Happy Sunday,

Humphrey here, I hope you had a good holiday weekend if you celebrate! I personally ate too many rice krispie treats and got a little bit sunburnt. I did want to take the intro of this newsletter to summarize some of the biggest takeaways of the newest “Big Beautiful Bill”. Now of course, this bill is 887+ pages long - but my biggest takeaways are the following:

Standard Deduction increases from $13,800 → $15,000 (Single), and $27,600 → $30,000 (Married)

Child tax credit increases from $2000 → $2200 per child in 2025.

Medicaid coverage starting in 2026 now requires 80 hours a month of work or community service in order to be eligible, for able bodied people (this is a big topic of controversy as many people will be ineligible that rely on it)

Food assistance program SNAP requires 80 hours a month of work for childless adults.

Student loans have now new maximums on borrowing to prevent unlimited borrowing. This I still need to research a bit longer.

There seems to be a lot of information about the bill that is still to be uncovered, so I’ll keep you guys updated.

- Humphrey & Rickie

Market Report

Nations Chase US Trade Deals as Bessent Hints at Longer Deadline

The United States is approaching a critical July 9 deadline for major trade negotiations, with Treasury Secretary Scott Bessent indicating that significant activity is expected in the final 72 hours.

While the Trump administration has threatened to revert to higher tariff rates for countries without an agreement, Bessent has signaled that there may be flexibility. Some nations that fail to meet the Wednesday deadline could be offered a three-week extension to continue negotiations.

President Trump is expected to send letters to about 12 trading partners, outlining potential new tariff rates which are set to take effect on August 1, creating a window for further talks.

The administration's strategy of applying "maximum pressure" has elicited a range of responses. Countries like Japan and India have signaled a firm stance, with India threatening retaliatory levies, while South Korea is seeking an extension to avoid auto tariffs.

Other nations, including Cambodia, Indonesia, and Thailand, are actively negotiating and offering concessions in hopes of securing favorable terms.

