Happy Wednesday all,

This week, we’re seeing growing signs that global trade and capital flows are under stress. From steep drops in Chinese smartphone exports to US companies borrowing heavily in Europe to hedge against domestic uncertainty.

In this edition, we break down:

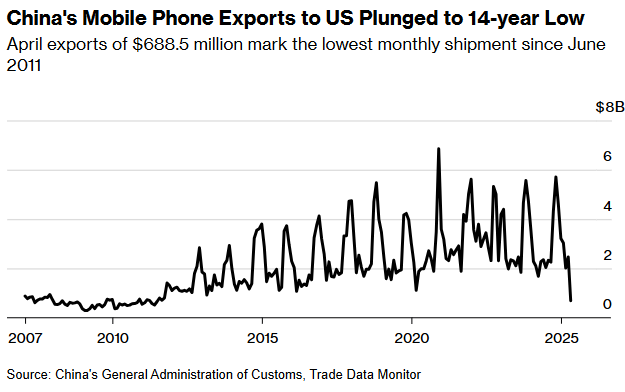

The 72% plunge in Chinese smartphone exports to the US and what’s driving it

The G-7’s latest push to counter low-value Chinese imports flooding global markets

Why American giants like Pfizer and Alphabet are turning to Europe for debt financing

Plus: eye-catching headlines and our chart of the week

As always, we’ve trimmed the noise and delivered the essentials. Let’s get into it.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Elon Musk confirms Tesla plan for robotaxis on Austin roads in June (CNBC)

Fortnite approved by Apple, returns to US App Store 5 years after removal (CNBC)

Toyota redesigns America’s top-selling RAV4 SUV to exclusively be a hybrid (CNBC)

UnitedHealth Built a Giant. Now Its Model Is Faltering. (WSJ)

Japan’s Exports to US Fall as Tariffs Start to Bite (WSJ)

Google Takes Aim at AI Firms Challenging Its Search Dominance (WSJ)

Target Cuts Sales Forecast on Shopper Pullback, Tariff Hit (BBG)

The Weekly Brief

Chinese Smartphone Exports to US Plunge to Lowest Since 2011

In April, Chinese shipments of Apple's iPhones and other mobile devices to the US fell to their lowest point since June 2011, with smartphone exports dropping a staggering 72% to just under $700 million.

This sharp decline significantly outpaced the overall 21% decrease in Chinese shipments to the US.

The Trump administration's tariff campaign, with levies reaching as high as 145% on Chinese goods, has been disrupting the flow of big-ticket items and redirecting electronics manufacturing, as seen by the quadrupling of phone component exports to India, where Apple is expanding its production.

This trade friction is already affecting major import and export categories, including smartphones, laptops, and lithium-ion batteries from China to the US, and liquid petroleum gas, oil, and soybeans from the US to China.

Tensions persist, with Beijing recently accusing the US of undermining trade talks through sanctions on Huawei's AI chips.

G-7 Countries Discuss Tariffs on Low-Value Chinese Products

In a news conference on Tuesday, G-7 finance ministers announced they are discussing coordinated actions to address concerns about oversupplied, low-value Chinese products flooding their markets, potentially through tariffs.

This comes as some countries have accused Chinese online retailers like Temu and Shein of undercutting local businesses.

The US has already removed the "de minimis" exemption that allowed duty-free imports of small, cheap packages from China, a move that saw a surge in shipments before it took effect and has prompted other countries like those in the EU, France, the UK, and Japan to consider similar measures.

Separately, the G-7 will also address the price cap on Russian oil, with Ukraine advocating for a revision to further pressure Russia's economy.

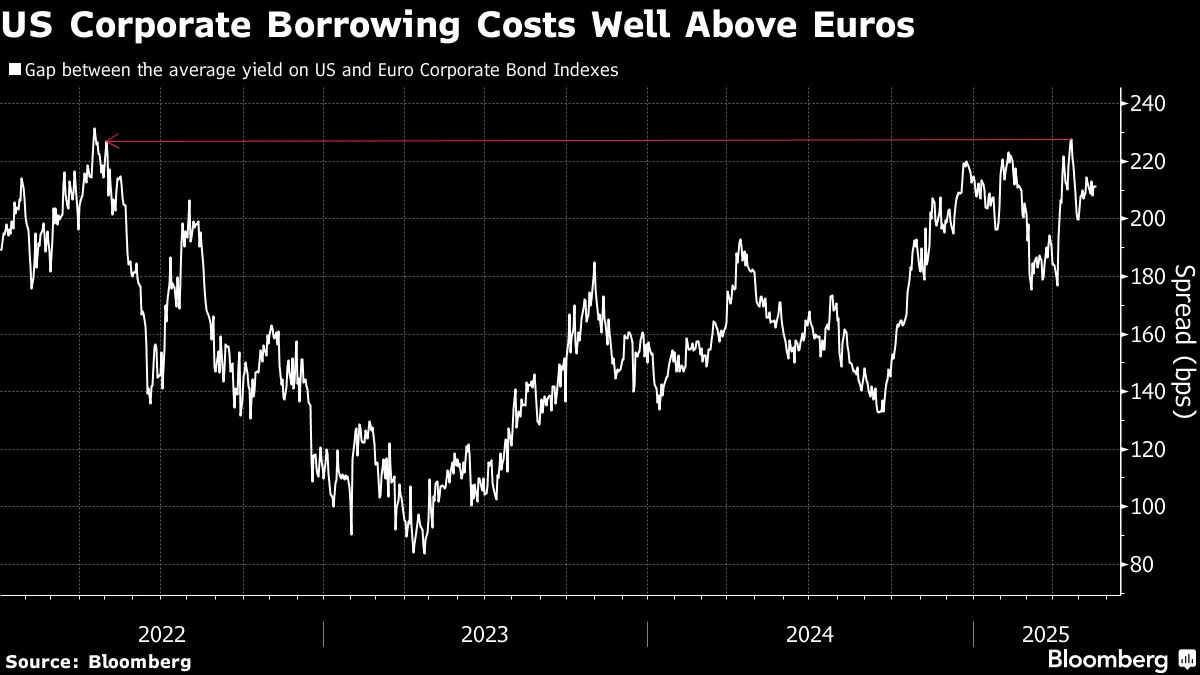

US Companies Turning to the European Markets for Borrowing Money

US companies are increasingly turning to the European bond market, issuing a record €83 billion in deals this year, a 35% increase from 2024.

This surge in euro-denominated borrowing by American giants like Pfizer and Alphabet has largely been driven by anxieties stemming from tariff threats and concerns about potential US market instability, inflated Treasury yields, and the nation's debt burden.

The recent downgrade of the US credit rating by Moody's has further fueled this shift.

The attractiveness of the European market has also been enhanced by lower borrowing costs compared to the US, with the average yield on European corporate bonds at 3.18% versus 5.3% in the US.

The corporate rats don’t even pay 1T in taxes.. this country needs an overhaul