🍎👓 Apple Makes Bet on VR/AR

Happy Wednesday all,

I’m back from North Carolina and today’s YouTube video is quite spicy 🌶. We cover what Net Worth you need to be considered Lower, Middle, or Upper Class based on data. That will be linked at the end of this newsletter.

This week has been QUITE eventful with the unveiling of Apple’s Vision Pro headset, which has an outward-facing screen that projects to the OUTSIDE world what is going on in your headset. So you know this picture?

Yeah, those aren’t her actual eyes - it’s a screen displaying what’s going on in her headset. That’s just one of the features I found mind-blowing and honestly dystopian about the whole presentation. The other fun fact to tell your friends about it: it only has a 2-hour battery life, the batteries will definitely be an extra accessory Apple tries to sell you, and it’s really heavy on your head, according to the reviews online.

The PGA Tour and LIV Golf have also announced a “merger” which has sparked controversy in the Golf and sports worlds. The PGA Tour commissioner has famously denounced LIV Golf because of its tie to the Saudi Arabian government and their history of humans-right abuse, but as of yesterday walked back those words and said he was “pleased to move forward to engender a new era in global golf for the better.” Many online and in the news have been calling him a hypocrite, and that money really got to him.

We’ll see what happens, but in the meantime, enjoy this week’s Hump Days :)

- Humphrey, Rickie & Tim

The Weekly Brief

Saudi Arabia to Cut Oil Output by 1M+ Barrels to Bring Stability (Bloomberg)

Saudi Arabia, the most important member of the OPEC+ coalition, announced they would be making an extra 1M barrel-a-day oil supply cut after a slide in crude prices. Saudi Energy Minister Prince Abdulaziz bin Salman said he wanted to bring stability to the market, even at the cost of ceding ground to Russia and the UAE, both of which are not cutting production.

Why Does It Matter?

Saudi Arabia is shouldering all the financial consequences of cutting oil production to stabilize oil prices after weaker economic outlooks drove the price downward. Saudi is sacrificing market share in an effort to bolster the price. Oil trended upward following the announcement.Apple to Sell Vision Pro AR Headset for Triple Meta’s Top-Line Price (Reuters)

At Apple’s annual developer conference, Apple unveiled a costly AR headset called the Vision Pro; the company’s riskiest bet since the iPhone more than a decade ago. The headset will start at $3,499, more than three times the cost of Meta’s line of VR headsets. Apple’s headset will be available early next year in the U.S.

Why Does It Matter?

Wall Street was not impressed with the new announcement. Shares were flat in post-market trading, signalling that it may take a long time for the headset to gain traction in a market 80% controlled by Meta. ECB Says Consumer Inflation Expectations Fell Significantly (Bloomberg)

Expectations for euro-zone inflation eased significantly in April opening the door for a rate pause this summer. Expectations for the next 12 months fell to 4.1% from 5% in March. Expectations for three years ahead fell to 2.5% from 2.9%. ECB President Christine Lagarde reiterated on Monday that rates will rise further to regain control of prices, saying there’s “no clear evidence” that underlying inflation has peaked.

Why Does It Matter?

The ECB is expected to raise rates next week. The latest consumer inflation expectation survey will feed into the debate at to how long interest rates must rise to bring inflation to the target 2%.A Message From Facet

Looking for a way to jump-start your financial freedom? How does $500 sound?

Right now, Facet's offering $250 into your brokerage account if you invest $5k within your first 90 days. They're also waiving the $250 enrollment fee* for new annual members.

What else comes with your Facet membership besides a $500 kick-start? Your own CFP® professional and a team of financial experts across investments, taxes, benefits, and more - plus industry-leading technology to easily manage and organize your entire financial life in one place.

All this and more for one flat, annual membership fee, meaning Facet won't take a percentage of your investments. So when you make more, you keep more.

Start keeping more of what's yours.

Sponsored by Facet Wealth, Inc., (Facet) is an SEC Registered Investment Advisor headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal or tax advice. Terms and conditions apply.

Hump Days Scoop

The U.S. Securities and Exchange Commission laid out two major lawsuits against two of the largest players in the crypto space: Binance and Coinbase. The lawsuits come after months of warnings from the SEC that regulation was coming. As we saw with the FTX saga, crypto is very much the wild west and the SEC is trying to bring order and clean up any grey areas that exist in the budding industry. This week we dive into what the lawsuits are about, how the SEC defines what constitutes a security, and the responses from Binance and Coinbase.

