🔐📈 Crypto Back from the Dead?

Happy Sunday and welcome back to Hump Days! The most important news of the week was that the Choco Taco might not be dead after all! A few weeks ago, news broke that Klondike’s ‘Choco Taco’ would be discontinued due to unprecedented spike in demand across other items. This move prompted so much outcry that Klondike stated this week that it would be “working on a plan to bring it back, though it may take some time”. Some great news amidst a crazy world…

Anyways, this week we saw:

Facebook is shutting down its live shopping feature to focus on reels

Starbucks to unveil a web3-based rewards program next month…

SEC is probing Robinhood’s compliance with short selling rules

Coinbase 🤝 BlackRock

This past Thursday, news broke that BlackRock would be partnering with Coinbase, causing Coinbase’s stock to shoot up 10%. This week alone, Coinbase is up 53%…

So what exactly is this partnership, why has Coinbase rallied so much recently, and is it all sustainable?

The purpose behind this partnership is to give BlackRock’s institutional clients direct access to crypto through Coinbase Prime. These clients will include hedge funds, asset allocators, financial institutions, and others.

This partnership comes at a time when crypto is still trying to find its footing after Bitcoin has lost about half of its value year-to-date, the collapse of the Terra ecosystem blew up the false sense of stability in stablecoins, and the implosion of hedge fund Three Arrows Capital.

In fact, Coinbase itself is facing a probe by the SEC into whether the company let Americans trade digital assets that should have been registered as securities.

So why now? In March, BlackRock CEO Larry Fink said that the firm was “studying the growing importance of digital assets and stablecoins and how they can be used to help clients”.

Then in April, BlackRock joined a group of investors in Circle Internet Financial, the issuer of USD Coin commonly known as USDC, and said that it would serve as a manager of USDC’s cash reserves.

It would be safe to guess that institutional clients of BlackRock are getting more comfortable with crypto, maybe because of the massive drawdown in prices or increased talks of regulation, and they want to get some exposure.

“Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets” - Joseph Chalom, Global Head of Strategic Ecosystem Partnerships at BlackRock

So what does this mean for the future of Coinbase?

While this partnership sparked some optimism this week, Coinbase isn’t out of the woods quite yet, as trading volumes on the platform have declined meaningfully and their reliance on cryptocoins excluding Bitcoin and Ethereum brings concerns.

However, in the short-term, this stock could see some further gains due to heavy short covering. According to FactSet, more than 22% of Coinbase’s shares are sold short. So as the stock continues to run up, these investors have to buy back the shares to cover their losses, which could further the increase in stock price.

According to S3 Partners, while short sellers of Coinbase have made over $800 million this year, those returns are now 40% lower than what they were prior to the partnership announcement.

The big question now is: Has the crypto market has found a “bottom” or is there more pain to come?

There’s a few important catalysts for crypto coming up that could propel it upwards, including potential stablecoin regulation and Ethereum’s long-awaited transition to the proof-of-stake model. Whatever happens, Coinbase’s partnership with BlackRock was some much-needed positive news for crypto investors amid a time of uncertainty.

Chart of the Week

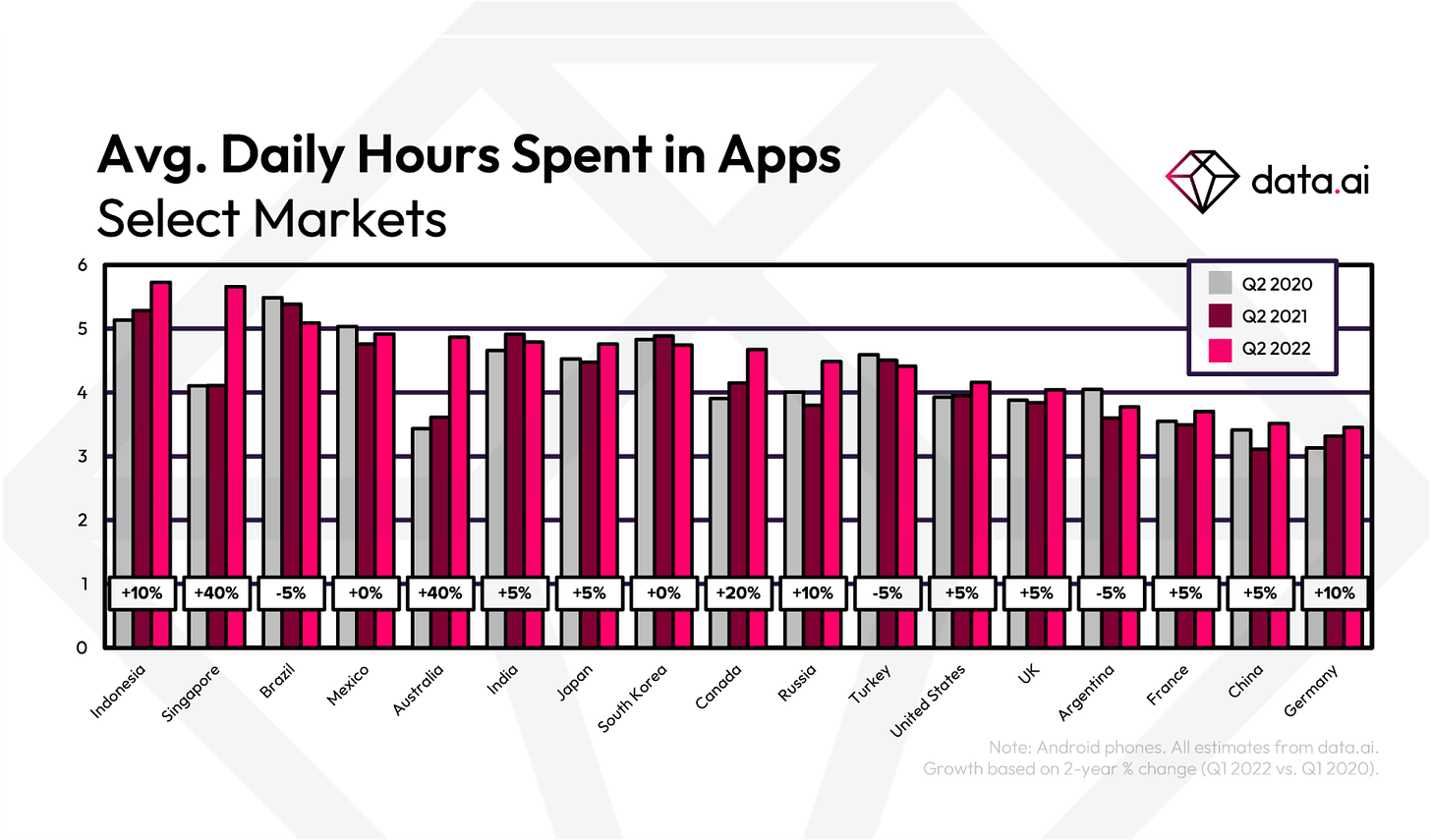

We have a mixed bag of data that suggests screen time trends differ across countries. In some cases we see hours spent in apps increasing year over year, but a good handful have been decreasing since Covid restrictions loosened.

Source: data.ai, TechCrunch