🫣 Buffett Is Selling More of WHAT Stock?!

Hey everyone,

Humphrey here! Happy Sunday. If you’re new to the newsletter - welcome. This past week was a good one, I personally worked on making more videos - including a Portfolio Roast video releasing on YouTube on Tuesday, and I was able to attend some NBA All-Star weekend events here in San Francisco thanks to YouTube and SoFi.

I’ve been debating starting a podcast, but the space seems really tough to grow in as so many podcasts exist already. I did record a pilot episode with Shelby Church, and am planning on just recording 4 more great conversations before potentially releasing it. Still though, I think if there’s some value there for listeners it may not matter if the space is crowded.

I hope your Valentines Day and President’s Day weekend is going well, and I’ll check back in with you guys on Wednesday with another edition!

- Humphrey & Rickie

Market Report

Buffett Sells More BofA Stock While Keeping Apple Position Intact

During the fourth quarter of 2024, Berkshire Hathaway continued its gradual reduction of its Bank of America position, selling 117.5 million shares to bring its ownership stake down to 8.9% - a move that has been closely watched since it began in mid-2024.

What's particularly noteworthy is how Berkshire managed its two largest positions differently: while continuing to trim Bank of America, it maintained its significant stake in Apple unchanged after an earlier reduction in 2024.

Apple remains Berkshire's dominant holding, comprising 28% of its portfolio and appreciating by more than $5 billion in the quarter alone.

The quarter also saw other notable portfolio adjustments, including new investments in SiriusXM and additional Occidental Petroleum shares, while dramatically reducing its Citigroup position by 73% and completely exiting its recently acquired Ulta Beauty position.

US Retail Sales Drop by Most in Two Years Amid Fires, Storms

US retail sales experienced their sharpest decline in nearly two years this January, falling 0.9% after an upward-revised 0.7% gain in December 2024.

Nine out of the 13 retail categories showed decreases, with notable drops in motor vehicles, sporting goods, and furniture stores. While severe weather conditions and wildfires in Los Angeles may have contributed to reduced brick-and-mortar shopping, the widespread nature of the decline suggests other factors were at play.

The decline is particularly significant following strong retail performance in late 2024's holiday season. The "control group" sales, which feed into GDP calculations, fell 0.8% - the largest drop since March 2023.

Additionally, President Trump's planned tariffs on various imported goods could potentially impact future retail sales figures, with some economists noting that recent consumer stockpiling of big-ticket items may have artificially inflated late-2024 sales numbers.

Investors Keep Buying Stocks as Trump’s Tariffs Loom

The stock market is currently navigating a complex situation regarding President Trump's tariff policies, with investors showing resilience despite looming trade tensions.

While Trump has announced 25% tariffs on steel and aluminum imports for March and reciprocal tariffs planned for April, the S&P 500 has continued to rally near all-time highs.

This apparent disconnect between market performance and tariff risks can be partially explained by the belief that the final tariffs may be less severe than initially feared, though market sentiment remains cautious.

The market's recent gains have been heavily concentrated in just a few major technology companies like Nvidia, Apple, and Tesla, while tariff-exposed stocks have notably underperformed.

Additionally, market analysts and major Wall Street banks are expressing increasing worry about these trade tensions, with Goldman Sachs identifying tariffs as a key risk to their 2025 outlook and Bank of America noting that stock fragility among large S&P 500 companies is approaching a 30-year high.

Corporate America is also sounding alarms, with companies like Ford warning that the planned tariffs on Mexico and Canada could severely impact the U.S. auto industry.

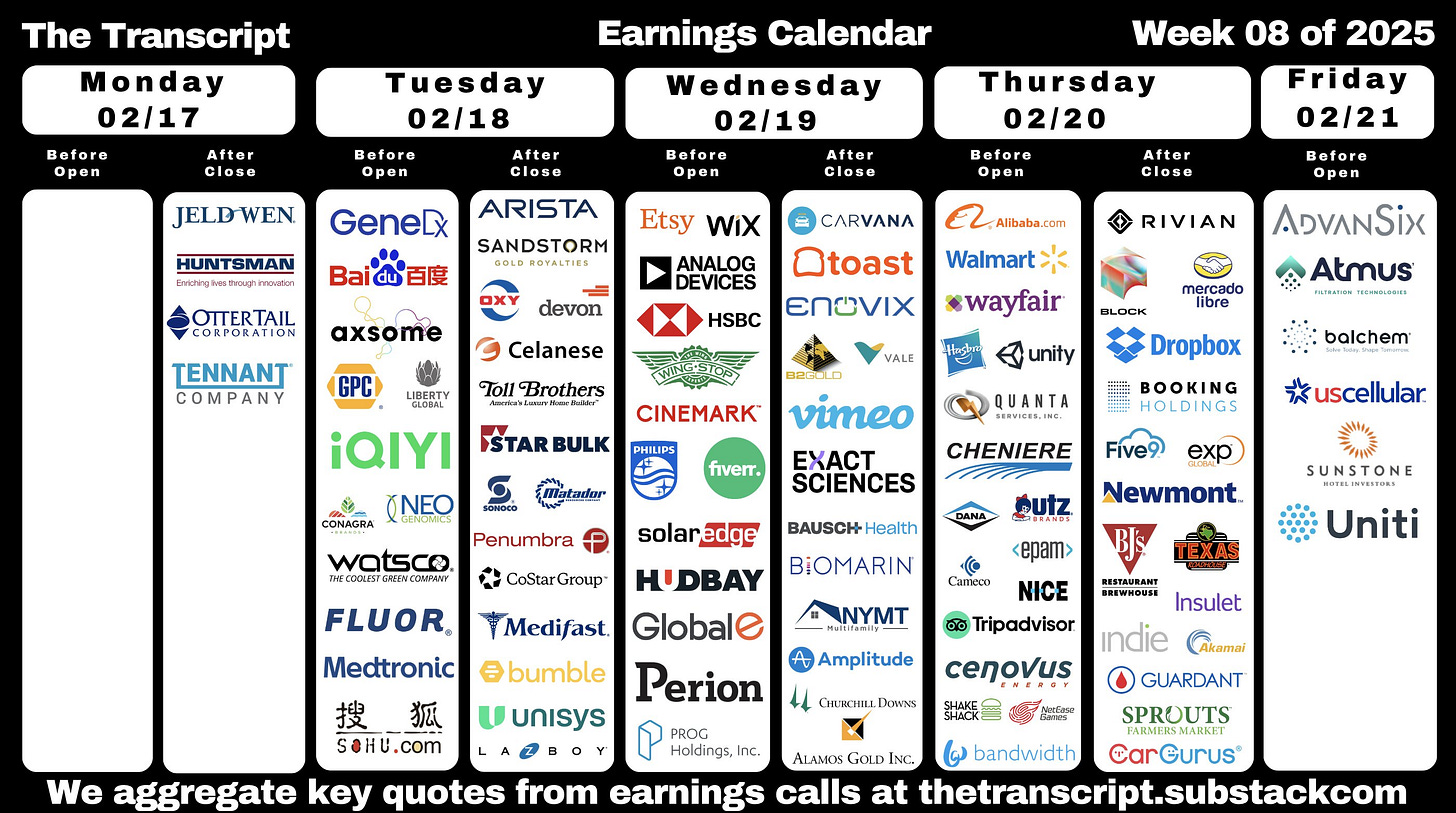

Forecast Ahead

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like minded investors.