🥺💰 Big Tech Starting to Lose Steam!?

Happy Sunday,

Today I wanted to share with you guys a lesson on saving and investing as early as possible. Take a look at this bar chart, where the assumption is you invest $5000 per year ($600/month) at an 8% return.

The earlier you start, the better.

$5000 at 18 by age 65 will amount to $2.264M

But if you start at age 25: $1,295,282.59

…at 35: $566,416.06

…at 45: $228,809.82

…at 55: $72,432.81

The later you start, the more it costs you down the road.

I do acknowledge not every 18 year old has $5k to invest a year, but it shows you the power of getting started early.

The same $5k a year if you start at age 25 vs 35 will net you a difference of over $700k+

In personal news, I’ve been reflecting on the fact that we’ve been publishing this newsletter for over 4 years now. That’s a long time. I hope you all have been enjoying it, and I’m constantly thinking of ways to improve it. If you have any suggestions, let me know.

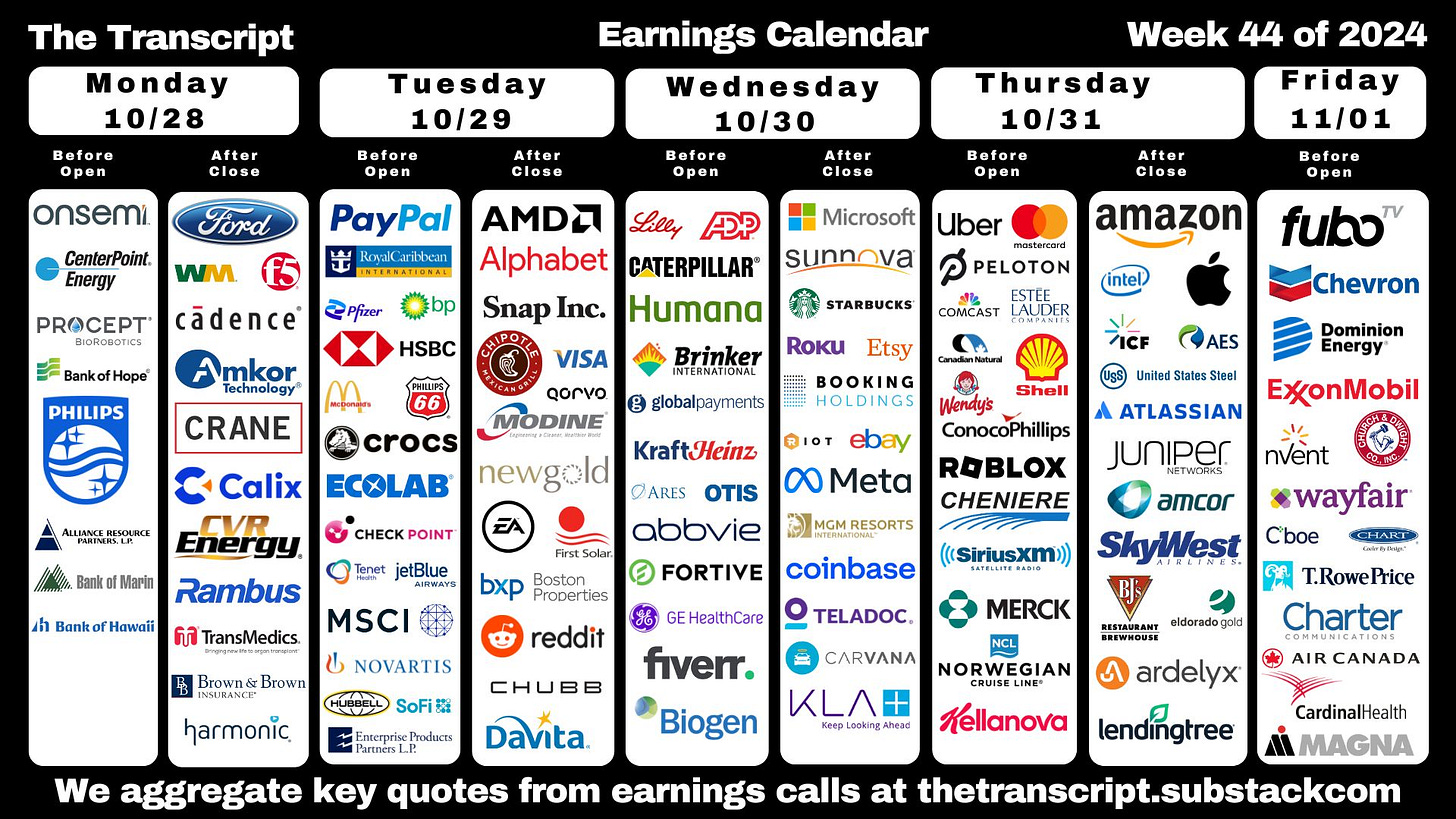

This week is a huge earnings week for stocks, so I’ll personally be keeping an eye on that and we’ll update you again Wednesday :)

For Halloween, I dressed up as a Priest. With a friar’s rope and everything. I’m not religious… but I did main a Night Elf Priest in World of Warcraft. Does that count?

Enjoy this week’s edition!

- Humphrey

Market Report

US Initial Jobless Claims Fall Back to Pre-Hurricanes Levels

Initial unemployment claims in the US decreased for the second consecutive week, dropping by to 227,000 last week, which was lower than economists' expectations of 242,000.

Continuing claims increased to nearly 1.9 million in the previous week, reaching a three-year high.

While this rise in recurring claims typically means difficulty in finding employment, it's likely also influenced by the recent hurricanes and potentially by furloughs related to the ongoing Boeing strike.

The four-week moving average of new applications rose to 238,500, and state-specific data showed decreases in hurricane-affected states like North Carolina, Georgia, and Tennessee, but an increase in Florida.

Big Tech Stocks Lose Some of Their Outperformance as Earnings Growth Slows

The stock market's technology giants are facing a slowdown in profit growth as they prepare to report their third-quarter earnings.

The five largest companies in the S&P 500 by market capitalization - Apple, Nvidia, Microsoft, Alphabet, and Amazon - are expected to post average earnings growth of 19%, which, while still outpacing the broader market, represents their slowest collective expansion in six quarters.

Since July 10, 2024, Magnificent 7 have underperformed every major sector in the S&P 500.

Investors will be closely watching the companies' heavy spending on artificial intelligence initiatives and infrastructure, with capital expenditures for Microsoft, Alphabet, Amazon, and Meta Platforms projected to reach $56 billion in the third quarter, a 52% increase from the previous year.

Consumer Sentiment Moves Higher on Interest Rate Relief

US consumer sentiment rose to a six-month high in October. This improvement was driven by more optimistic views on buying conditions, particularly for durable goods, as consumers anticipate further interest rate relief in the coming year.

Inflation expectations remained stable at 2.7% for the next year, while long-term expectations slightly decreased to 3%. The survey also revealed increased confidence in household incomes and the labor market.

The upcoming presidential election is also influencing sentiment, with Republican and independent voters showing more optimism, possibly reflecting growing confidence in a Trump victory.