holdings or cap the size of any one stock ended up with less exposure to high-performing stocks like Nvidia, which has significantly impacted their performance.

This highlights the difficulty of picking the right thematic ETF, as even within a seemingly promising theme like AI, different strategies can lead to vastly different outcomes.

Many thematic funds are launched during market bubbles and often underperform due to poor timing, high fees, and the risk of funds being wound up or changing strategy.

Student Loan Leniency Is Ending Soon.

Americans with federal student loans will need to resume payments starting at the end of September. This policy has helped shield borrowers from severe consequences for missed payments over the past year.

With more than 40 million Americans holding federal student debt, the end of the grace period is expected to strain many financially.

The situation is further complicated by ongoing legal battles over Biden's Saving on a Valuable Education (SAVE) plan, which aims to base loan repayments on income.

However, key parts of this plan have been blocked by court rulings, leaving the future of student loan forgiveness uncertain as the presidential election approaches.