Jobs Report Takes Pressure Off Fed to Cut Rates

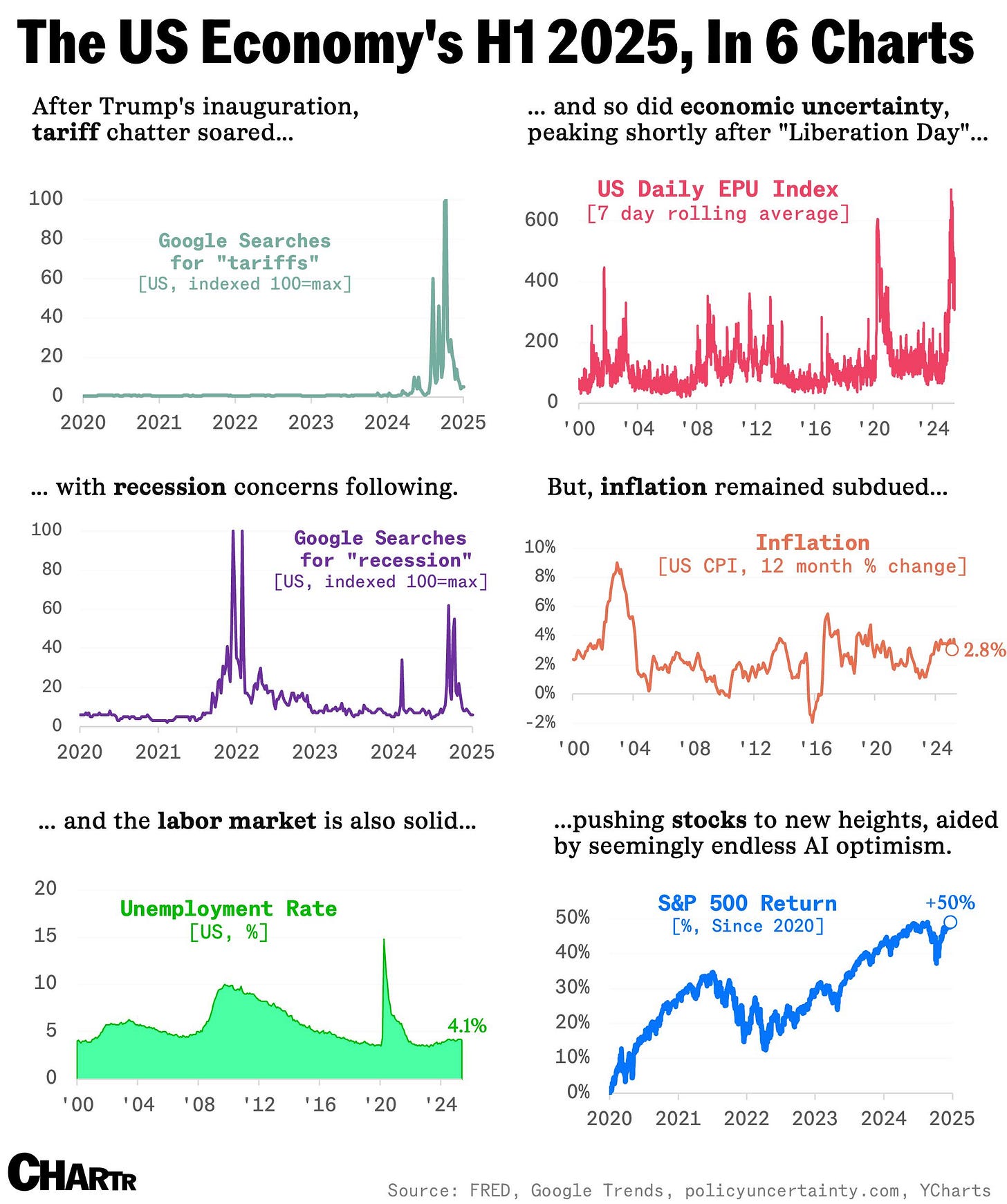

After June’s booming jobs report, the Federal Reserve is now expected to keep interest rates on hold until at least the fall, as headline numbers appeared solid. The U.S. economy added 147,000 jobs, surpassing estimates, and the unemployment rate decreased to 4.1%.

This outcome gives the central bank, led by Chair Jerome Powell, justification to adopt a "wait-and-see" approach, with Atlanta Fed President Raphael Bostic stating that a period of uncertainty is not the time for significant policy shifts, especially with a resilient macroeconomy.

However, beneath the strong headline figures, several economists and analysts point to signs of underlying weakness in the labor market. Private payrolls saw their smallest increase since last October, with much of the overall job growth driven by government hiring.

Furthermore, the drop in the unemployment rate was partly attributed to a decline in the labor force participation rate, potentially linked to stricter immigration policies.

While a majority of Fed officials still anticipate at least one rate cut this year, the market consensus has now moved the timeline for the first reduction to September.

OPEC Increases Oil Production, Putting Downward Pressure on Oil Prices

In a surprise move, OPEC+ has decided to accelerate the increase of its oil production starting in August, a decision expected to downward pressure on global oil prices.

This action caters to President Trump's calls for lower fuel costs to combat inflation but poses a financial risk to oil producers worldwide, including American shale companies and OPEC's own members.

While consumers and the Trump administration may welcome cheaper fuel, the price drop could harm the U.S. shale industry, which has already planned to reduce drilling.

Furthermore, the lower prices present a significant challenge for OPEC+ nations themselves, particularly Saudi Arabia, which requires oil prices above $90 a barrel to fund its ambitious economic transformation and manage a growing budget deficit.

While OPEC+ maintains it can pause or reverse the supply additions, for now, it appears to be prioritizing market share over higher prices.

Hey all, yep I got that wrong yesterday. I was referencing a couple citations online that were indeed incorrect. Apologies and I'll make an update and correction on Wednesday's newsletter. The Roth IRA is not going away

Have Roth IRAs been eliminated in 2026?! I have not seen this was in the bill. Is it?