Blue Owl Capital: Deep Dive Analysis

Note: This is not financial advice, and any investment commentary is strictly opinion only. This is analysis for educational purposes only. Consult with a licensed professional before investing.

What is Blue Owl?

Blue Owl Capital, also known as Blue Owl, is an American alternative investment asset management company that is currently listed on the New York Stock Exchange under the ticker symbol $OWL. The company is headquartered in New York City and has additional offices in Hong Kong, Singapore, and other locations.

Blue Owl was formed in December 2020 as a result of a merger between Owl Rock Capital Group and Dyal Capital Partners, a deal valued at $12.2 billion. The transaction was completed, and Blue Owl was listed on the New York Stock Exchange in May 2021. Since its inception, the company has continued to grow through acquisitions and expansions. For instance, it acquired Oak Street, a private equity real estate firm, for $950 million in October 2021, and Ascentium Group, a business development office based in Hong Kong, in December 2021 as part of its plans to expand in Asia.

What Makes Blue Owl Unique?

Blue Owl Capital's predominant focus on permanent capital in its AUM sets it apart from other alternative asset managers. As of the end of the first quarter, 79.15% of the total AUM was permanent capital, accounting for approximately $114.3 billion. This concentration of permanent capital reduces volatility and enables steady growth in AUM against disruptive macroeconomic backdrops. Notably, Blue Owl's operational model does not depend on the traditional 20% carried interest charged to returns over minimum hurdle rates but rather on management fees from this ever-growing base of permanent capital.

Permanent capital refers to capital available for an unlimited time horizon and is typically managed using a permanent capital vehicle (PCV). These PCVs do not seek to draw down their principal at any point in time due to their perpetual nature. They are generally utilized for long-term capital growth and are less concerned with the short-term performance of a financial product. This type of capital is seen as "always reliable" and can come in various forms, such as partnerships, trusts, or corporations. Endowments, partnerships, corporations, and certain types of trusts are common examples of situations that create a PCV.

The concept of permanent capital investments is relatively new and is considered to be the "holy grail" of alternative investments. Public market investors have often shown hesitance towards the volatility of alternative asset managers’ fee income, which is subject to investors redeeming their money and relies on performance fees that can be highly variable.

For instance, Blackstone had to limit investor withdrawals from its $69 billion real estate income trust in December of last year following a surge in redemption requests, marking an unprecedented event for the firm's asset management operations.

Permanent capital offers a solution to this issue by providing a steady and reliable source of fee income. In this light, Blue Owl's model, with its emphasis on permanent capital, provides a predictable and resilient revenue stream, which has driven steady AUM growth even amidst several disruptive macroeconomic factors.

Business Model

Blue Owl Capital offers three major product lines: Direct Lending, GP Capital Solutions, and Real Estate. These products are structured as BDCs, REITs, and private investment funds.

Direct Lending

Direct lending involves non-bank creditors providing loans to businesses without the use of intermediaries, such as investment banks. Blue Owl focuses on lending to defensive businesses in recession-resistant industries or non-cyclical markets. Direct lending investments typically have floating-rate, short terms to maturity, strong covenants, and low correlation with public markets.

Direct lending has several benefits, including protection from rising rates and shorter durations than fixed-rate debt. However, direct lending also carries certain risks, such as failures in establishing a robust sourcing pipeline, conducting proper due diligence, structuring the investment, sustaining active management, and navigating a restructuring.

Why Would Companies Choose Direct Lenders Over Traditional Banks?

Direct lenders have been taking share in the public credit universe for a number of years (estimated at about 20% today, up from about 3% in 2010). The growth in market share of direct lenders in the public credit universe can be attributed to several factors:

Flexibility: Direct lenders can offer customized financing solutions tailored to a company's specific needs. Unlike traditional banks, which often have rigid lending criteria, direct lenders can work closely with borrowers to structure loans that suit their unique circumstances. This flexibility enables businesses to access capital that may not be available through conventional channels.

Speed: The decision-making process at direct lending firms like Blue Owl is typically faster than at traditional banks. Direct lenders have leaner organizational structures, enabling them to make quick credit decisions and disburse funds more rapidly. This speed can be crucial for businesses requiring immediate capital access for growth, acquisitions, or other time-sensitive needs.

