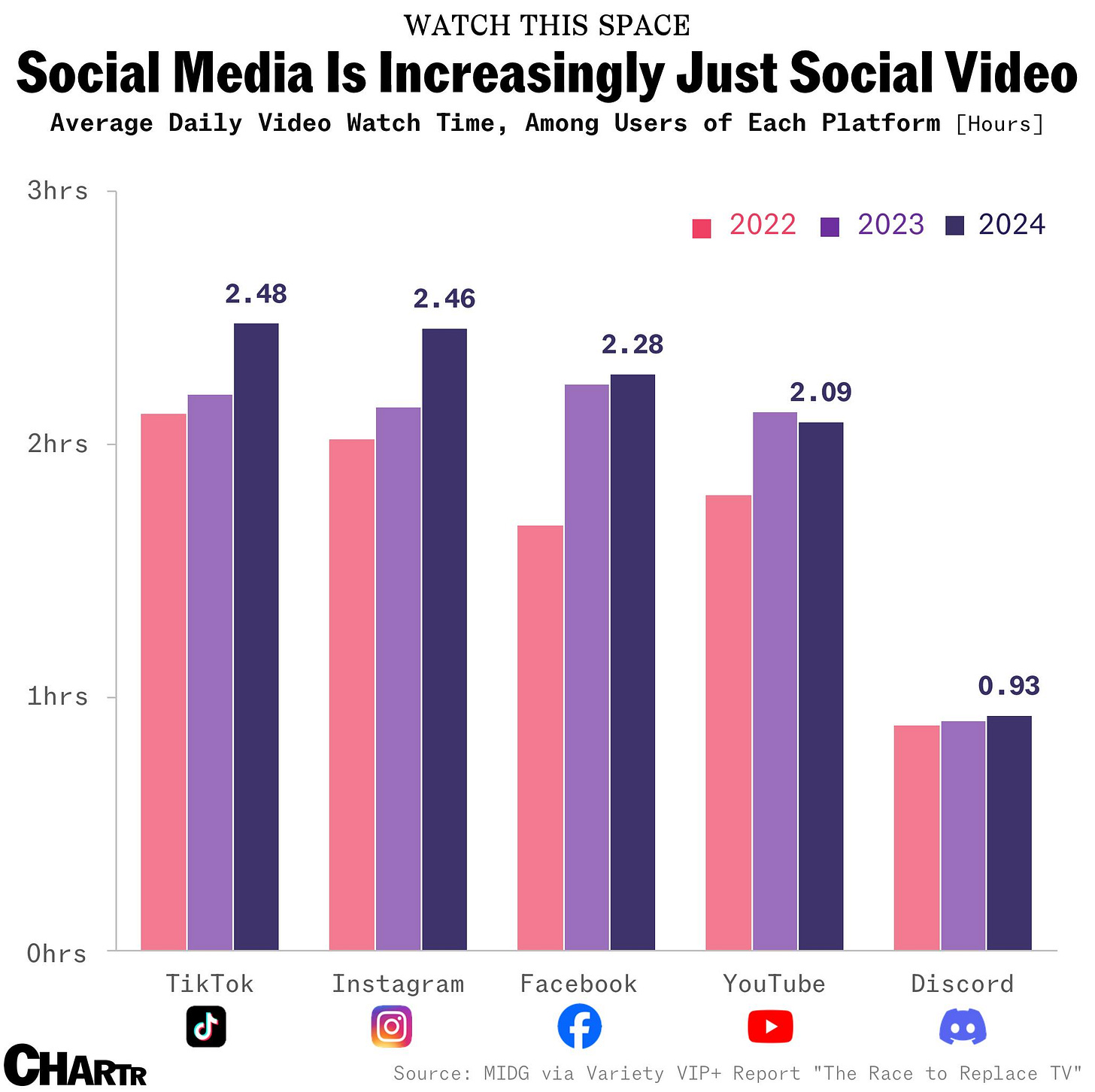

📸📈 Are Instagram Photos Dead? Video Watch Time is Taking Over

Happy Sunday!

One of the graphics in today’s newsletter depicts how much social video has taken over every single social media platform. And this was something I was noticing the other day while scrolling Instagram — none of the posts from the people I was following were even photos or carousel photos any more. In fact, they were exclusively video - which makes me think — why do we even still go on Instagram? It seems like it’s just ingrained in our society these days.

There’s also this high amount of “pressure” that Gen-Z and younger feel with posting on Instagram, like it’s no longer a place for fun and creative posts, everything has to be curated for an outside audience. I’ve personally felt this pressure before as well, and when I check my personal Instagram I haven’t posted anything in over three years. I’m trying to be better about posting stories and more posts on my main page, so I am hoping you are enjoying those if you are seeing them! I’m also headed to London and Scotland in a week and a half for a 10-day trip, so I’ll be sure to share more of those pics on my Instagram too.

What are your thoughts on Instagram, the take-over of social video, and other social media platforms? Do we need something new? Perhaps no more scrolling and just enjoy life?? Haha.

