✨📦 Amazon's Space Race for Internet Satellites

Happy Wednesday all,

We have a great new video series on the YouTube channel today, where I’m roasting the investment portfolios of my subscribers’ submitted portfolios! It will be linked at the end of the newsletter, as well as you can probably just check it out on the YouTube channel!

In personal news, I’ve been playing Chess. And I’m AWFUL. I think I’ve been playing 1 - 2 hours a night for the past few weeks and my Elo Rating has not budged. I’m a novice 630 rating. I even paid for a Chess.com subscription and am consuming a bunch of chess content. I wonder who the best Chess player is that also reads Hump Days? If that’s you - reply to this email with your rating.

Enjoy this week’s Hump Days!

- Humphrey, Rickie & Tim

👀 Eye-Catching Headlines

💰 Goldman Racks Up $21 Billion for Its Largest Private Credit Pool (BBG)

🛢️ ConocoPhillips to Acquire Marathon Oil in $17.1 Billion All-Stock Deal (WSJ)

☕️ 40 Minutes for Starbucks Coffee? Customers and Workers Fume Over Fewer Staff (BBG)

🚗 Stellantis CEO says $25,000 Jeep EV coming to the U.S. ‘very soon’ (CNBC)

⛳️ Scottie Scheffler Charges Dismissed After Arrest at PGA Championship (WSJ)

👨🏼💼 Inside Donald Trump and Elon Musk’s Growing Alliance (WSJ)

✈️ American Airlines tumble 15% after sales strategy backfires; carrier cuts growth (CNBC)

The Weekly Brief

Covid-Era Homebuyers Face Huge Rate Jump

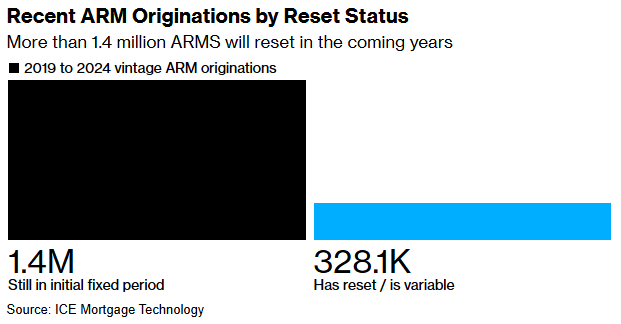

Over 1.7 million American homeowners with adjustable-rate mortgages (ARMs) face significant payment increases as their loans reset amidst soaring interest rates.

Many of these loans, averaging around $1 million, were taken out before rates surged to a two-decade high. An estimated 330,000 borrowers will experience this adjustment in 2024, with rates jumping from around 3.3% to approximately 5.3%, increasing monthly payments by nearly $1,000.

The broader impact of these resets is somewhat contained since ARMs represent only 5.5% of U.S. mortgages. However, the loans are significantly larger on average, amplifying their financial strain.

Store Brands Outpacing National Brands Amid Inflation

Amid rising food prices and economic pressures, U.S. consumers are increasingly turning to lower-cost store brands over national brands to save money. Store brands, which claimed 22% of grocery store sales last year, have been gaining traction as groceries have become 26% more expensive since 2019.

Retailers like Walmart and Aldi are heavily investing in their private-label offerings, aiming to match or surpass the quality of national brands.

This shift is challenging major food companies like McCormick and Mondelez, pushing them to narrow price gaps and introduce new products to compete.

Amazon's $10 Billion Satellite Venture Enters Factory Mode

Amazon is investing over $10 billion in Project Kuiper, aiming to compete with SpaceX's Starlink by launching thousands of satellites to provide global internet coverage.

Despite starting later and relying on a US rocket industry with recent challenges, Amazon hopes to catch up by developing satellites that can transmit more data and leveraging its established brand and Amazon Web Services.

With a new manufacturing facility in Kirkland, Washington, coming online, Amazon plans to begin testing its service later in 2024 and start commercial operations next year, targeting to have 1,618 satellites in orbit by July 2026.