Expertise in niche industries: Direct lenders often specialize in specific sectors or types of loans, allowing them to develop deep industry knowledge and expertise. Blue Owl, for instance, focuses on technology lending, among other strategies. This specialization enables direct lenders to better understand the unique risks and opportunities associated with certain industries, making them better equipped to provide tailored financing solutions.

Non-dilutive capital: Direct lending can offer an alternative to equity financing for companies seeking to minimize dilution for existing shareholders. By providing debt capital, direct lenders like Blue Owl allow businesses to access the funding they need without issuing new shares, thus preserving the ownership stakes of current shareholders.

Access to capital for underserved segments: Direct lenders can serve as an important source of financing for businesses that may be overlooked or underserved by traditional banks. This includes smaller or middle-market companies, businesses in specialized industries, or those with unique credit profiles that may not fit within conventional banking criteria.

While near-term stress on the U.S. banking system has decreased, there are still concerns regarding the impact of recent stresses on lending standards and borrowing activity in the future. Early surveys show a continued tightening of bank lending standards, particularly from small banks, which are expected to tighten credit more aggressively. According to J.P. Morgan, in 2022, U.S. high-yield and bank loan volumes fell 70% YoY to $359bn, marking the lowest issuance total since 2010.

This is extremely beneficial to direct lenders such as Blue Owl to step in and offer alternative financing solutions.

Blue Owl's Direct Lending Strategies

Blue Owl offers a variety of direct lending solutions, focusing on two main types of loans: unitranche and recurring revenue loans. Unitranche loans combine senior and subordinated debt into a single loan with a blended interest rate, simplifying the capital structure and reducing negotiation complexities. Recurring revenue loans cater to companies with stable and predictable revenue streams, often from subscription-based business models or long-term contracts.

In addition to these primary loan types, Blue Owl positions itself as an alternative to a last round of venture capital equity for mature, late-stage companies that are likely to go public in a different market environment. Blue Owl's direct lending strategies include diversified lending, technology lending, senior secured or unsecured loans, subordinated loans, mezzanine loans, first-lien lending, and opportunistic lending.

I know this is a lot of jargon, but it’s essentially just different loans that have varying rankings on the capital stack of a company. Debt that is lower on the stack is riskier (since it only gets paid out only after all higher-ranked debt is paid) but has a higher yield.

These strategies cater to various borrower needs, focusing on different levels of risk, industry sectors, and stages of a company's lifecycle.

Blue Owl’s Interest in Software Lending

Technology lending has emerged as an increasingly attractive opportunity for direct lenders like Blue Owl in the current market environment. Focused primarily on mission-critical application and systems software businesses, technology lending offers a unique value proposition due to the inherent stability of these companies. These businesses tend to have highly recurring and diversified revenue streams, robust customer retention rates, and strong organic growth potential.

As banks re-evaluate their underwriting risk in light of macroeconomic uncertainties, direct lending becomes a more valuable source of capital for technology companies. This is particularly relevant for late-stage, VC-backed companies that may struggle to access public equity markets and are in search of non-dilutive capital to fuel their growth or address liquidity needs. Blue Owl’s technology lending strategy has a loss rate of 0% and a weighted average loan-to-value (LTV) of 30.

As one Blue Owl executive described:

“So just think about a generic transaction. $5 billion acquisition in software. That means in that $5 billion acquisition, we'll lend that company a $1.5 billion, and a really sophisticated buyer is going to write a $3.5 billion equity check. So now we have two things going for us. One, an incredibly durable world class business with high gross margins, great cash flows, significant long term value. And, number two, we have $3.5 billion that is ahead of us in that capital stack, every dollar of which would have to be lost for us to have $1 of a problem.”

Protection and Performance

Blue Owl lends to businesses with conservative loan-to-value (LTV) ratios and significant sponsor equity (~90% of portfolio companies are supported by large PE firms), ensuring the alignment of interests between sponsors and lenders.

With an annualized loss rate of 0.05% and a weighted average LTV in the low 40s across the direct lending portfolio, Blue Owl demonstrates a strong track record of performance. Moreover, direct lending has provided 100% of the return of U.S. equities with less than 25% of the volatility in the last 18 years, providing a relatively stable source of returns in a volatile market.

