😥🙈 Red Days Hurt... It Shall Pass!

Happy Sunday everyone,

Another crazy month has passed and April is finally over. This month, we saw the largest monthly decline in the NASDAQ since 2009… The bond market hasn’t been doing well either, which is on track for its biggest yearly fall since 1920…

While it is getting increasingly scary and nerve-wracking to see your portfolio fall, don’t fear! Years from now, all of this will just be a small bump in the road!

This past week, we got earnings from the “FAAMG” stocks and also some important macroeconomic data from the government. We’ll break down all of it here!

You may be wondering why you’re getting Hump Days on a Sunday. We are always trying to provide you with more content and we hope that this new Sunday edition will give you more insights into anything relevant happening in the markets.

I hope you enjoy the first newsletter of Hump Days: Sunday Edition! :)

- Humphrey & Team

Notable Stories:

Bill Hwang, founder of defunct Archegos Capital, has been charged with securities fraud (WSJ)

Elon Musk sells $4 billion worth of Tesla stock (Bloomberg)

Weekly Data Releases:

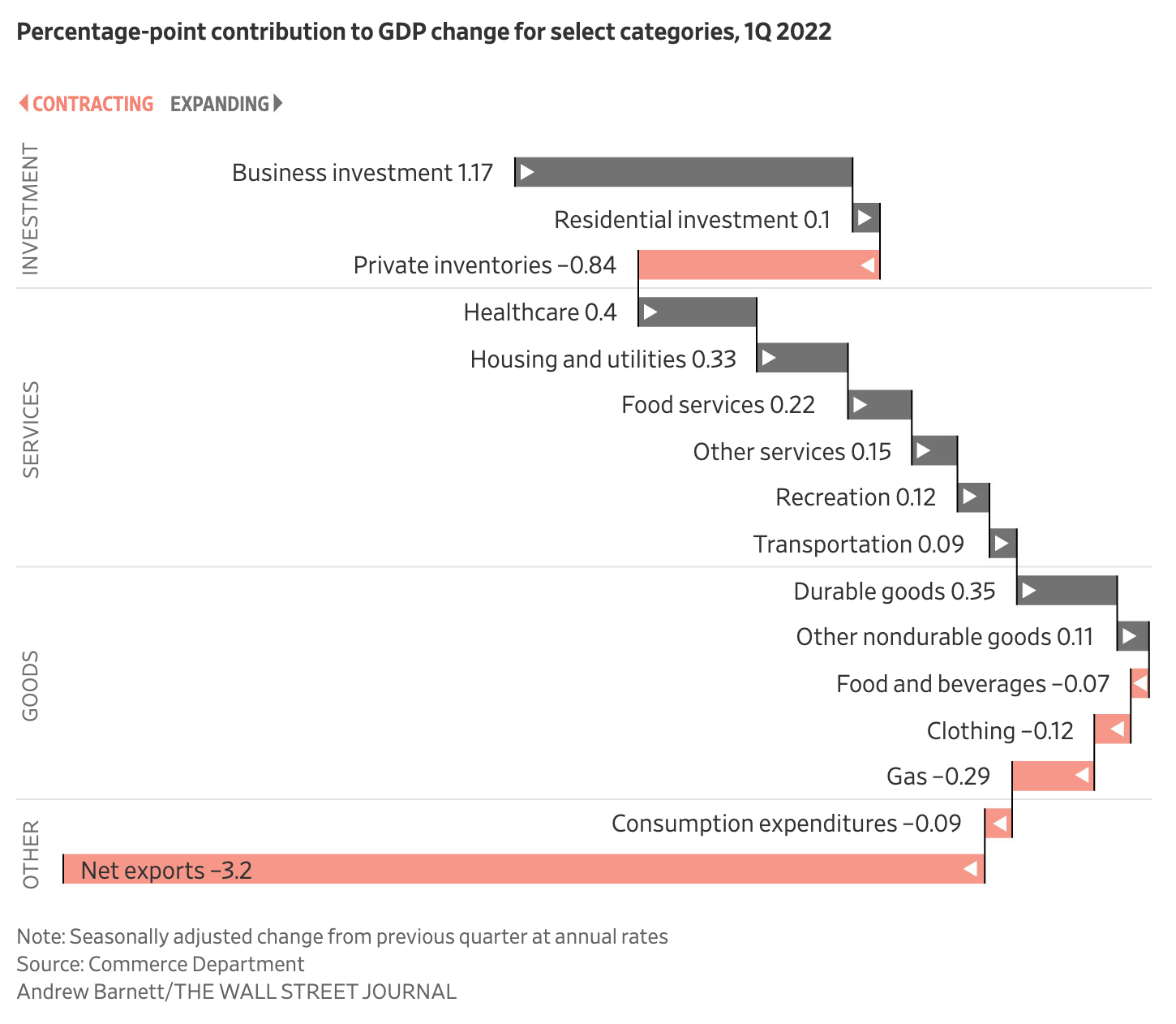

Q1 GDP: -1.4% vs. Wall Street’s estimate of 1.1%

“The drop in GDP stemmed from a widening trade deficit, with the U.S. importing far more than it exports. A slower pace of inventory investment by businesses in the first quarter—compared with a rapid buildup of inventories at the end of last year—also pushed growth lower. In addition, fading government stimulus spending related to the pandemic weighed on GDP.” - Wall Street Journal