What is the SEC suing Binance and Coinbase for?

The SEC is suing the two crypto exchanges for different reasons, outlined below.

Binance

In 2019, Binance and founder Changpeng Zhao were ordered to split the U.S. company from the U.S. exchange. Essentially, American users were supposed to be restricted from transacting on Binance.com and instead were to be funneled into Binance.US, the independent trading platform for U.S. investors.

The SEC is claiming that Binance and Zhao failed to sever a split and that Binance and Zhao secretly allowed high-value U.S. customers to continue trading on the Binance.com platform. Binance.US was supposed to be a separate, independent platform for U.S. investors, but the SEC claimed that Zhao secretly controlled it from behind the scenes.

Binance was also accused of artificially inflating trading volume as well as illegally offering financial products such as commodity derivatives, which allow investors to place a bet on the price of a cryptocurrency without buying it directly.

Coinbase

Central to the allegations against Coinbase was that the crypto exchange failed to register as a securities exchange, broker, and clearing house as required by law. The SEC also alleged that at least 13 of the 250+ cryptocurrencies available on the platform were securities and thus subject to more regulation and reporting.

Among the list of 13 cryptocurrencies included Cardano, Solana, and Sandbox. In fact, Gary Gensler, SEC Chair, said that the only cryptocurrency he felt comfortable identifying as a commodity instead of a security was Bitcoin.

How are cryptocurrencies categorized as securities and why does it matter?

The SEC categorizes an asset as a security if it passes the Howey Test, which is a set of four considerations that outline what constitutes an investment contract. According to the test, an investment contract is:

An investment of money

In a common enterprise

With the expectation of profit

To be derived from the efforts of others

The case for Bitcoin, as outlined by former SEC Chair Jay Clayton, is that Bitcoin is considered a replacement for sovereign currencies. It does not pass the Howey test because it never sought public funds to develop its technology.

Being categorized as a security means that the asset is subject to disclosure and regulation requirements.

What were the responses from the crypto exchanges?

Coinbase CEO Brian Armstrong reiterated the grey area of regulation of the crypto industry, saying that Coinbase had tried to work with the SEC but that “there was no path to come in and register.”

Binance stated its intention to defend the platform vigorously but added in a blog post that “because Binance is not a U.S. exchange, the SEC’s actions are limited in reach.”

Chart of the Week

Polls run by the University of Michigan and by the Conference Board, agree that consumer expectations have subsided since the start of the year. Consumers are still more hopeful than they were at the worst of 2022, but this doesn’t look like material for a rally. The Michigan survey shows expectations almost as low as in the aftermath of the Lehman bankruptcy.

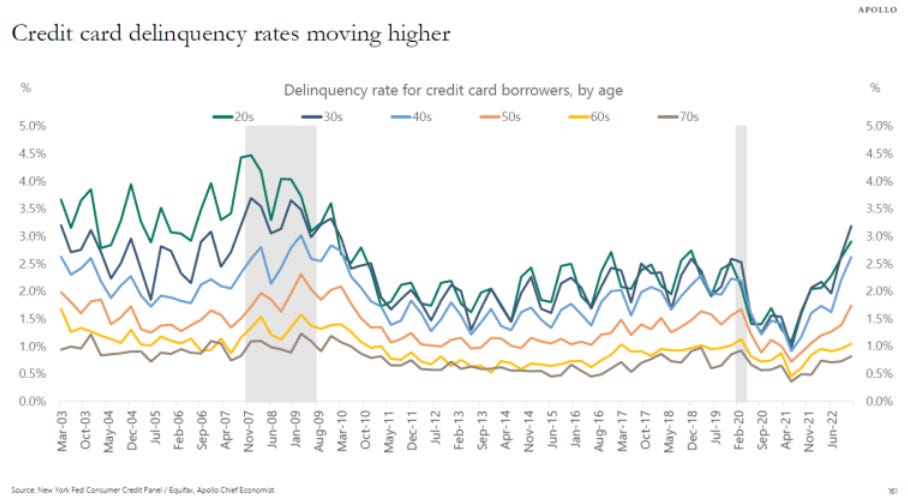

These low expectations make sense, given that consumer consumption runs on credit. Currently, credit card delinquencies are rising fast, running at their highest in more than a decade. This shows up most clearly in younger age groups, who tend to spend a lot more than older groups.

In Case You Missed It

Partnerships

If you are a brand looking to reach thousands of business leaders and investors through our two weekly newsletters, we would love to hear from you!