😕🧠 AMD Didn't Impress Investors, Still Chasing Nvidia

Happy Wednesday all,

Is the US labor market cooling down? September’s job openings dropped to their lowest since 2021, even as hiring held steady. Meanwhile, Meta’s earnings beat expectations with $40.5 billion in revenue, but user growth missed estimates, leading to a slight drop in stock. Zuck is pushing AI innovation, with projects like its Llama model and smart glasses gaining traction, yet hefty investments in its Reality Labs continue to weigh on profits.

In other news, AMD’s AI chip growth didn’t quite impress investors, while Alphabet’s AI push is boosting its cloud and search revenues. And on the housing front, high mortgage rates and low inventory are sidelining buyers and builders alike. Let’s dive into this week’s market insights!

- Humphrey & Rickie

👀 Eye-Catching Headlines

Reddit shares soar 22% on earnings beat and better-than-expected forecast (CNBC)

Chipotle misses revenue estimates as same-store sales growth disappoints (CNBC)

Consumer confidence surges as election nears, while job openings move lower (CNBC)

A Wall Street Landlord Bought Your Neighbor’s House. It’s a Mixed Blessing. (WSJ)

Elon Musk’s xAI in Talks to Raise Funding Valuing It at $40 Billion (WSJ)

With Dreams of a Lunar Outpost, China Takes New Risks in Space Race With US (WSJ)

Blackstone Raises $22 Billion in New Direct Lending Fund (BBG)

Royal Caribbean Rises as Cruise Demand, Pricing to Accelerate (BBG)

The Weekly Brief

US Job Openings Fall to Lowest Level Since Early 2021

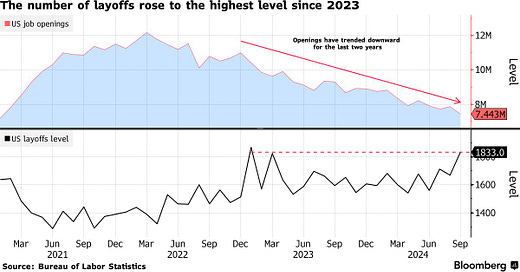

The US labor market showed signs of cooling in September, according to the latest JOLTS report. Job openings fell to 7.44 million, the lowest level since early 2021, while layoffs increased to the highest since January 2023.

The decline in job openings was widespread across industries, with notable drops in healthcare, government, and accommodation and food services.

Additionally, fewer workers voluntarily quit their jobs, indicating reduced confidence in finding new employment.

While the JOLTS report suggests a slowdown, other indicators, including the September employment report, point to a still-strong labor market and economy. The ratio of job openings to unemployed workers remained at 1.1, similar to the strong labor market of 2019.

Hiring also picked up to its fastest rate since May, aligning with September's robust payroll growth.

AMD Tumbles After AI Chip Growth Fails to Inspire Confidence

Advanced Micro Devices (AMD) reported mixed results for its third quarter and provided a fourth-quarter revenue forecast that fell short of analyst expectations, causing its stock to decline in after-hours trading.

While AMD's Q3 revenue grew 18% year-over-year to $6.82 billion, beating estimates, its profit of 92 cents per share only met projections.

The company raised its AI chip sales forecast for 2025 to $5 billion, up from a previous estimate of $4.5 billion, but this increase failed to impress investors who were hoping for more substantial growth in AMD's AI business.

AMD's data center segment, which includes AI chips, saw significant growth with revenue more than doubling to $3.5 billion.

However, the company still trails behind Nvidia in the AI chip market, where Nvidia holds about 80% market share. CEO Lisa Su emphasized that customers are open to AMD's offerings and that the company is ramping up production to meet demand.

Despite these efforts, AMD's Q4 revenue forecast of approximately $7.5 billion fell slightly below the analyst consensus of $7.55 billion.

Alphabet’s AI Bet Is Paying Off With Growth in Cloud and Search

Alphabet, Google's parent company, reported strong financial results for the third quarter, reducing concerns about its AI investments and market position. The company's revenue, excluding partner payouts, increased by 16% year-over-year to $74.6 billion, surpassing analyst expectations.

The cloud division showed particularly impressive growth, with sales jumping 35% to $11.4 billion, driven by increased adoption of AI solutions among customers.

CEO Sundar Pichai highlighted significant progress in AI efficiency, noting a 90% reduction in the cost of producing AI answers in search queries over 18 months.

The company is also leveraging AI to improve its own operations, with over a quarter of Alphabet's new computer code now written by AI.

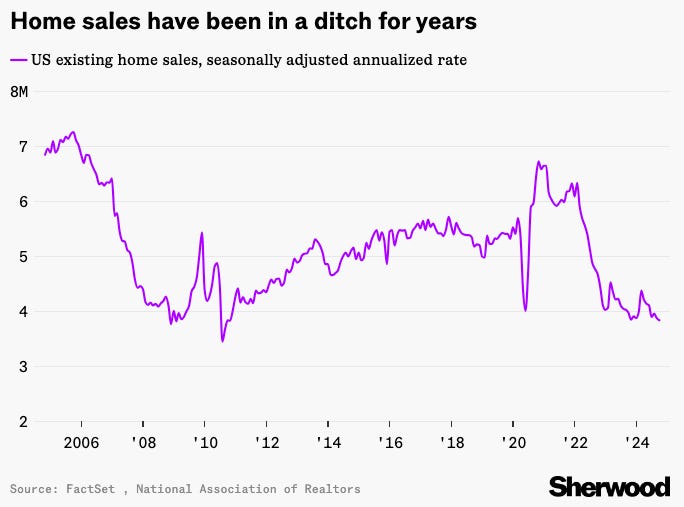

US Housing Slump Continues as Mortgage Rates Tick Back Up

The US housing market is facing significant challenges, with record-high prices, extremely low inventory, and mortgage rates above 6% that have made homeownership unaffordable for many Americans.

This situation has led to a sharp decline in home sales, with transaction levels similar to the housing bust nearly two decades ago.

The predicament is affecting both buyers and sellers, with potential sellers reluctant to give up their low mortgage rates and buyers struggling to find affordable options.

Even homebuilders, who might be expected to benefit from high prices, are feeling the impact of reduced sales. DR Horton, the largest US homebuilder, recently reported lower profits and sales than expected, citing rate volatility and uncertainty as factors causing buyers to hesitate.

The company is responding by offering incentives and building smaller homes to address affordability concerns.