🏷️🛍️ Black Friday Sales Accelerated!

Happy Sunday,

This week’s edition dives into the numbers and narratives shaping the global markets: Black Friday is back in force, with sales growth signaling a resilient consumer—albeit one that’s spending smarter. Meanwhile, Wall Street continues to dominate, flexing its muscles as US equities outperform the rest of the world. And over in Russia, the ruble is grappling with historic lows as sanctions and geopolitical pressures weigh heavily.

Let’s break it all down, from the biggest headlines to the key takeaways that could shape the weeks ahead.

- Humphrey & Rickie

Market Report

Black Friday Sales Accelerate As Retailers Maintained Disciplined Discounting

Black Friday sales in the US showed stronger growth this year, with retail sales excluding automotive increasing by 3.4% compared to last year.

E-commerce was particularly robust, with online sales growing by 14.6%, while in-store sales saw a modest 0.7% increase.

Despite the positive sales figures, retailers face challenges in navigating a shorter shopping season and appealing to consumers who are more intentional about their spending.

Many shoppers are spreading out their holiday purchases, comparing prices more frequently, and waiting for the best possible deals.

Retailers have adapted by extending Black Friday specials, offering more discounts, and focusing on exclusive items. However, with leaner inventories compared to previous years and the potential impact of future tariffs, consumers may find that the current bargains might not stick around.

Wall Street Wins Once Again as US Assets Outpaces Rest of World

Despite a week marked by accelerating US inflation data, Donald Trump's tariff threats, and many Wall Street professionals on vacation, the S&P 500 outperformed European and Asian stock benchmarks, approaching its best year versus global markets since 1997.

The S&P 500 marked 53 records this year, or about one every five days.

Wall Street attributes this continued US outperformance to several factors, including expectations of strong earnings growth, potential tax cuts, and deregulation under the Trump administration.

Despite concerns about extreme bullishness and high valuations, investors remain optimistic, with the S&P 500 setting new records and the Russell 2000 showing strong performance.

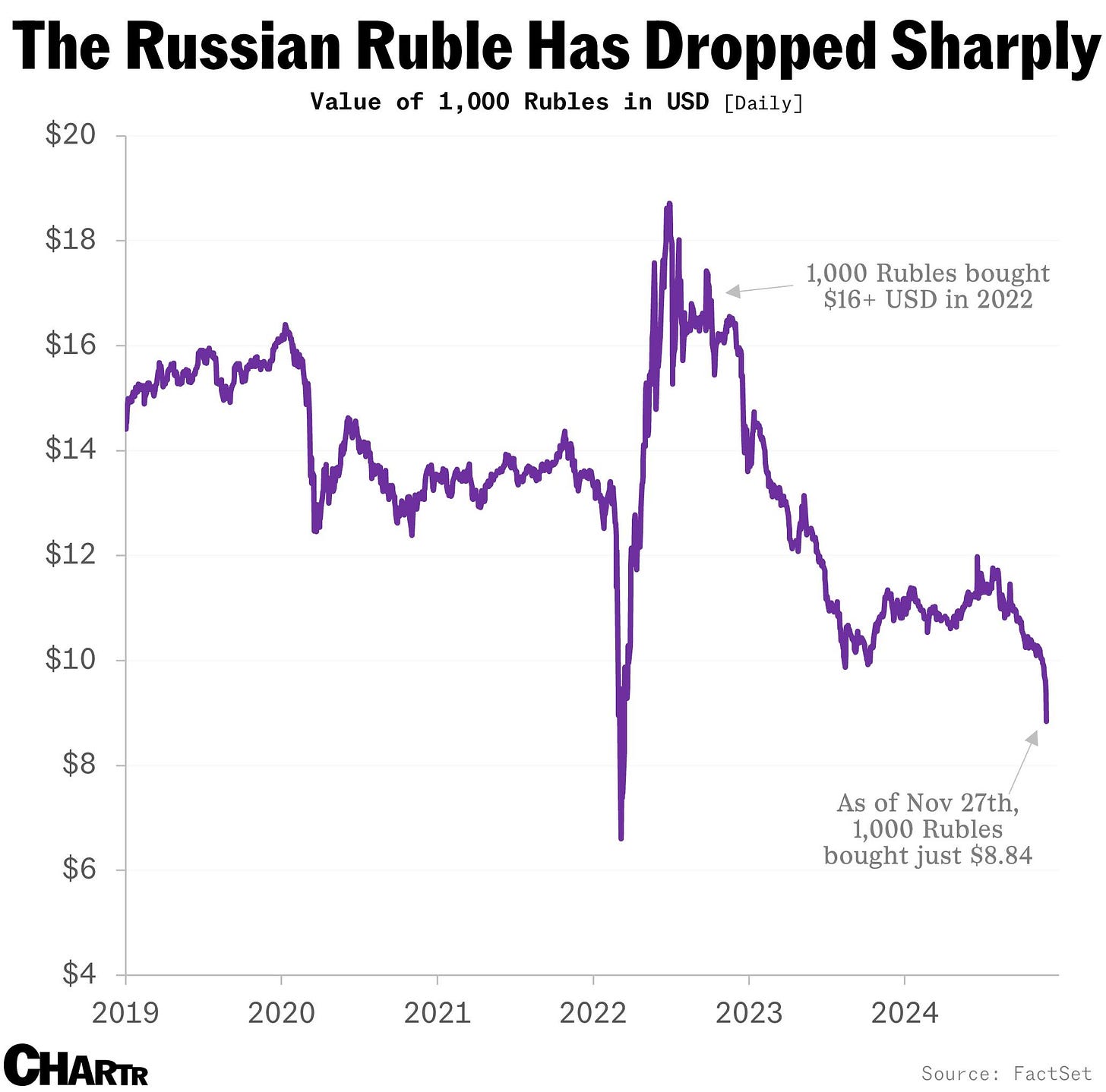

Russia’s Ruble Falls to Lowest Since Beginning of the Ukraine War

The Russian ruble saw a 7% drop on Wednesday and a 20% decline this year, with 1,000 rubles now worth less than $10. The currency's collapse is partly attributed to recent US Treasury sanctions, which banned Gazprombank and over 50 smaller banks from handling energy-related transactions with US entities.

Additionally, fears of escalating conflict in Ukraine have contributed to the ruble's depreciation.

In response to this sharp decline, Russia's Central Bank has taken decisive action by suspending foreign currency purchases until the end of 2024.

This measure would ideally reduce volatility in financial markets and stabilize the ruble's value.