💸😰 Can Inflation Relief Offset Market Fears?

Happy Sunday,

The markets are in flux as investors react to a mix of economic concerns and policy shifts. Stocks are pulling back after an initial post-election surge, consumer spending is slowing, and the US trade deficit is hitting record highs. With tariffs looming and inflation showing signs of easing, all eyes are on how businesses and consumers will navigate the shifting landscape.

Let’s break it all down.

- Humphrey & Rickie

Market Report

Markets Navigate Choppy Waters as Global Risks Keep Mounting

The US stock market is showing signs of stress after the initial post-election euphoria has begun to fade. After a strong rally following Donald Trump's victory, the S&P 500 has declined for two consecutive weeks and four of the last five, nearly erasing all its post-election gains.

Investor sentiment has turned sharply negative—reaching levels not seen since 2022—as multiple concerns converge to create what one analyst called a "fog of uncertainty."

Several key factors are driving this market anxiety. First, the big tech stocks that have powered much of the market's gains over the past two years are losing momentum, with the top seven technology stocks entering correction territory.

Second, fears about President Trump's tariff policies continue to mount, with 25% tariffs on Mexican and Canadian imports set to take effect March 4 and additional levies threatened against China.

Third, recent economic data has raised concerns about a potential slowdown. These worries have triggered a flight from risk, with money flowing out of speculative investments and into safer positions.

Interestingly, US equities are now underperforming global markets, with Chinese ADRs and European equities gaining roughly 10% or more in 2025 compared to the S&P 500's modest 1.2% rise.

Despite the negative sentiment, some analysts see potential for a rebound, noting that extremely poor sentiment readings have historically been contrarian indicators. According to UBS, stocks typically perform well after such negative sentiment, with higher returns a year later about 85% of the time.

US Consumer Spending Drops While Inflation Offers Relief

US consumers unexpectedly tightened their wallets in January, with inflation-adjusted spending dropping 0.5% - the largest monthly decline in nearly four years. '

The pullback was primarily driven by decreased car purchases and recreational goods amid extreme winter weather.

This cooling follows a strong holiday season and raises questions about whether this represents a temporary pause or signals a more cautious consumer approach for 2025. Services spending, which forms the bulk of consumer expenditures, also showed tepid growth.

On a positive note, the Federal Reserve's preferred inflation measure offered some relief. The core personal consumption expenditures (PCE) price index rose 0.3% from December and 2.6% year-over-year, matching the smallest annual increase since early 2021.

Meanwhile, personal incomes increased by 0.9% in January, boosted partly by cost-of-living adjustments for Social Security recipients. This helped push the saving rate to its highest level since June.

The Countries Fueling America’s $1.2 Trillion Goods Trade Deficit

The US recorded a staggering $1.2 trillion goods trade deficit in 2024—an all-time high that has become a major focus for President Trump's economic policy.

In response, Trump recently announced a "reciprocal tariff" approach, essentially promising to match other countries' trade barriers with equivalent US tariffs.

The deficit has been accelerating dramatically in recent months, with January's preliminary figures showing a record $153 billion monthly goods deficit as businesses rushed to import products ahead of threatened tariffs.

Looking at specific trading relationships, China remains the largest contributor to America's trade deficit at $295 billion, though this is down from its 2018 peak. Meanwhile, Mexico has emerged as a growing concern, with a $172 billion deficit that has more than doubled since Trump's first term.

The trade deficit represents the gap between what Americans buy from other countries versus what US companies sell abroad. While the US maintains a surplus in services trade, it's not enough to offset the massive goods imbalance.

President Trump's administration believes these deficits harm American manufacturing and jobs, hence the aggressive tariff strategy targeting major trading partners.

January's spike in imports demonstrates how businesses are adapting to the new trade environment - rushing shipments to beat tariff implementation dates, which may temporarily worsen the very deficit the administration aims to reduce.