Hope you’re having a good day.

Humphrey, Tim, and Rickie

Market Report

S&P 500’s Near-Term Returns Hinges on the Battered Stocks

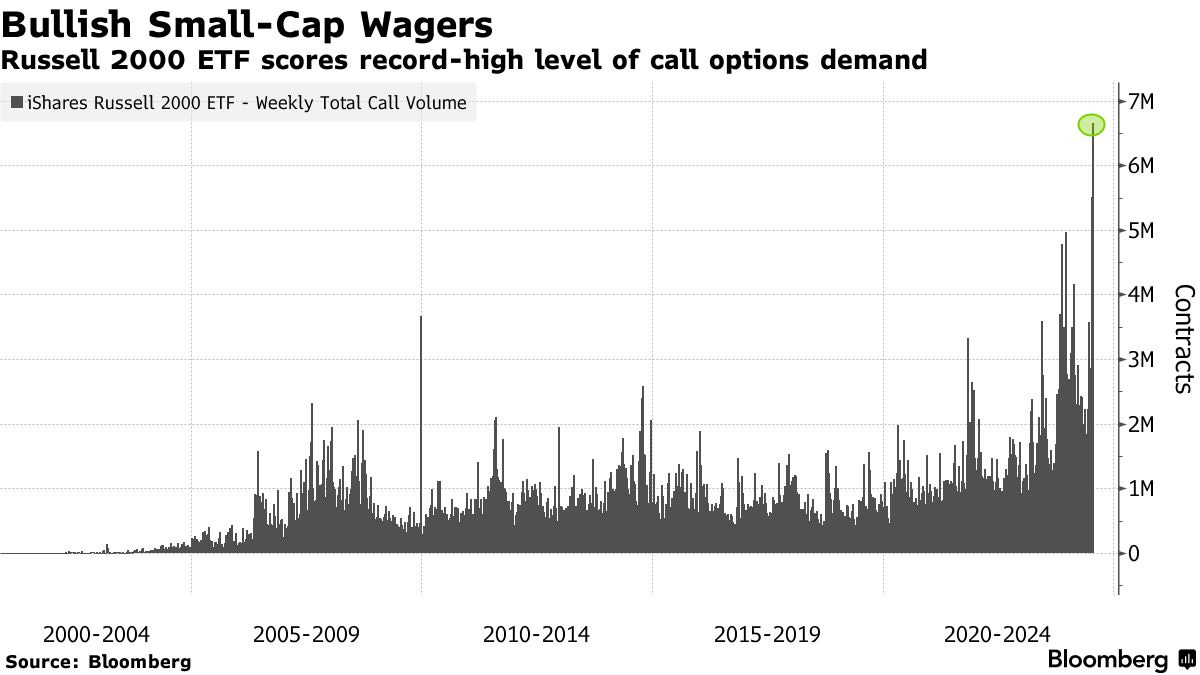

As the market becomes more confident about imminent interest-rate cuts, segments of the stock market outside of Big Tech are experiencing significant gains.

The equal-weighted S&P 500 Index recently outperformed the traditional S&P 500, marking its best relative performance since November 2020, as investors shift focus from tech giants to other sectors.

Historically, rate cuts have bolstered returns in rate-sensitive areas like utilities, staples, and health care.

This shift comes amid a backdrop of the S&P 500 and Nasdaq 100 posting their worst weeks since April, with small caps and the equal-weight S&P 500 seeing substantial inflows.

