💸💰 2025 Tax Brackets Have Arrived!

Happy Wednesday all,

Hope your week’s going smoothly! We’ve got a fresh batch of news for you this hump day—from a sharp selloff in Treasuries that’s got traders talking 1995 flashbacks, to the new 2025 tax brackets that could shift where your income lands. And if you’ve been wondering how rising interest payments on the national debt could affect the economy and politics, we’ve got you covered on that too.

Grab your coffee, buckle up, and let’s dive into the latest headlines!

Enjoy this week’s Hump Days!

- Humphrey & Rickie

👀 Eye-Catching Headlines

McDonald’s Quarter Pounders Linked to Deadly E. Coli Outbreak, CDC Says (BBG)

Starbucks Suspends 2025 Guidance After Another Sales Slump (BBG)

GM’s Stock Soars on Steady Profits, Rosier Full-Year Outlook (BBG)

TSMC denies US is probing the company after report suggests blacklisted Huawei is using its chips (CNBC)

Why the Fed Cut Rates and Mortgage Rates Jumped (BBG)

Frontier, Spirit Airlines Revive Merger Talks (WSJ)

Goldman Sachs Faces Fine Over Apple Credit Card Business (WSJ)

The Weekly Brief

Treasuries Plunge Like It’s 1995 as Traders See Soft Landing

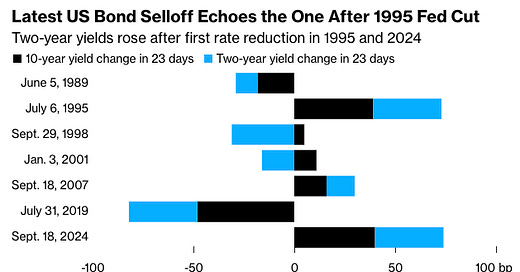

The recent selloff in US government bonds mirrors the situation in 1995 when the Federal Reserve, under Alan Greenspan, successfully orchestrated a soft landing by cooling the economy without triggering a recession.

Since the Fed's rate cut on September 18, two-year yields have increased by 34 basis points, similar to the rise seen in 1995.

This increase in yields suggests a reduced probability of recession risks, supported by strong economic data, which may prompt the Fed to slow its pace of rate cuts.

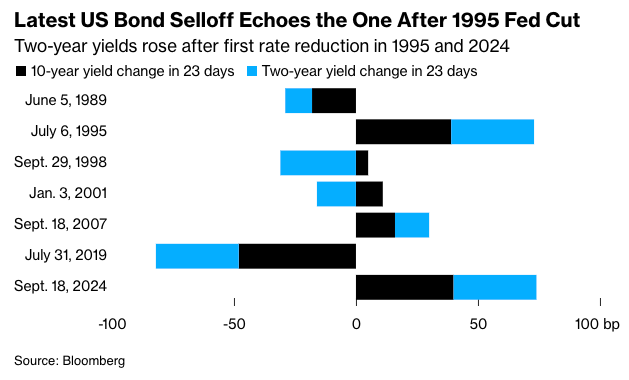

Traders now expect a total reduction of 128 basis points through September 2025, down from previous expectations of 195 basis points.

This environment has led to increased volatility, as indicated by the ICE BofA Move Index reaching its highest level this year, highlighting investor uncertainty about the Fed's future rate path and broader economic conditions.

The 2025 Tax Brackets Are Here. See Where You Land.

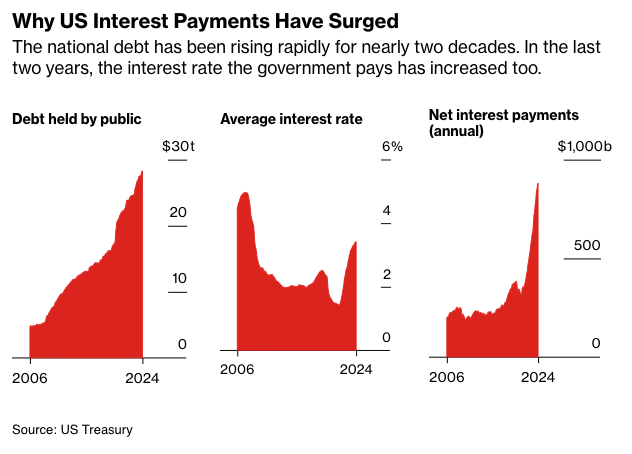

For 2025, the IRS has announced a modest 2.8% inflation adjustment to tax brackets, resulting in higher income thresholds for each bracket.