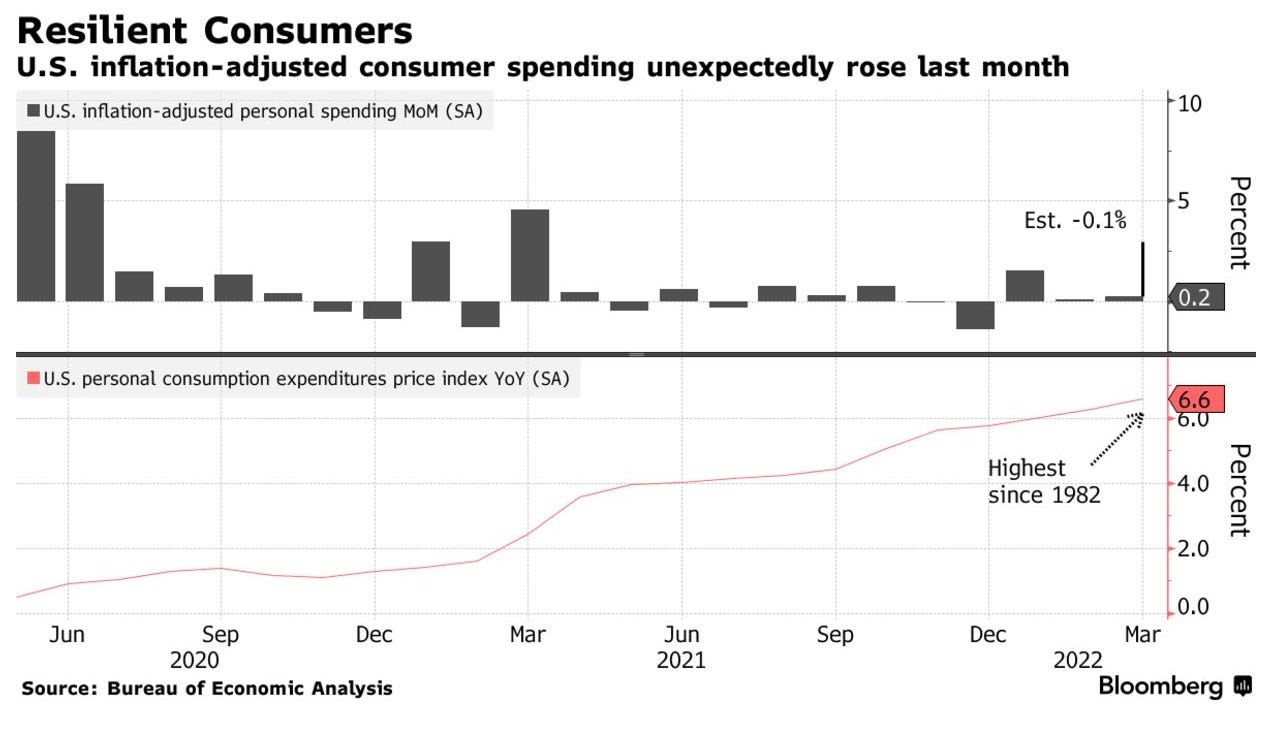

Core PCE Inflation: 5.2% vs. Wall Street’s estimate of 5.3%, the highest since 1982.

Core PCE Inflation is the Federal Reserve’s preferred inflation tracker, which is different from CPI (consumer price index) because it excludes the more volatile prices of food and energy.

Notable Earnings

Microsoft (MSFT)

Earnings per share of $2.22 vs. $2.19 est. ✅

$49.36b in revenue vs. $49.05b est. ✅

“We are entering a new era where every company will become a digital company. Our portfolio of durable digital businesses and diverse business models built on a common tech stack position us well to capture the massive opportunities ahead.” - Satya Nadella, Q3 Earnings Call

Alphabet (GOOG, GOOGL)

Earnings per share of $24.62 vs. $25.78 est. ❌

$68.01b in revenue vs. $67.89b est. ✅

Board authorized a $70b stock buyback.

“We are excited about the new opportunities we see now. Short-form video is one. YouTube Shorts is now averaging over 30 billion daily views. That's 4x as much as a year ago. In the first quarter, we added new capabilities to video editing, and we are continuing to invest in making Shorts a fantastic experience for creators and viewers alike.” - Sundar Pichai, Q1 Earnings Call