GP Capital Solutions

Blue Owl's GP Capital Solutions seeks to achieve superior risk-adjusted returns by building a diversified portfolio of minority equity stakes in institutionalized private capital firms. The private capital market has experienced tremendous growth, with AUM increasing from $2.7 trillion in 2010 to approximately $8.9 trillion in 2021, and it is projected to reach $17.8 trillion by 2026. The growth of private markets is partly driven by increased individual investor participation in private equity.

According to Preqin, individual investors allocate an average of 5% of their portfolios to alternative investments, compared to 27% for pensions and 29% for endowments. A significant 90% of investors surveyed by intend to maintain or increase allocations to private debt, private equity, and real estate.

Blue Owl has successfully captured a significant portion of this market, with a 60% share in the total amount of capital raised in this space and involvement in 88% of the deals above $600 million in size.

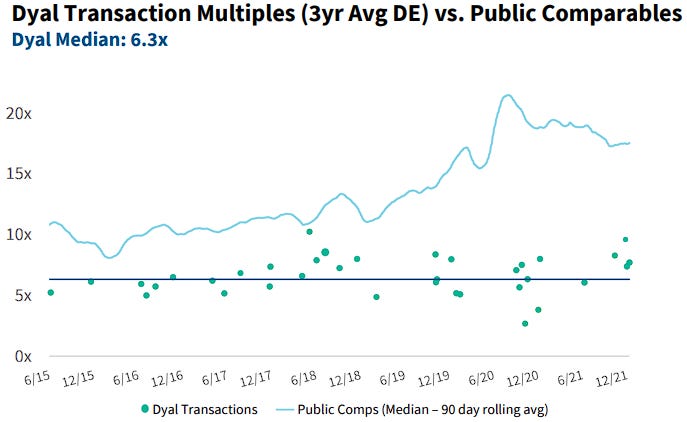

Since 2015, Dyal, a division of Blue Owl, has closed 38 minority stakes transactions at an average entry multiple of 6.3x DE, representing a ~50% discount to public market comparables. This impressive track record showcases Blue Owl's expertise in identifying and executing attractive investment opportunities in the private capital space.

Additionally, Blue Owl has expanded into professional sports minority investments, with a focus on building diversified portfolios of minority equity investments in professional sports teams. Their first fund in this strategy is primarily focused on the NBA.

“But I think what a lot of people don't understand is that this is a market with very limited competition, and we are by far the largest player in this market. There's Blue Owl, there's Blackstone, and then there's Goldman.” – Doug Ostrover, Blue Owl CEO

Real Estate

Blue Owl's real estate segment focuses on acquiring mission-critical properties backed by investment-grade (IG) and creditworthy entities, with a strong emphasis on industrial and essential retail spaces. By leveraging its net lease strategy and expertise in sale-leaseback transactions, Blue Owl has established itself as a dominant player in the real estate sector, raising 60% of dedicated capital within the net lease market.

The net lease strategy primarily targets single-tenant, free-standing properties in the U.S. and Canada with an average lease term of 15 years. These properties are occupied by businesses offering essential goods or services, such as grocery stores, pharmacies, and discount retailers, which are generally resistant to e-commerce and economic downside risks. Blue Owl's approach emphasizes relationships with large, IG-rated, and creditworthy companies, enabling a more secure and predictable cash flow.

Blue Owl's real estate assets provide a high degree of cash flow certainty, even in uncertain times. With 100% of cash flow from net rent being contractual and all financing costs fixed, Blue Owl's investments proved resilient during the COVID-19 pandemic, with tenants paying 100% of rent in cash and on time. The triple net lease structure also insulates Blue Owl from capital expenditure costs and rising expenses, such as utilities, taxes, and maintenance.

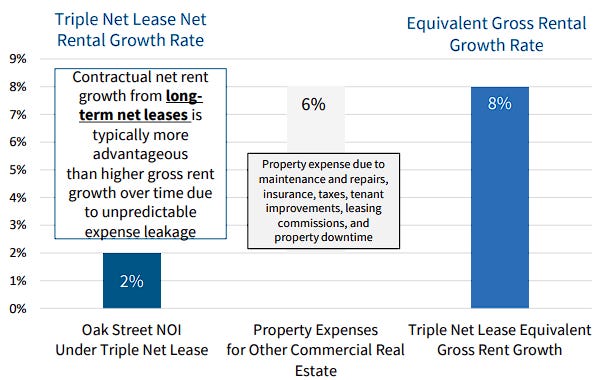

The triple net lease structure, also known as NNN lease, is a popular type of commercial real estate lease agreement where the tenant is responsible for covering property-related expenses in addition to the base rent. These expenses include property taxes, insurance premiums, and maintenance costs. This arrangement makes triple net leases particularly attractive to investors and property owners, as it shifts the financial burden of property ownership and management to the tenant.

