🚨🛟 British Bonds on Red Alert!

Welcome to the Sunday Primer,

One of the reasons the market was down so bad last week was that jobless claims hit a five-month low. The Fed is trying to slow down the labor market, which means they want people to lose their jobs in an effort to fight inflation. When I was first learning about the market, this concept was something that seemed like a paradox to me. Don’t we want low unemployment? After all, if things are going so well, shouldn’t your portfolio benefit?

Well, it’s slightly more complicated than that. The stock market is not the economy and vice versa.

Wages increasing usually mean that the Federal Reserve will continue raising interest rates to counter inflation and slow growth - which is their #1 objective right now. The fact that the Fed has been increasing rates, but jobless claims remain low - signals to people that raising rates isn’t working effectively to slow inflation. I hope this quick explanation helps contextualize the state of the market/economy we’re currently in.

Let’s brief you on what to expect this coming week in the markets! Enjoy.

- Humphrey, Rickie & Tim

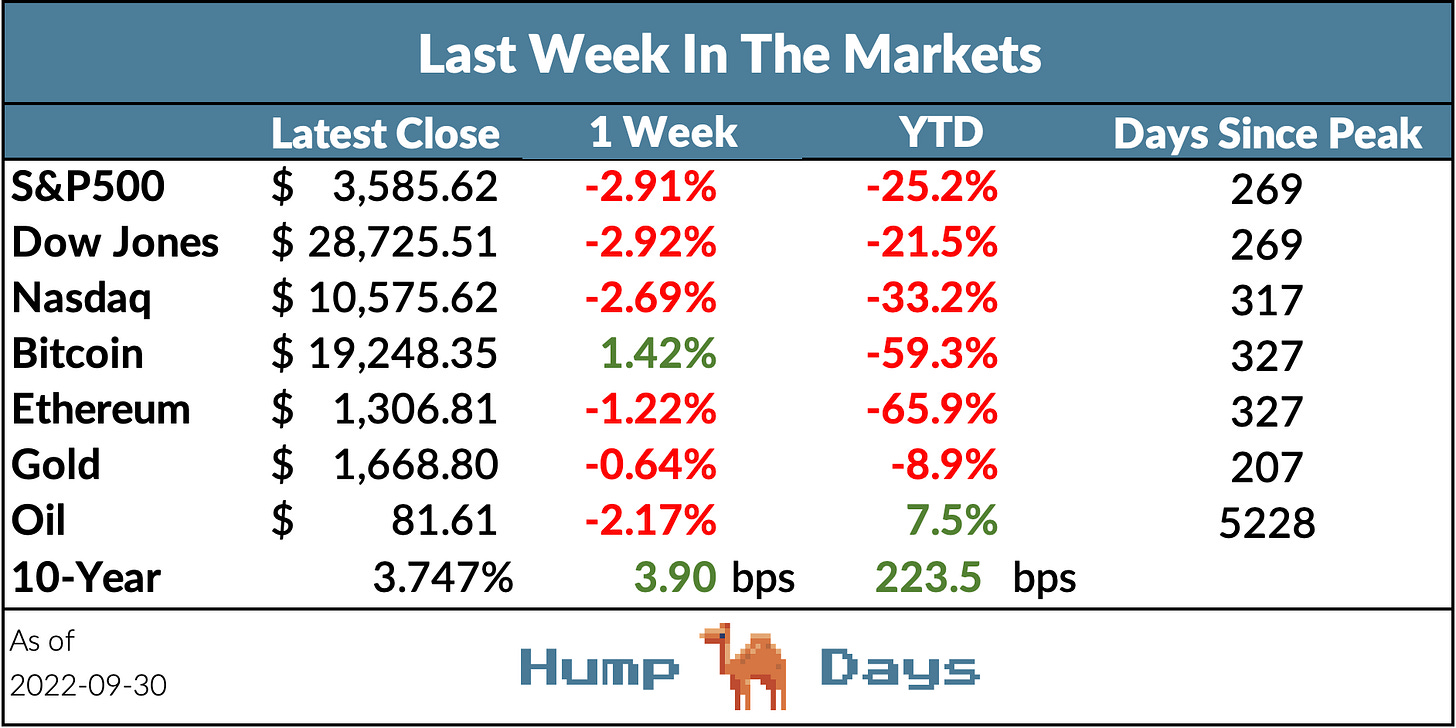

Market Report

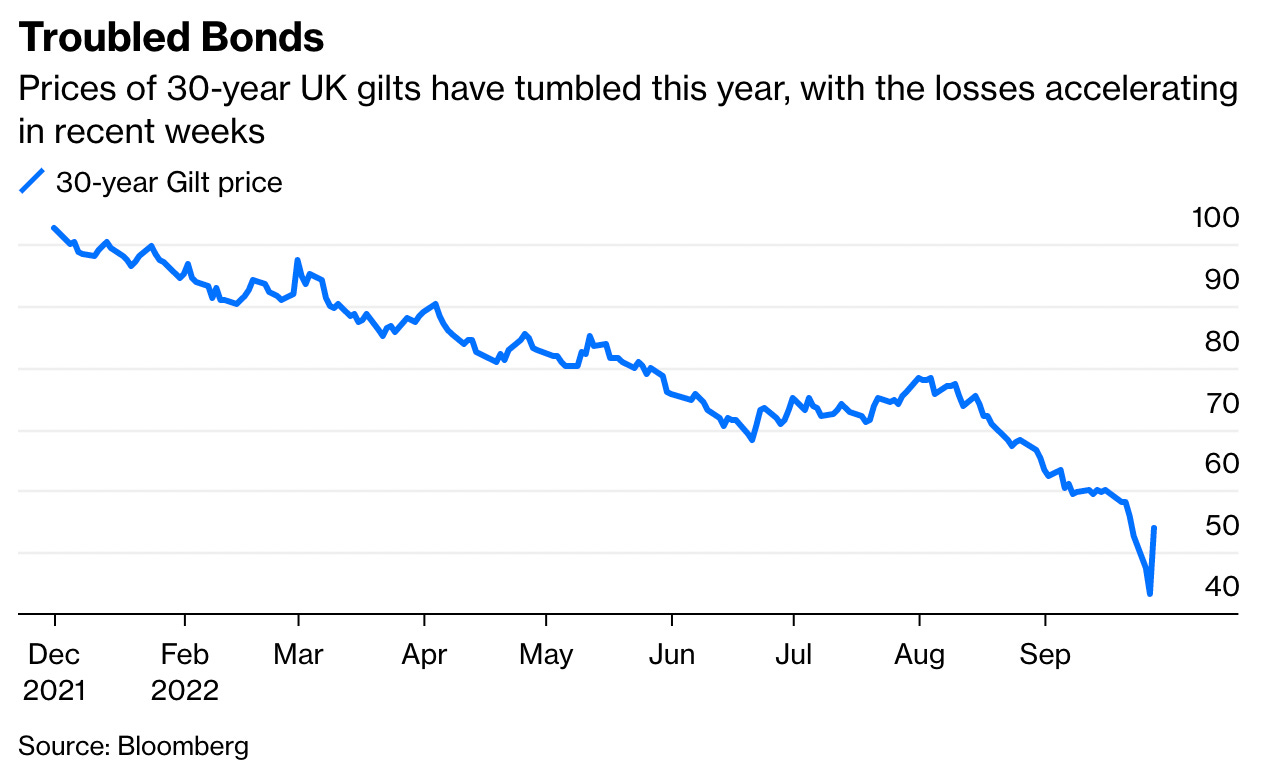

The Bank of England decided to start an “unlimited bond-buying” operation to fight off a complete crash in the UK government bond market. According to Bloomberg, UK insurance and pension funds were facing hundreds of millions of Pounds of margin calls as the value of their bond holdings declined.

The announcement of the purchases had an immediate impact on the gilt market, sending 30-year yields to their biggest drop on record. They earlier climbed to the highest since 1998. This historic response by the Bank of England led investors to wonder which central bank will be the next to fold to market volatility.

