Happy Sunday,

Housing starts decline, commercial real estate debt deteriorates, and government contractors flood a shrinking job market. Behind each datapoint: persistent rate pressure, policy uncertainty, and shifting structural demand. The cracks are widening.

Welcome to the Sunday Primer.

- Humphrey & Rickie

Market Report

New Home Construction Falls to Five-Year Low

US residential construction significantly slowed in May, reaching its lowest pace since the beginning of the pandemic. Housing starts plummeted by 9.8% to an annualized rate of 1.26 million homes, falling short of all economist estimates.

This decline could be due to multiple factors, including elevated inventories of completed homes, persistently high mortgage rates (with the 30-year fixed rate at 6.84% last week), and subdued buyer demand.

Builders are increasingly resorting to incentives like price cuts and mortgage rate buydowns to attract buyers, which is eroding their profits. The number of building permits issued also dropped to a five-year low, signaling a continued slowdown in future construction.

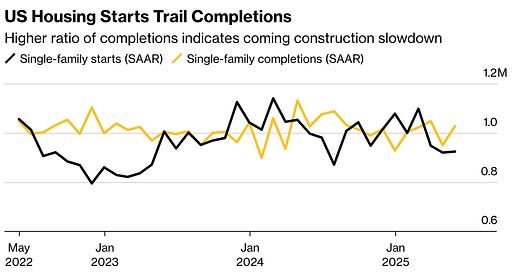

The rate of housing starts is currently below housing completions, indicating a reduction in homes under construction and suggesting that residential investment will likely act as a drag on GDP growth for the foreseeable future.

Regionally, most areas saw declines in new construction, with the South and Midwest experiencing significant drops, while the West saw an increase.

Commercial Real Estate in Pain as Delinquencies Spread

The US commercial real estate (CRE) credit market is experiencing significant stress, largely due to a surge in borrowing costs and the lasting impact of work-from-home trends.

Delinquencies are on the rise, and the amount of distressed CRE debt climbed 23% year-over-year to over $116 billion by the end of March, marking the highest level in over a decade.

While office spaces are a primary concern, the issue is spreading, with multifamily properties increasingly contributing to past-due and nonaccrual loans, which have reached their highest rate since 2014. This means that banks are losing confidence in recovering these debts.

Beyond financial pressures, policy uncertainty is also hindering market activity, as businesses delay investment decisions.

Proposed policies like the Section 899 'revenge tax' could deter foreign investors, potentially impacting all US real estate lenders.

Laid-Off Government Workers Are Flooding The Shrinking Job Market

Thousands of private government consultants are now facing a shrinking job market, largely due to cost-cutting efforts initiated during the Trump administration.

Data from Lightcast shows that job postings among seven major consulting firms that faced government contract cuts are down significantly—27% since 2023 and 11% from a year ago. Companies like Booz Allen Hamilton and Deloitte have notably fewer openings and have announced job cuts.

Federal government employment itself saw a loss of 59,000 jobs since January, with many workers taking buyout deals.

The impact is particularly felt in the Washington, D.C. metro area, a hub for federal workers, where overall job postings were down 17% in April compared to January. Specifically, management consulting job postings in the region plummeted by 28% between February and May.

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like minded investors.