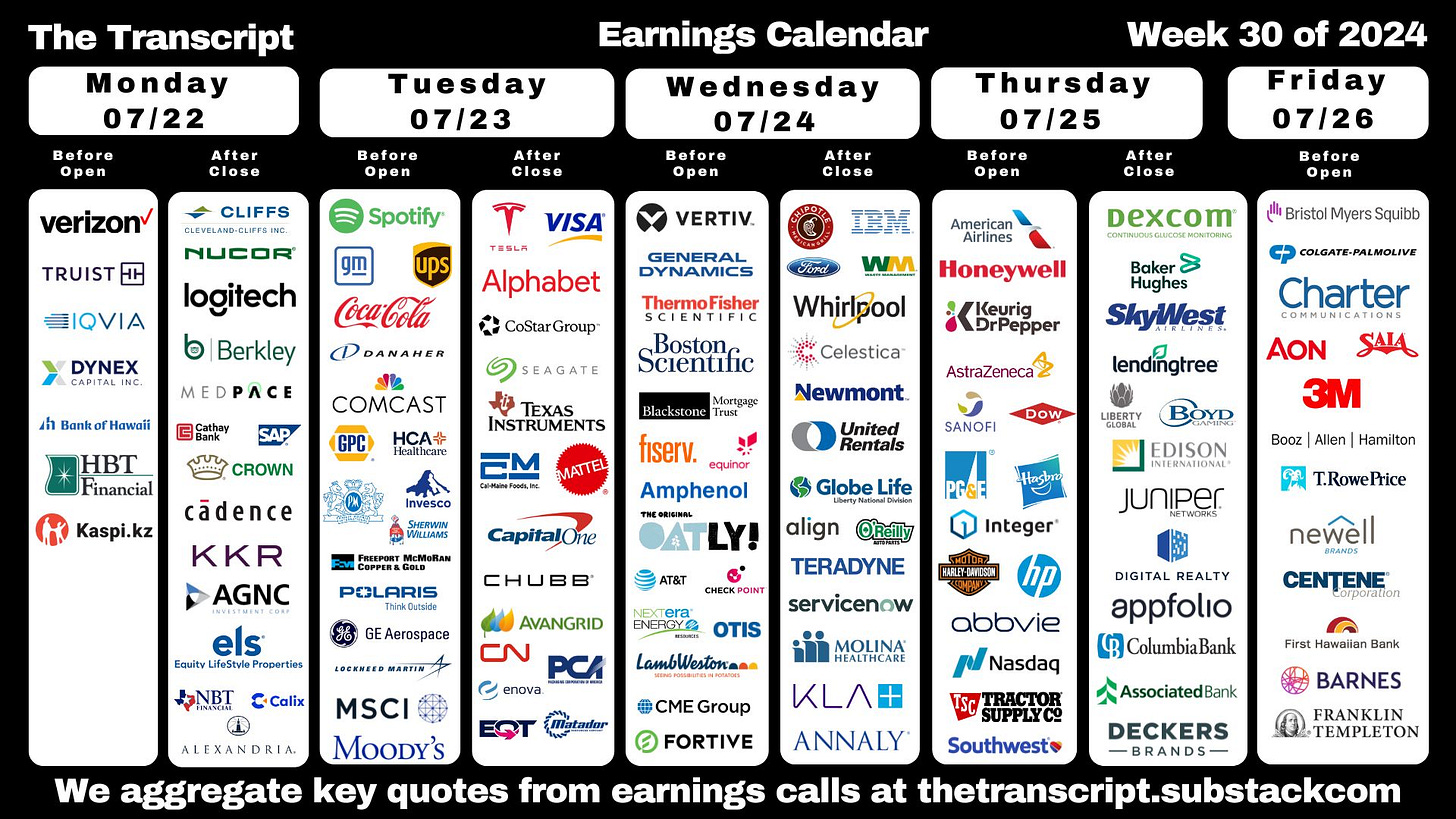

The market's anticipation of rate cuts is driving diversification, with upcoming earnings reports and economic data likely to influence what comes next.

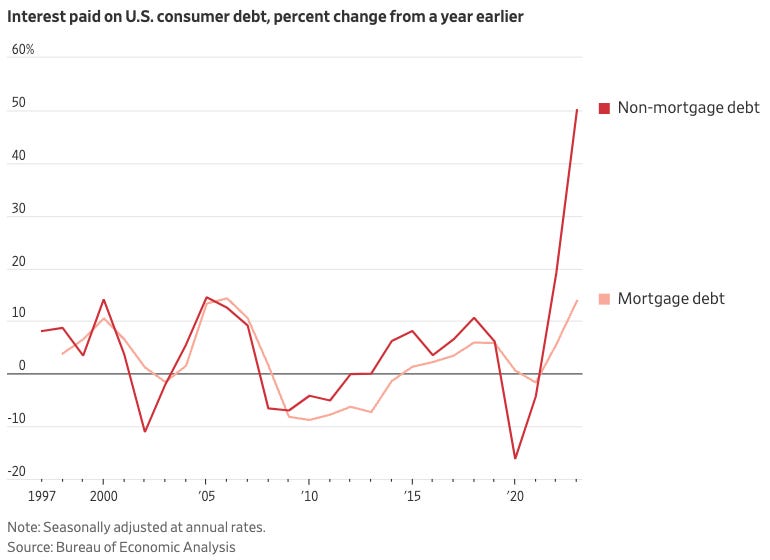

American Borrowers Are on Shakier Ground.

The American economy has demonstrated resilience against high inflation and interest rates, with recession fears subsiding, steady job growth, and continued consumer spending.

However, individual borrowers are facing significant challenges due to elevated borrowing costs across various sectors.

Credit card balances have risen to record levels, with average interest rates reaching 22%, leading to increased delinquencies.

Student loan repayments have resumed, with 40% of borrowers missing their first payment. Auto loan borrowers are also struggling, with write-offs at banks reaching their highest levels since 2011.

Secret Bank Ratings Show US Regulator’s Concern on Handling Risk

The key US regulator, the Office of the Comptroller of the Currency (OCC) found that half of the major banks it oversees have inadequate management of operational risks, including cyber-attacks and employee errors.

The confidential assessments found that 11 of 22 large banks had "insufficient" or "weak" operational risk management, contributing to one-third of the banks rating poorly overall.

The OCC's operational-risk assessments are part of the CAMELS rating system, which influences the level of regulatory scrutiny and requirements banks face.

In response to recent bank failures, the OCC and other regulators have increased their focus on operational risks, including those from third-party vendors and AI tools, to ensure banks actively manage these threats.