Additionally, Blue Owl's real estate assets offer an attractive hedge against inflation, with an annual net rent growth of around 2% on average. This growth, combined with the triple net lease structure, ensures that Blue Owl's net rent remains stable and secure throughout various economic cycles. In 2022, Blue Owl's triple net lease strategy delivered a remarkable 20% return, outperforming public REITs that returned -20%.

Why Blue Owl?

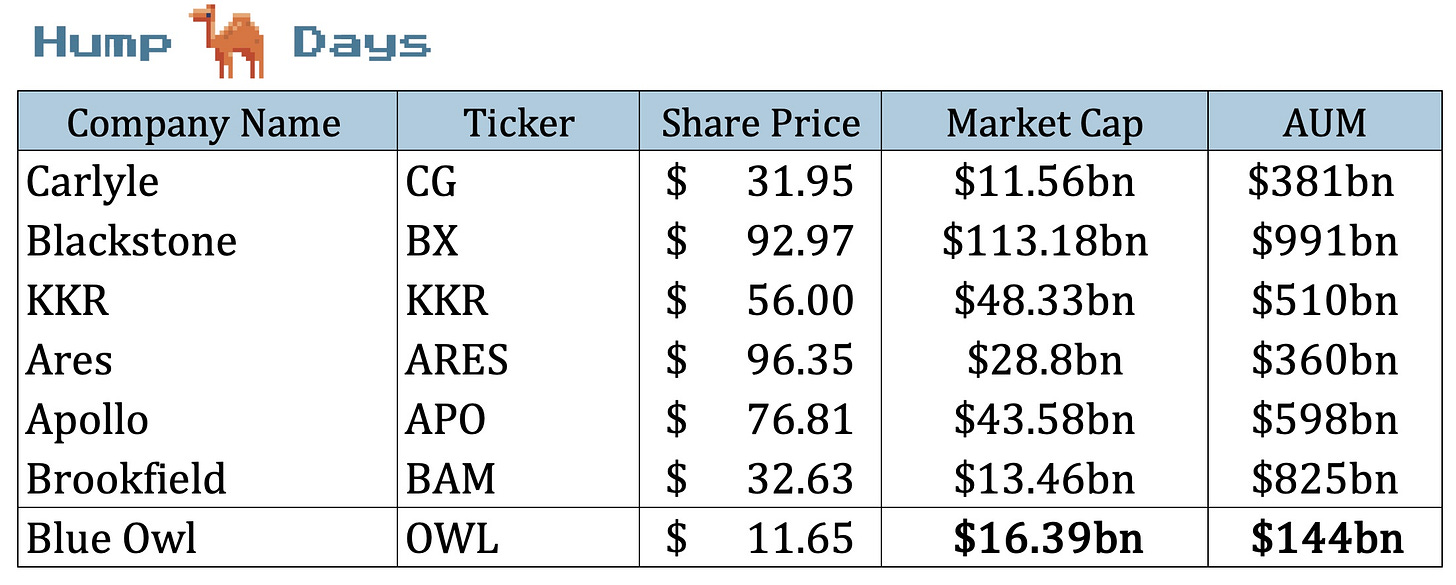

Out of its alt asset manager peers, Blue Owl is a baby. It’s the new kid on the block. So why Blue Owl and not any of its better-known peers?

Well, first of all, I personally do like some of the other alt-asset managers. Specifically Apollo, KKR, and Blackstone. But the public and private markets are going through a fundamental shift. Higher rates. I know everyone knows this by now, but the zero-interest rate environment is over.

As the market digests higher rates and the new economic environment, volatility will surely shake things up. What happens when markets get volatile? People get scared, and they may buy/sell depending on which direction the market is headed.

That’s where Blue Owl comes in. Its predominant permanent capital enables it to invest without worrying about redemptions, withdrawals, distributing within a certain amount of years, etc. Plus, Blue Owl’s permanent capital base consists mainly of pensions and insurance companies. The goals of these groups align well with the permanent capital approach as the perpetual cash flows match well with the payout requirements of pensions and insurance companies, which have regular, predictable liabilities.

