💸🍔 Buy Now, Pay Later… for Your DoorDash Order?

Happy Sunday,

I set out to do one “tough” physical goal for 2025 and that was to run a marathon. This past week, I signed up for the San Diego half marathon in June! I’m running between 10-15 miles per week right now and plan to up it to 20 miles per week soon. Here are the stats from my latest run, and I’m planning to do the full marathon in December.

In financial news: The Federal Reserve has kept interest rates unchanged, and now policymakers are wrestling with a delicate balance—slowing growth, rising inflation, and the impact of new tariffs. Meanwhile, markets are paying close attention to economic data, showing more concern over upcoming reports than President Trump’s latest trade threats.

In this edition, we break down what the Fed’s latest decisions mean for the economy, why volatility measures are behaving unusually during the market downturn, and how “Buy Now, Pay Later” is creeping into everyday purchases like food delivery.

- Humphrey & Rickie

Market Report

Fed Holds Rates Steady Despite Economic Crosswinds

For a second consecutive meeting, the Federal Reserve kept interest rates unchanged in the 4.25%-4.5% range, as officials navigate between concerns of an economic slowdown and persistent inflation.

Chair Jerome Powell acknowledged increased uncertainty stemming from President Trump's policy changes, particularly regarding tariffs, but maintained the Fed isn't rushing to adjust rates until there's more clarity on their economic impact.

"We are not in a hurry," Powell emphasized at his press conference, adding they're focused on "separating the signal from the noise as the outlook evolves."

New economic projections reveal mixed signals, with officials lowering growth forecasts while raising inflation estimates. Despite the gloomier outlook, the Fed's "dot plot" - the chart showing individual committee members' rate projections - still indicates two quarter-point rate cuts anticipated this year, unchanged from December's forecast.

However, eight officials now see only one reduction or fewer in 2025, highlighting a growing divide among policymakers. Powell downplayed recession concerns, noting that while outside economists have "generally raised their estimated likelihood of a recession, a severe downturn still isn't likely."

He also described potential tariff-driven inflation as likely "transitory" – reviving a term the Fed previously abandoned after incorrectly assessing post-pandemic inflation.

Moving to the technical side, the Fed announced it would slow the pace of its balance sheet reduction beginning in April, lowering the monthly cap on maturing Treasuries from $25 billion to $5 billion.

This decision aims to ease potential strain on money market rates as the government approaches its debt ceiling.

Balance sheet reduction, also called "quantitative tightening," is the process where the Fed shrinks its holdings of Treasury bonds and mortgage-backed securities by allowing them to mature without reinvestment.

This reduces liquidity in the financial system, effectively complementing interest rate hikes in tightening monetary policy.

Looking ahead, the Fed's updated economic projections show officials raised their median estimate for core inflation to 2.8% by year-end (up from 2.5%), while their 2025 economic growth forecast cooled to 1.7% (down from 2.1%).

With tariffs continuing to create uncertainty, the timing of the first cut remains unclear, with analysts now focusing on whether easing might begin in summer or be pushed to later in the year.

Markets Watching Economic Data Over Trump's "Tariff Liberation Day"

