🤨🍎 Buffett Rushing Out of Apple?

Happy Wednesday all,

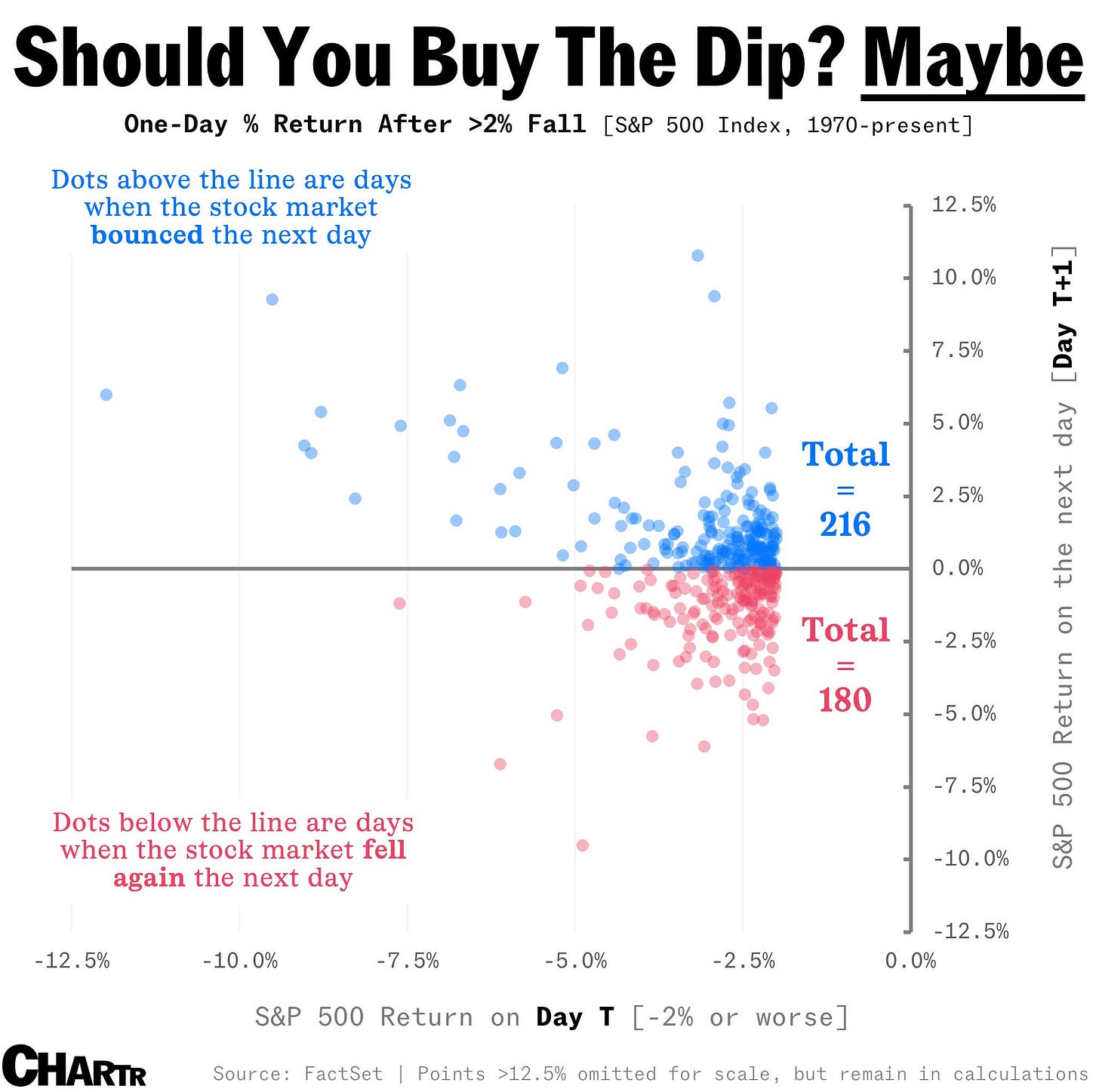

Today we have a dual-intro for you. This is Humphrey checking in with you from Scotland, as our team (mostly just Rickie and I) are on vacation till the 11th. I saw the stock market drop on Monday in the US as I was in the Isle of Skye (a remote part of northwest Scotland), and it was honestly just a weird feeling… Being out in the middle of nowhere looking at sheep but also realizing that the entire financial world was panicking on Monday. I didn’t get a chance to make any content about it, so apologies, but to me, I’ve seen a lot of these dips and crashes in my life, and my long-term strategy is to just hold my ETFs and stocks for as long as possible - so my game plan is to just stay calm and continue on. I’ll pass it to Rickie now.

Rickie checking in with you from St. Moritz, Switzerland! I hope you’re doing well and haven’t been looking at your portfolios much… I’ve been trying really hard not to look. 🫣

I’ll be in Switzerland the next couple days on a road trip with my family - so lot’s of hiking, nature, and mountains! It’s good to get a little bit of a reset having been in my home office for so long so I always look forward to this trip every year with my family. Two years ago, we took the train down from Zurich toward Milan and the views were just so amazing, we had to come back and turn it into a road trip to be able to stop in all the little towns along the way. Next week, maybe I’ll have some photos to show you!

