🇨🇳✍️ China Fires Back With Tariffs

Happy Wednesday all,

The markets are shifting, tech is tumbling, and China is striking back. This week, we’re covering major shake-ups—from the latest US-China trade tensions to surprising gains in US manufacturing. Plus, Alphabet’s cloud stumble has investors questioning the AI boom.

Let’s dive into the biggest stories shaping the week.

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Disney tops quarterly profit estimates, but starts to lose Disney+ streaming subscribers (CNBC)

Uber beats fourth-quarter revenue expectations but offers soft guidance (CNBC)

AMD Tumbles After Giving Disappointing Outlook for AI Growth (BBG)

White House crypto czar David Sacks says first priority is stablecoin legislation (CNBC)

USPS temporarily suspends some inbound packages from China, Hong Kong (CNBC)

The Weekly Brief

China Fires Back after 10% US Tariffs Take Effect

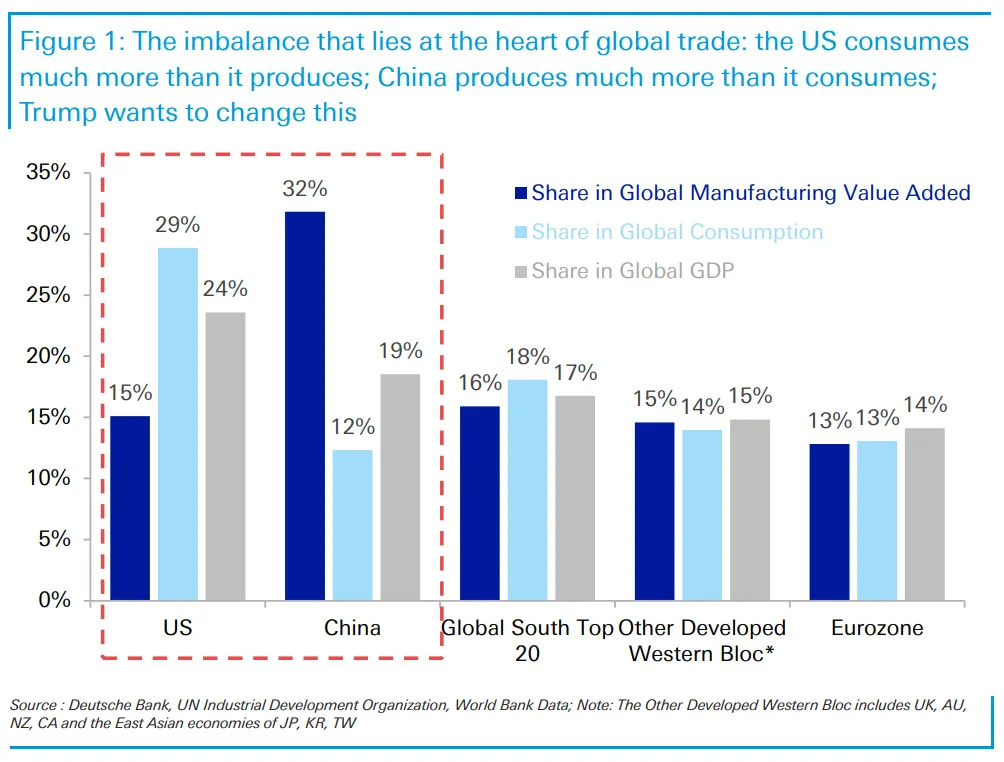

After Trump’s tariffs on China took effect Tuesday midnight, China sprung into action… Instead of matching tariffs dollar-for-dollar, China imposed targeted 10% and 15% tariffs on around $14 billion worth of American products, while simultaneously taking additional strategic actions such as launching an antitrust investigation into Google, tightening export controls on critical minerals, and adding two US companies to its blacklist.

This approach from China is a lot different from Trump’s first term. With a significant trade imbalance and a more troubling economic situation, China is likely being cautious to avoid escalating a full-blown trade war.

The country has been working to diversify its imports away from the US and is relying on manufacturing and overseas sales to maintain economic growth while managing a property market downturn and deflationary pressures.

Trump has expressed interest in reaching a deal and has stated he wants more balanced trade, while also seeking Chinese cooperation on issues like the Ukraine conflict and the future of TikTok.

According to analysts, Chinese officials, with limited bargaining room, are likely to offer concessions such as purchasing more American oil and gas, maintaining yuan stability, or delivering on previous trade agreements.

US Manufacturing Activity Expands for First Time Since 2022

The US manufacturing sector showed signs of recovery in January, with the Institute for Supply Management's manufacturing gauge rising to 50.9, marking its first sign of manufacturing expansion since 2022.

The positive data included a notable increase in new orders to 55.1, the strongest growth since May 2022, and a production gauge climbing to 52.5, its best reading since March.

The survey suggests a gradual build-up of optimism among factory managers and an expansion in hiring once again.

Alphabet Slides After Cloud Sales Fall Short of Expectations

Alphabet, Google’s parent, reported a mixed fourth-quarter earnings that sparked investor concerns. The company's revenue of $81.6 billion fell slightly short of analysts' expectations and expected capital expenditures for 2025 was over $20 billion higher than analyst expectations, with shares dropping over 7% in after-hours trading.

Google's cloud business showed slower growth than anticipated, generating about $12 billion in sales, which missed estimates. Despite this, the company remains committed to AI investments, announcing a massive $75 billion in capital expenditures for 2025.

While search advertising brought in $54 billion and YouTube exceeded revenue expectations with $10.5 billion, the company faces increasing pressure to demonstrate the tangible business benefits of its AI investments.

CEO Sundar Pichai emphasized that these investments are crucial for addressing customer demand and maintaining competitive edge, particularly in light of emerging AI challengers like Chinese startup DeepSeek.

In Alphabet's Other Bets segment, including projects like Waymo, continues to explore innovative technologies, with Waymo now averaging 150,000 trips per week and planning international expansion.