This means taxpayers will need more income to move into higher tax brackets, potentially reducing tax liabilities slightly for those with unchanged earnings.

The top federal income tax rate of 37% will apply to incomes over $751,600 for married couples and $626,350 for individuals.

Additionally, the standard deduction will increase to $15,000 for individuals and $30,000 for married couples filing jointly.

Other key changes include adjustments to capital-gains tax thresholds and estate- and gift-tax exclusions. The estate-tax exclusion will rise to $13.99 million, allowing individuals to shelter more from estate taxes. The annual gift-tax exclusion will increase to $19,000.

These adjustments come amid ongoing uncertainty about potential changes to the tax code after 2025 when many provisions from the 2017 Tax Cuts and Jobs Act are set to expire.

US Interest Burden Hits 28-Year High, Escalating Political Risk

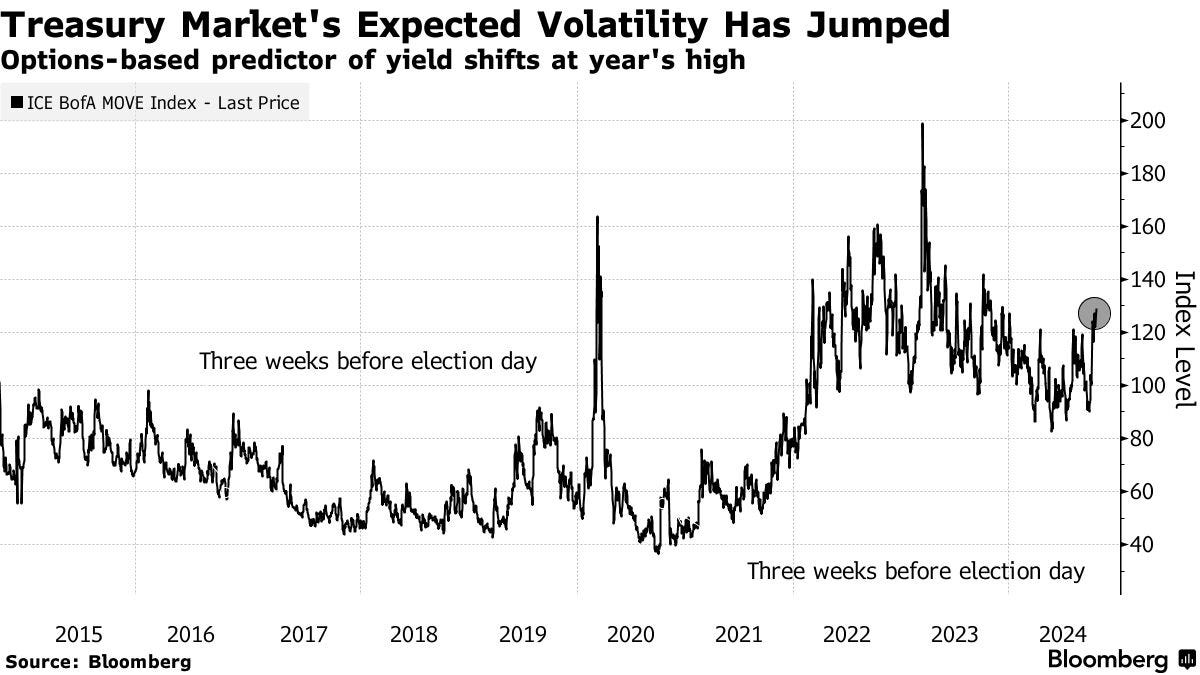

The US government's interest payments on its national debt have reached the highest level since the 1990s, totaling $882 billion for the fiscal year ending in September.

This cost now represents 3.06% of GDP, driven by historically high budget deficits and rising interest rates.

The increase in debt servicing costs has surpassed defense spending for the first time and now accounts for about 18% of federal revenues.

Despite the Federal Reserve's recent rate cuts offering some relief, the scale of interest costs continues to add to the overall debt load, which is now approaching 100% of GDP.

The Congressional Budget Office projects that interest payments will continue to rise, potentially crowding out private investment and impacting economic growth. Political dynamics further complicate the situation, as narrow majorities in Congress could empower deficit-wary legislators to influence tax and spending policies.