In the meantime, get up to date with the markets and financial world with our edition today!

Enjoy this week’s Hump Days!

- Humphrey, Rickie & Tim

👀 Eye-Catching Headlines

Left Behind in the Retail Real-Estate Comeback: Department Stores (WSJ)

Disney Posts First-Ever Streaming Profit, Warns of Pressure on Theme-Parks Business (WSJ)

What Market Upheaval? Companies Are Selling Debt Just Fine (WSJ)

Weekly mortgage refinance demand soars 16% as rates sink to lowest level in over a year (CNBC)

Consumer giants from Starbucks to General Mills have one big sales problem: China (CNBC)

The True Cost of Layoffs (BBG)

Private Credit Fund Burned by Risky Bets Is Bleeding Cash (BBG)

The Weekly Brief

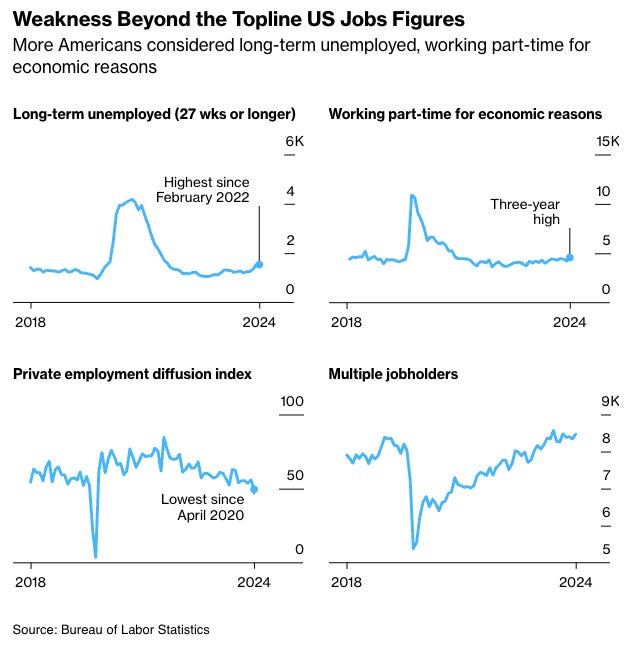

Unemployment Rate Rises Again, Solidifying Path to Rate Cut

The U.S. job market saw a significant slowdown in July, with employers adding only 114,000 jobs, far below the expected 175,000.

This marks one of the weakest job growth figures since the pandemic.

The unemployment rate rose to 4.3%, the highest level since October 2021, reflecting a fourth consecutive month of increase.

This unexpected rise in unemployment triggered the "Sahm rule," a recession indicator with a perfect track record over the past half-century.

The disappointing job report, along with other weak economic data from the week, has raised concerns about a more abrupt economic downturn and increased pressure on the Federal Reserve to consider cutting interest rates in September.