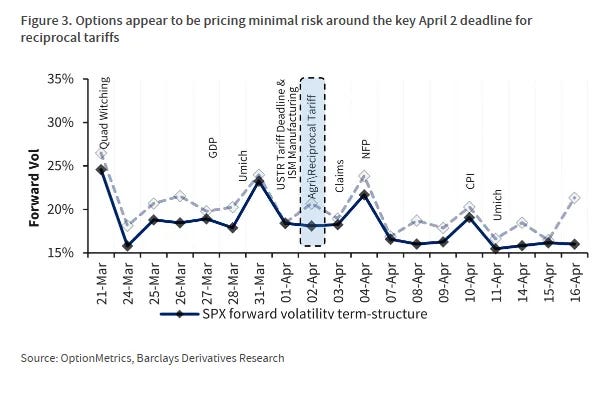

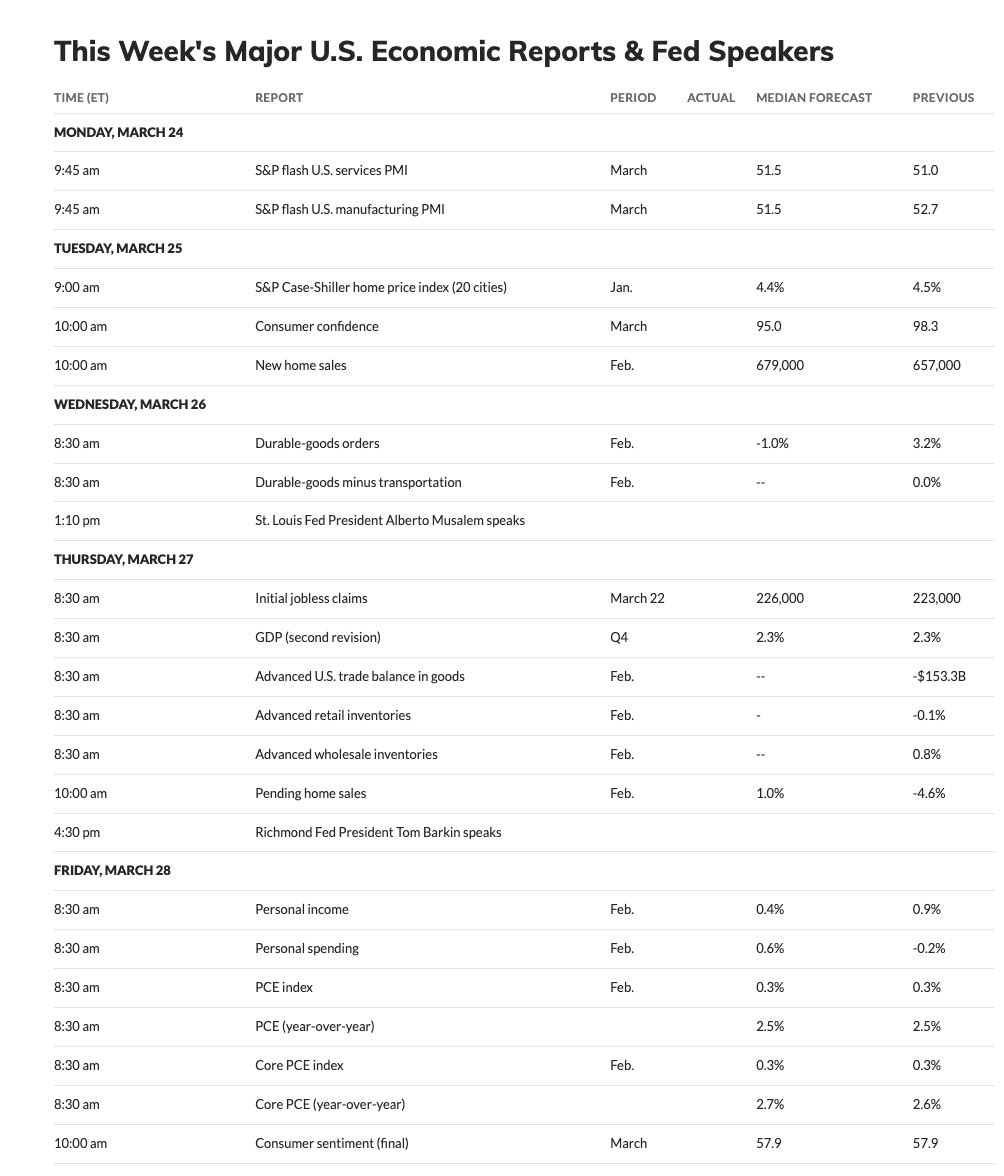

Despite President Trump's April 2 "Liberation Day" tariff threat grabbing headlines, options markets show investors are equally focused on upcoming economic data releases.

Implied volatility in S&P 500 options shows heightened demand for protection on March 31 (Core PCE Price Index release) and April 4 (monthly unemployment data) – suggesting the market is more interested in how the economy is responding to Trump's policies than in the announcements themselves.

Something interesting that happened during the recent 10% S&P 500 decline has been the relative calm in volatility measures. The VIX hasn't spiked as dramatically as during previous selloffs, and the VVIX (which measures expected swings in the VIX) recently hit its lowest point since early December.

This soft response in volatility likely comes from the fact that investors are gradually reducing positions and rotating into other markets rather than panic-selling, lessening the need for downside protection.

Buy Now, Pay Later Comes to Your DoorDash Delivery Order

DoorDash is partnering with Klarna to bring services to food delivery, allowing users to split payments into four interest-free installments or align payment dates with their paycheck schedules.

While BNPL services have usually been used for larger purchases like furniture or electronics, now we’re getting it for takeout meals.

The partnership comes as BNPL services continue to boom, with usage hitting record highs last holiday season and generating over $18 billion in online spending. While merchants pay fees ranging from 1.5% to 7% per transaction, many find the cost worthwhile as these services can boost average sales by 30-50% and increase conversion rates.

However, this is continuing to push concerns about potential debt accumulation, particularly as Americans' overall debt levels reached $18.04 trillion last quarter, with serious delinquencies on auto loans and credit cards hitting 14-year highs.