Another interesting factor about Blue Owl is its dividend. Management has reiterated time and time again that it will aim to deliver a dividend of $1 / share by 2025, which is roughly a ~35% CAGR from today’s implied 2023 annual dividend.

Based on this $1 dividend target by 2025, I did some back-of-the-envelope calculations to derive a 2025 price target for Blue Owl. Here was my approach:

Find the forward dividend yield for each competitor

Calculate the average dividend yield

Make the avg. dividend yield Blue Owl’s dividend yield in 2025

Take the $1 dividend and divide it by the dividend yield to get the implied share price

Using this approach, I got an implied 2025 share price of $32.39, representing a 67% IRR from today’s share price. If Blue Owl’s share price stayed stagnant until 2025, there would be a ~9% implied dividend yield which is highly improbable.

In my view, it’s a win-win. If there’s appreciation in the stock, great! If the price stays stagnant, it gives me time to increase my position while collecting dividends.

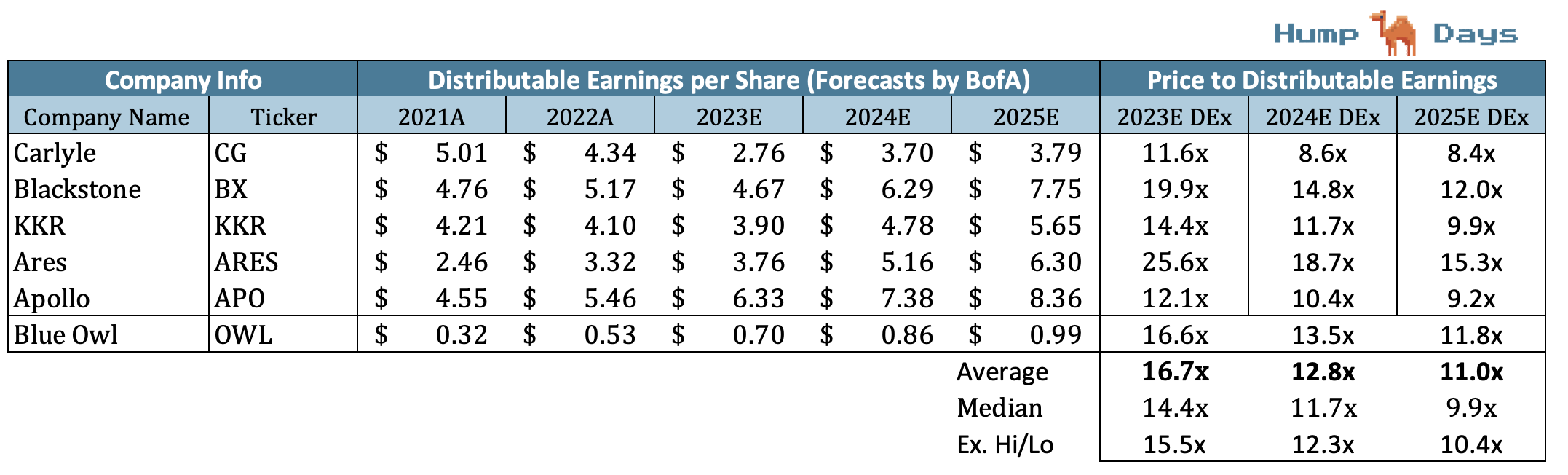

When evaluating alternative asset managers like Blue Owl, we typically use the price-to-distributable earnings metric over the traditional price/earnings ratio due to their unique business operations. Their income types, which include stable management fees and unpredictable performance fees, coupled with their ability to distribute a significant portion of earnings to shareholders, make distributable earnings a more accurate measure of shareholder value.

The metric also factors out distortions caused by non-cash charges, irregular incentive compensation, and unrealized gains or losses from investments, providing a more stable measure of profitability.

Since distributable earnings can be quite tedious to calculate, I used Bank of America’s calculations and projections for each of these asset managers’ distributable earnings.

We can see that OWL is trading at a slight premium to its competitors, likely due to the larger permanent capital base and higher expected growth. However, it has the highest growth potential and a higher dividend yield than most of the other managers. Over time, I expect OWL’s dividend yield to fall to the industry average as its share price appreciates.

Despite the lack of any discount to its peers, Blue Owl Capital is still an attractive investment due to its defensive tilt with permanent capital.