Happy Wednesday all,

I’ve been super productive this week. In just Monday and Tuesday alone, I’ve gotten about a week’s worth of work done!

It’s a great feeling, but a huge reason as to why I’m able to do this is because I recently procrastinated a lot — so I feel like I “owe” work to myself. Haha. I’ve always been one that works better with a deadline or impending consequences… like in school, if I had three weeks to finish a paper, I’d probably wait until the last day or two before it was due. Are you the same? I’d love to know.

I’m calling my productive mode, “Monk Mode”, and I’ve just been kind of shouting it at random throughout the house whenever my brain wanders throughout the day.

In the kitchen washing dishes? “Monk MODEE!” I hope you get the idea.

Anyway, as you can tell, Monk Mode is making me a bit loopy…so let’s just stick to the Hump Days this week and I hope you enjoy ;)

- Humphrey, Rickie & Tim

👀 Eye-Catching Headlines

Small biz owners worried about inflation but happy to be entrepreneurs (Axios)

Once-Loved EV Startups Teeter on Edge as Buyers Sour on Industry (BBG)

US Companies Have $1.76 Trillion Opportunity to Free Up Cash (BBG)

High-Tech Trading Firms Race to Grab Bond Market Turf (BBG)

FTX says most customers of the bankrupt crypto exchange will get all their money back (CNBC)

Profits Are Booming—and That’s Shielding the Economy (WSJ)

AstraZeneca to withdraw Covid vaccine worldwide, citing a drop in demand (CNBC)

The Weekly Brief

Americans Are Racking Up Debt That Regulators Can’t Track

The growing popularity of "Buy Now, Pay Later" (BNPL) platforms like Affirm, Klarna, and Afterpay is raising concerns among economists and financial experts due to the lack of transparency and reporting to credit agencies.

This "phantom debt” allows consumers to split purchases into smaller installments, and is not visible in traditional financial health assessments, masking the real economic situation of American households.

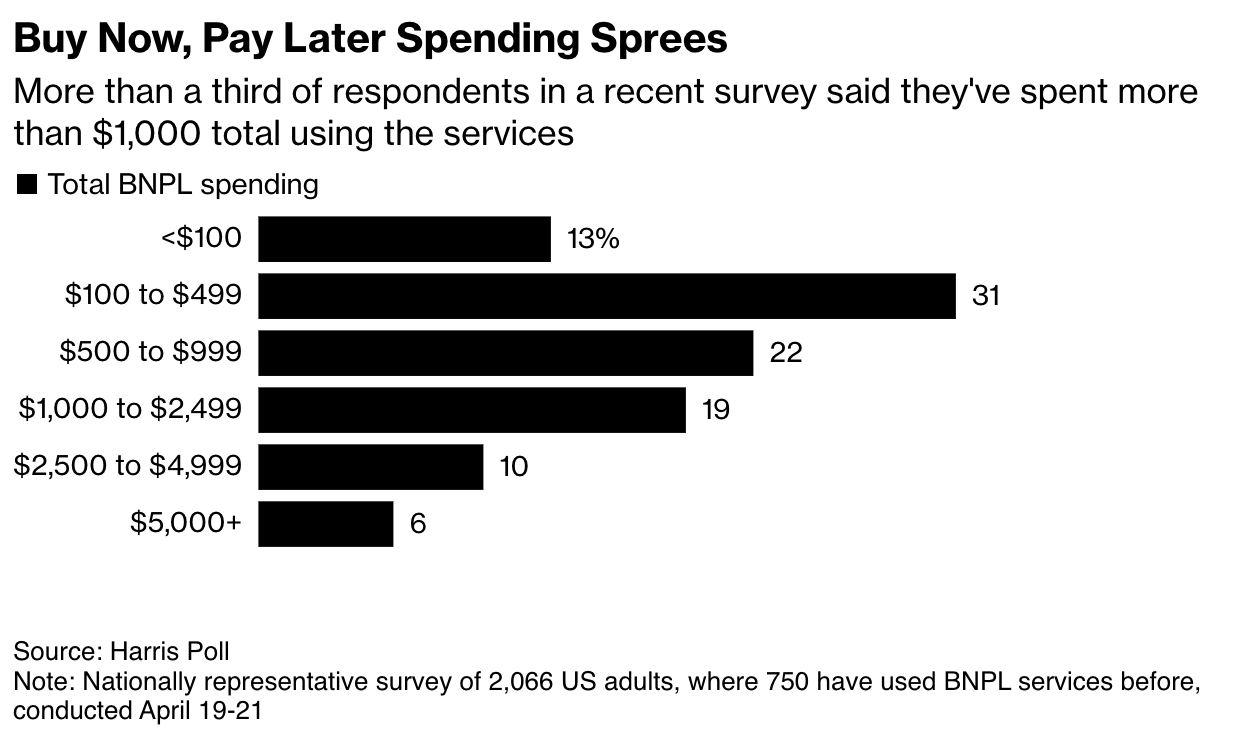

Despite the surge in BNPL usage, with $19.2 billion spent in Q1 alone and a global market projected to reach $700 billion by 2028, there still aren’t any financial disclosures. A Harris Poll revealed that 43% of BNPL users are behind on payments.