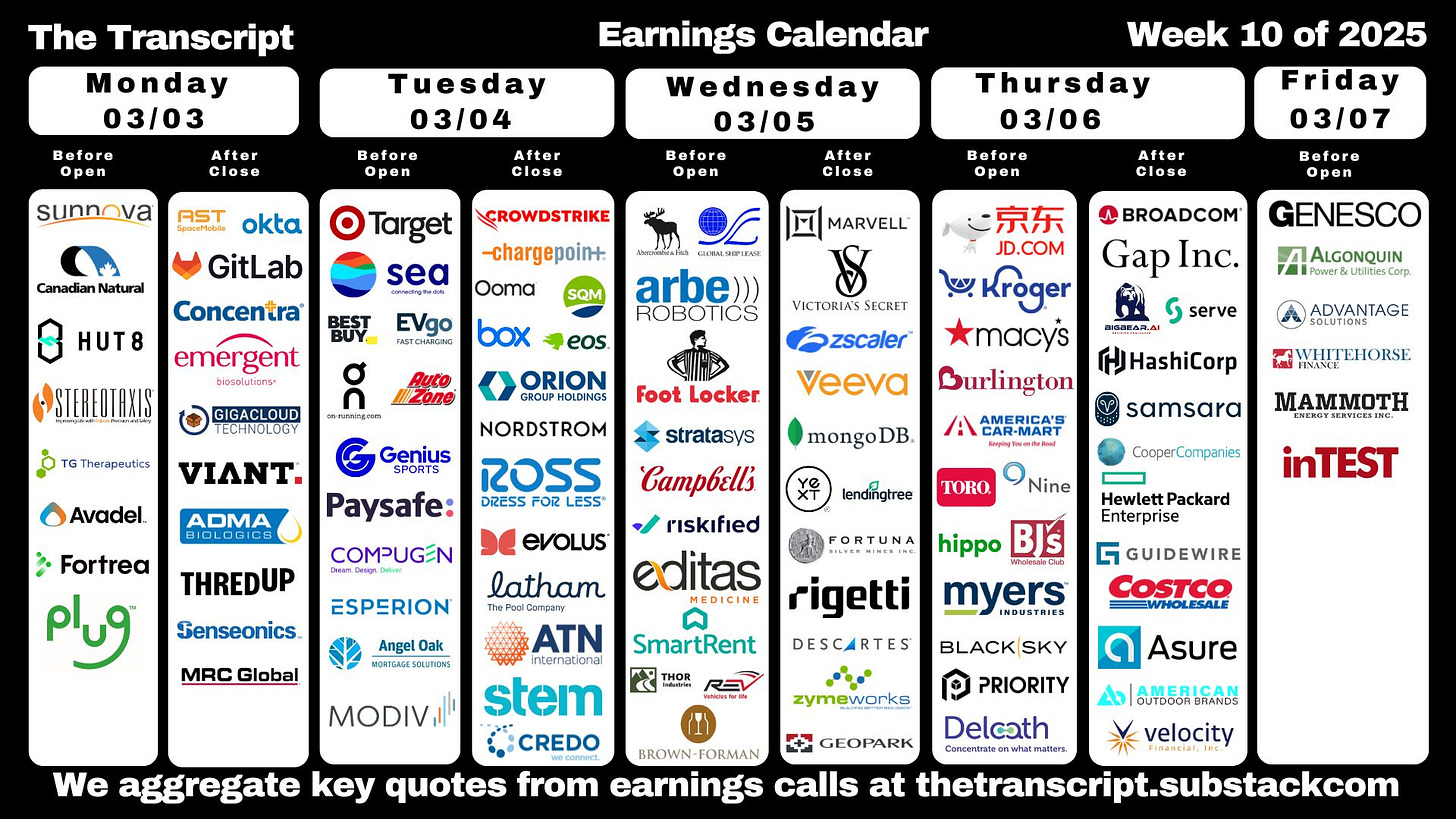

Forecast Ahead

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like-minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like-minded investors.