🔥💰 Are Big Tech Stocks on Sale!?

Happy Sunday,

To those of you who replied to my email last Sunday and suggested different video topics, I appreciate you - I read every single one but did not get to reply to all of them. I think my ask for video ideas just comes from the fact that I haven’t been as creative as I want to be.

And I think that issue is due to not having enough hobbies or activities outside of work. I’ve realized lately that the brain needs activities where it can space out and just breathe a little. In the past, those hobbies for me would be online role playing games: I enjoyed the mindless grind of defeating monsters over and over again for experience/loot. It would feel like I was getting ‘something done’ when in reality I was just spacing out. That space can spark creativity, inspiration, and make you more productive in the times that you are ‘working’.

My PC is sitting in my closet collecting dust, so I may try to bring that out sooner rather than later to enjoy some spacing out time. But I’m also thinking about filling my time with writing, cooking, stretching, or journaling.

I know this hasn’t been a personal finance personal-life update, but I hope you can take away something from it which is to make sure you prioritize balance in your life.

Enjoy this week’s edition!

- Humphrey

Market Report

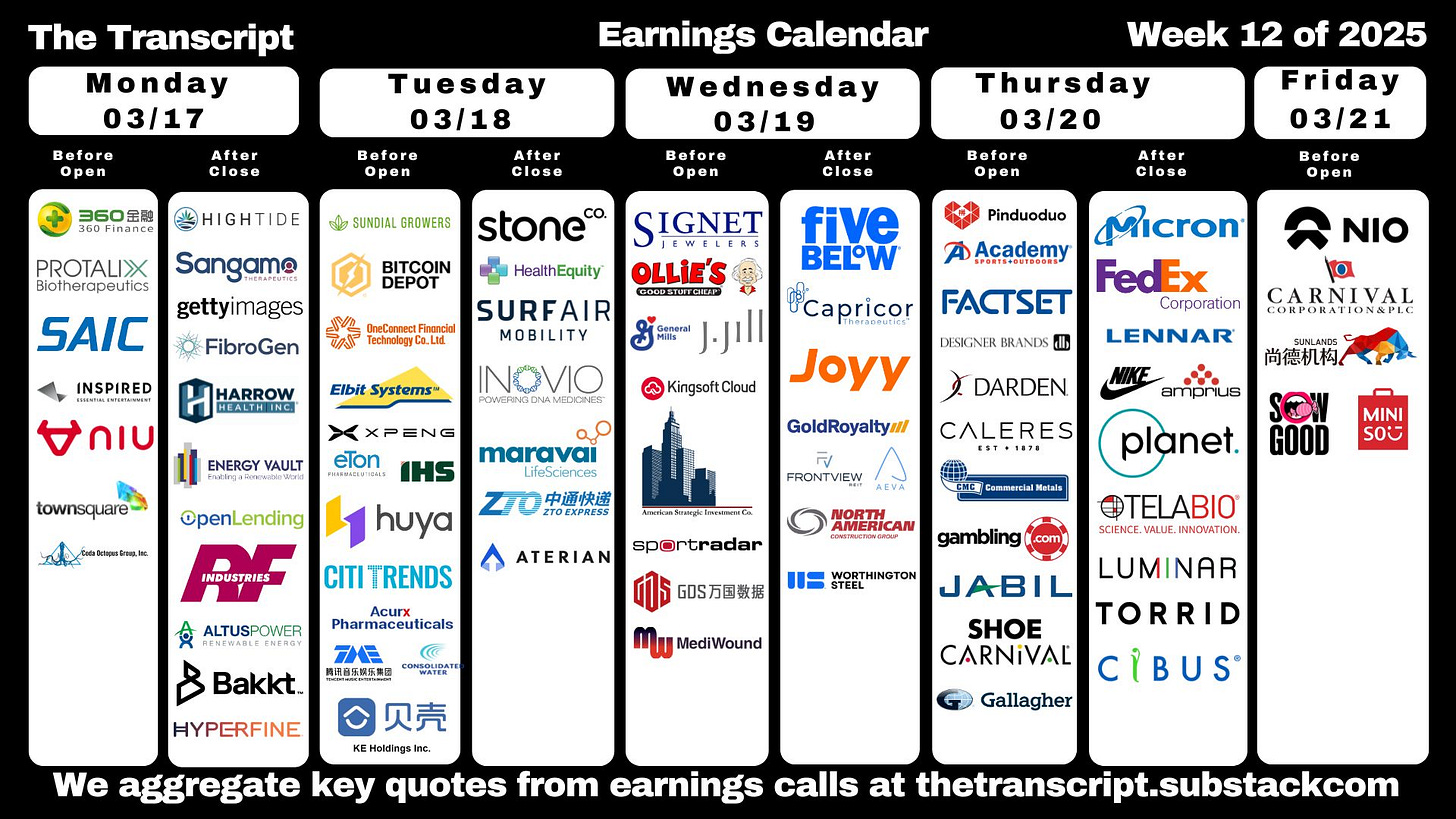

Big Tech Stocks Cheapest in Months as Markets Struggle to Find its Path

The market's recent selloff has taken a notable downturn, with the S&P 500 entering correction territory and tech giants suffering significant valuation drops. What's interesting is that despite these steep declines, the market hasn't shown the typical panic signals we've seen in past crashes.

The VIX (volatility index) has risen steadily rather than spiking dramatically, and liquidity has remained relatively stable—a crucial factor that helps markets absorb selling pressure without triggering a cascade effect.

While options trading (especially zero-day contracts that now make up over half of S&P 500 option volume) can influence market movements, it hasn't been the primary driver of the current selloff.

Looking specifically at the "Magnificent Seven" tech stocks (Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla), valuations have fallen to their lowest levels since last September but still remain well above the lows seen in previous downturns.

Currently trading at about 26 times projected earnings, these stocks still have room to fall before reaching the roughly 19 times earnings that marked bottoms in 2018 and 2022.

Investors who previously flocked to these stocks on hopes of Trump administration policies boosting growth are now retreating as officials signal comfort with short-term market pain while pursuing economic restructuring.

US Consumer Sentiment Drops, Price Expectations Soar on Tariffs

US consumer sentiment plummeted to its lowest level since November 2022, dropping to 57.9 in March from 64.7 in February—a decline steeper than economists had predicted. Meanwhile, long-term inflation expectations hit 3.9%, the highest level in 32 years, while short-term inflation expectations increased to 4.9%.

The driving factor appears to be growing concern about President Trump's expanding tariff policies, which have been affecting everything in financial markets.

The economic uncertainty is having tangible effects on consumer outlook, with expectations about personal finances falling to record lows and confidence in the stock market declining to levels not seen since May 2023.

The producer price index, the change in the price of goods sold by manufacturers, showed that producer prices remained unchanged after a 0.6% increase in January, primarily due to a 1% drop in trade services margins received by wholesalers and retailers.

However, goods prices excluding food and energy rose by 0.4% (the largest increase in over two years). Food prices increased by 1.7%, while energy costs declined by 1.2%.

Overall, the report gave conflicting signals about inflation's trajectory, with reduced retail margins potentially shielding consumers from some price increases in the short term.

However, economists are increasingly focused on the additional 10% levy on Chinese imports implemented in early February, with data already showing price increases in categories like steel, machinery, furniture, and appliances. The PPI report came after consumer price data showed the smallest monthly increase since October.

Forecast Ahead

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like minded investors.