Core PCE, the Federal Reserve’s preferred inflation tracker, rose higher than estimates and marked acceleration in inflation. The index rose 0.6% in the month and was up 4.9% from a year ago.

This inflation data comes as consumer debt recently rose to an all-time high ($4.2T) for the bottom 90% of Americans. While this data isn’t pretty, it makes sense because if your costs are rising and your wages aren’t increasing, you have to fill that gap somehow.

As the Fed continues to raise rates higher to fight inflation, there’ll be a higher cost for consumers to service their debt, which could lead to even more debt.

Forecast Ahead

Economic Data (Throughout Week)

Next week we’ll get more economic data that will be closely watched by investors and most importantly, the Federal Reserve.

On Monday, we’ll get Manufacturing PMIs, which track business activity and the general direction of economic trends within the manufacturing sector. A PMI above 50 is growth compared to the previous month and a PMI under 50 is a contraction compared to the previous month. We’ve seen business activity slow down over the past few months as inflation rises and demand cools down.

Other important data will be about the labor market. The record amount of job openings has kept unemployment low and the labor market too tight. Any signs of loosening in the labor market will be a positive for the Fed while continued tightening could lead the Fed to go further with rate hikes.

Corporate Earnings (Throughout Week)

October 6th - Conagra Brands (CAG), McCormick & Company (MKC), Levi Strauss & Co. (LEVI)

October 7th - Tilray, Inc. (TLRY)

What We Read Last Week

Bank of England launches £65bn move to calm markets (Financial Times)

NASA’s Asteroid-Deflection Mission Spotlights Planetary Defense Effort (WSJ)

Ten Things Elon Musk’s Texts Reveal About the Twitter Deal (Bloomberg)

Stuck on the Streets of San Francisco in a Driverless Car (NYT)