Happy Sunday,

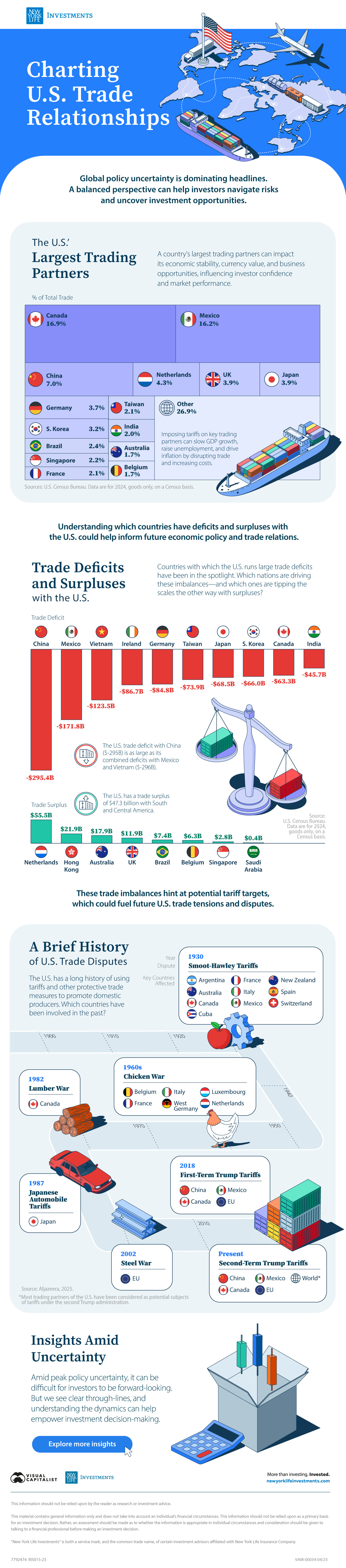

This week’s edition covers key developments across monetary policy, international trade, and tech strategy. The Federal Reserve held interest rates steady, signaling a cautious stance amid persistent inflation concerns and growing uncertainty around the economic outlook. At the same time, US and Chinese officials met in Switzerland for high-level trade talks, reporting “substantial progress” despite escalating tariff threats from both sides.

In tech, Apple is exploring a long-term shift away from its search partnership with Google, signaling broader ambitions in AI-powered search and raising questions about the future of mobile browser dominance.

- Humphrey & Rickie

Market Report

Federal Reserve Holds Rates Steady as Economic Uncertainty Looms

This past Wednesday, Fed Chair Jerome Powell announced that the Federal Reserve would be maintaining the fed funds rate at a range of 4.25% to 4.5%, a level it has been at since December.

In his remarks to reporters, he emphasized taking a patient approach, stating they aren’t in a hurry to cut rates due to increased uncertainty about the economic outlook.

Powell also highlighted potential negative consequences of sustained large tariffs, suggesting they could lead to higher inflation, a slowdown in economic growth, and increased unemployment. While acknowledging that the inflationary effects of tariffs could be short-lived, he also noted the possibility of more persistent inflation.

The Federal Open Market Committee (FOMC) unanimously voted to keep rates unchanged, citing growing risks of both higher inflation and rising unemployment.

Despite concerns about a potential recession and some businesses pausing investments, the labor market was described as "solid," with continued job additions.

The Fed acknowledged that while the US economy contracted at the start of the year, underlying demand remained firm, and recent indicators have suggested continued economic expansion.

Powell reiterated that the central bank is comfortable waiting for more data to understand the economic trajectory before making any moves, despite repeated calls from President Trump to cut rates immediately.

Meanwhile, interest rate traders are increasingly anticipating a delay in Fed rate cuts. When looking at how SOFR future spreads have been moving this year, it suggests that investors are predicting that any cuts expected by December 2025 will be less significant than previously thought.

US & China Hold Trade Talks in Switzerland Over the Weekend

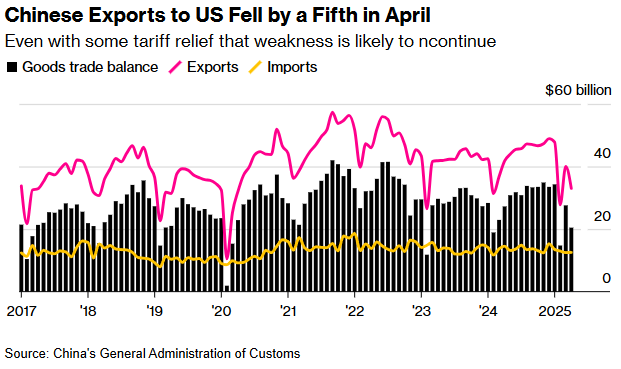

Following two days of negotiations in Switzerland, U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer announced "substantial progress" in de-escalating the trade war with China.

The talks, held with Chinese Vice Premier He Lifeng, aimed to address escalating tensions marked by President Trump's increase of tariffs on Chinese goods to 145% and China's retaliatory tariffs of 125%.

The U.S. announcement of a quick agreement came despite President Trump's pre-meeting social media post suggesting an "80% Tariff on China seems right!" He later hailed "great progress" during the talks.

Details of the agreement are expected to be shared on Monday, though there was no immediate confirmation from Beijing. This new development occurs against the backdrop of a previous trade deal signed in January 2020, which the Trump administration claims China failed to honor and the Biden administration allegedly did not enforce.

Apple Explores Shift Away From Google, Eyes AI Search Future

In a bid to downplay the significance of its lucrative search partnership with Google amidst an antitrust trial, Apple executive Eddy Cue revealed that the company is actively considering a revamp of its Safari browser to prioritize AI-powered search engines.

Cue testified that Apple might not need the Google deal in the long run and even suggested the iPhone could become obsolete within a decade due to technological shifts.

He noted a recent decline in Google search queries on Apple devices, attributing it to users switching to AI alternatives like OpenAI's ChatGPT, Perplexity AI, and Anthropic's Claude, which Apple plans to integrate as options in Safari.

Despite this, Cue acknowledged the financial importance of the current Google deal, which brings Apple roughly $20 billion annually, and expressed concern over its potential termination.

Court documents from the Justice Department's lawsuit against Alphabet indicate that Google's Chrome browser might be gaining market share within the iOS ecosystem, potentially explaining the dip in Safari search volume mentioned by Cue.

Despite the rise of LLM-based search tools, analysts at Bloomberg believe Google's vast user base on Chrome (4.1 billion monthly active users), its extensive search index, and first-party data across its app family provide a significant distribution and monetization advantage.

Forecast Ahead

Big Number

Overcome the Sunday Scaries

🎉 Want to see what I invest in?

I just launched my brand new paid Whop community, Critical Wealth. Join to see:

✅ My Portfolio + Buys & Sells

✅ Access to exclusive videos (2 per month not seen on YouTube)

✅ Investing Questions Answered

✅ Membership in a community of like minded investors

If you’re looking for an engaged community, I’m building one of the best communities in personal finance and investing, and for less than a dollar a day you can support the channel and get access to a private community with other like minded investors.

Shut up we will be friends forever there is no breakups