The BNPL model, appealing due to its easy credit approvals and installment plans, has attracted financially vulnerable consumers, leading to increased spending and debt.

Assets in leveraged single-stock ETFs have doubled this year

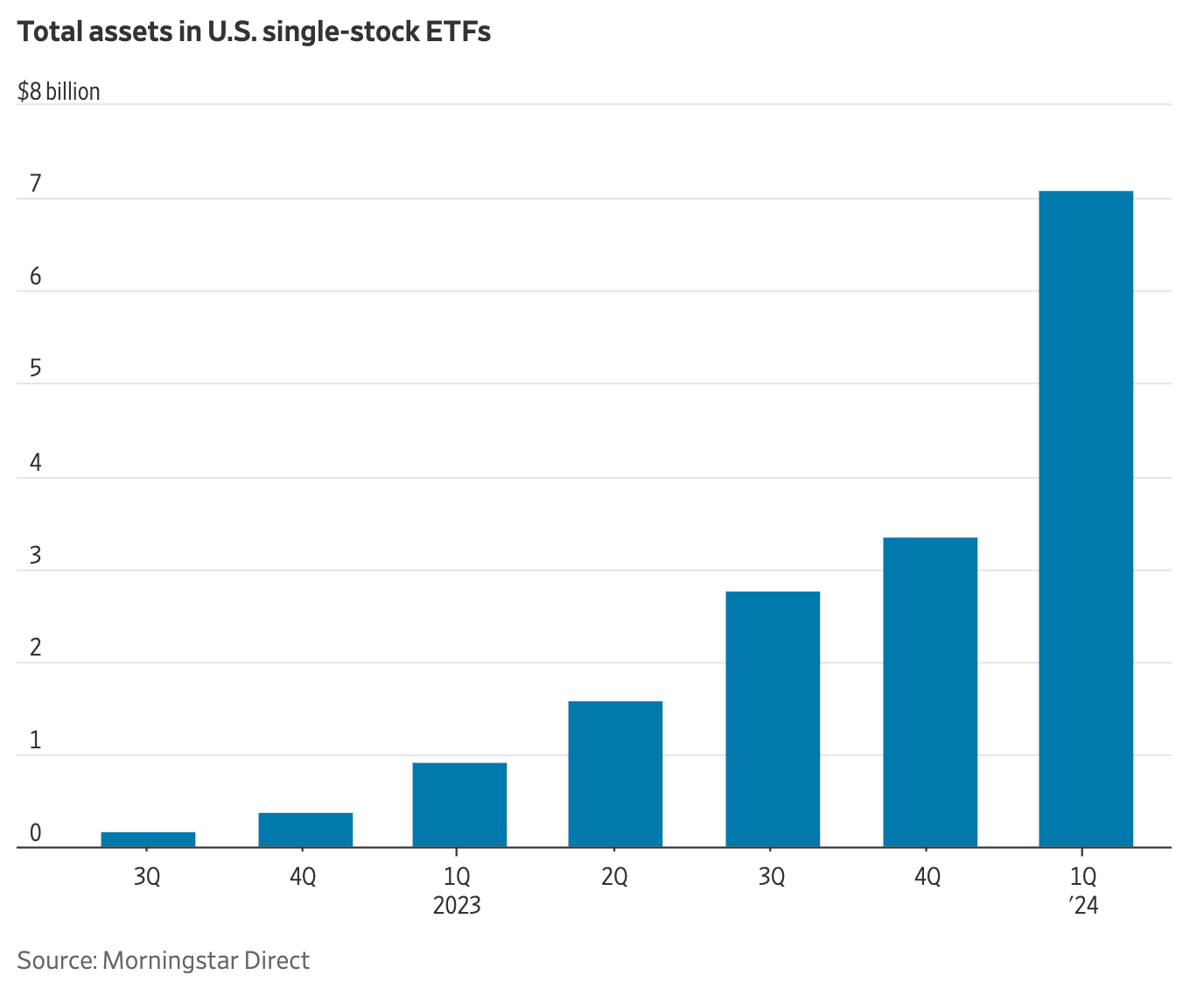

Increased market concentration in a select few tech names and the surging market have spurred everyday investors to increase their risk by using single-stock exchange-traded funds (ETFs) that amplify returns through borrowed money or derivatives.

These funds, particularly popular for stocks like Nvidia, Tesla, and Coinbase, aim to double or inversely mirror daily returns, gaining significant traction with $7.1 billion in assets by the first quarter.

The issue is that these funds are highly speculative, as demonstrated by the sharp losses in some inverse ETFs, but proponents also see them as democratizing margin investing, making high-risk strategies more accessible and cheaper than traditional margin accounts.

Amid high interest rates, U.S. companies are focusing on freeing up cash from their operations, with revealing that the top 1,000 U.S. companies could unlock a combined $1.76 trillion by optimizing working capital management.

The study showed deteriorating performance in 2023, with cash trapped in operations due to longer days of sales outstanding and a shorter period for paying suppliers, highlighting the urgency for companies to manage inventory and payment terms more effectively.

Some companies are beginning to form specialized teams to address these issues and redirect freed-up cash toward investments, debt reduction, and shareholder returns.