Warren Buffett Sells HALF of Berkshire’s Apple Position

Warren Buffett's Berkshire Hathaway cut its stake in Apple, selling nearly half of its position during the second quarter of 2024.

The conglomerate's Apple holdings now stand at approximately $84 billion, down from $140 billion at the end of March.

This move has raised questions about Buffett's confidence in Apple's growth prospects, but many Wall Street analysts are urging investors to remain calm.

Despite the reduction, Apple remains Berkshire's largest single position, and the sale may be attributed to portfolio rebalancing and profit-taking after Apple's substantial growth since Berkshire's initial investment in 2016.

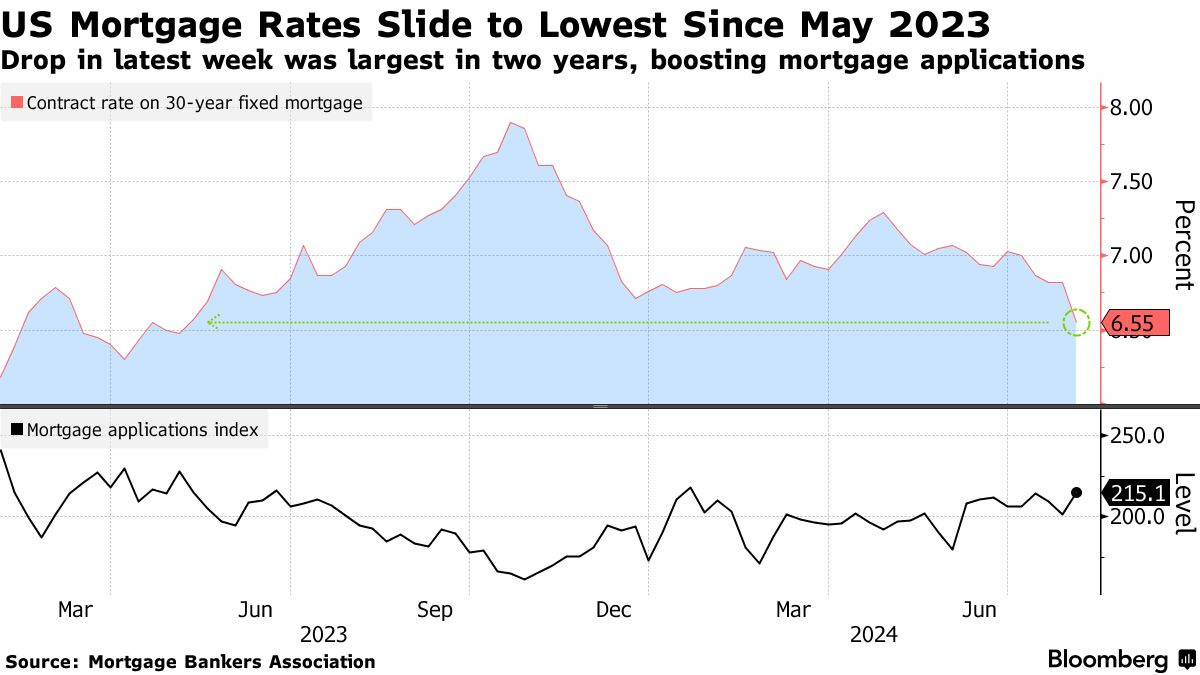

US Mortgage Rates Tumble to 6.55% in Biggest Drop in Two Years

Last week, US 30-year mortgage rates experienced their most significant drop in two years, reaching their lowest level since May 2023, according to the Mortgage Bankers Association.

The rate on a 30-year fixed mortgage fell by 27 basis points to 6.55%, while the rate on a five-year adjustable mortgage dropped 31 basis points to 5.91%, the lowest this year.

This decline propelled a nearly 16% increase in refinancing applications. Mortgage applications to buy a home rose by 0.8%, marking the first increase in a month, and the overall index of applications climbed 6.9% to the highest level since the beginning of the year.

Despite the lower mortgage rates, rising home prices continue to challenge prospective buyers.