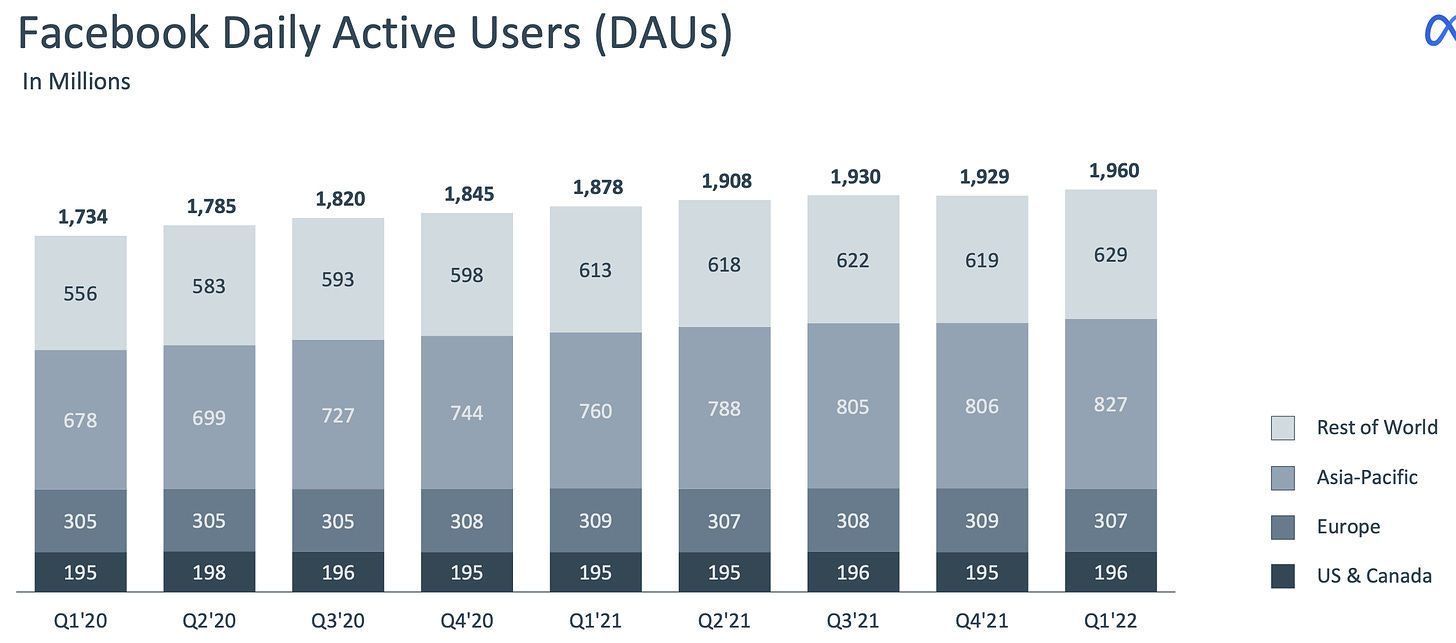

Meta Platforms (FB)

Earnings per share of $2.77 vs. $2.55 est. ✅

$27.91b in revenue vs. $28.22b est. ❌

“Over the next several years our goal from a financial perspective is to generate sufficient operating income growth from Family of Apps to fund the growth of investment in Reality Labs while still growing our overall profitability.” - Mark Zuckerberg, Q1 Earnings Call

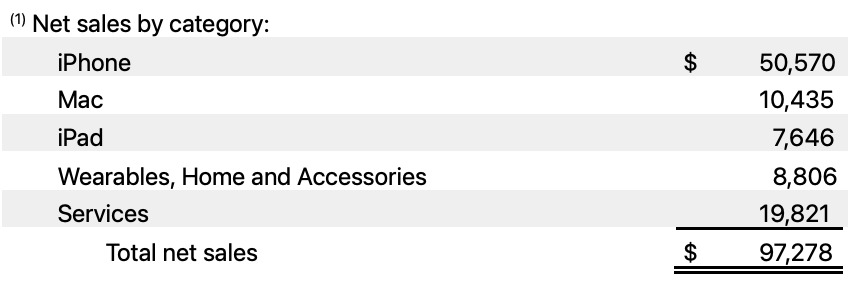

Apple (AAPL)

Earnings per share of $1.52 vs. $1.43 est. ✅

$97.28b in revenue vs. $93.99b est. ✅

“Supply constraints caused by COVID-related disruptions and industry-wide silicon shortages are impacting our ability to meet customer demand for our products.” - Luca Maestri, Apple CFO

What The Hell Happened to Amazon?

On Thursday, Amazon released earnings that stunned many, and showed how severe the supply chain challenge and inflation really are.

Earnings per Share of -$7.56 vs. $8.22 est. ❌

$116.44b in revenue vs. $116.52b est. ❌

While analysts of Wall Street projected Amazon to earn ~$4.21 billion in net income, Amazon reported a loss of $3.84 billion.

Amazon did acknowledge a whopping $7.6 billion loss from their investment in Rivian, when adding this loss back Amazon’s net income, they would’ve still missed estimates by ~$500 million.

In the earnings call, everything began to make more sense. Amazon’s CFO described how inflation and wage increases added $2 billion of costs when compared to last year. In addition, lower productivity due to overstaffing and overcapacity due to stabilized demand lead to another $4 billion of additional costs.

Overall, Amazon incurred around $6 billion in costs for the quarter! Unfortunately, the bad news doesn’t end there. Later in the earnings call, Amazon estimated that they would incur another $4 billion of these costs in Q2.

Inflation and supply chain constraints isn’t just a problem for Amazon, but for Apple as well, who estimated $4 billion - $8 billion in supply constraint related costs.

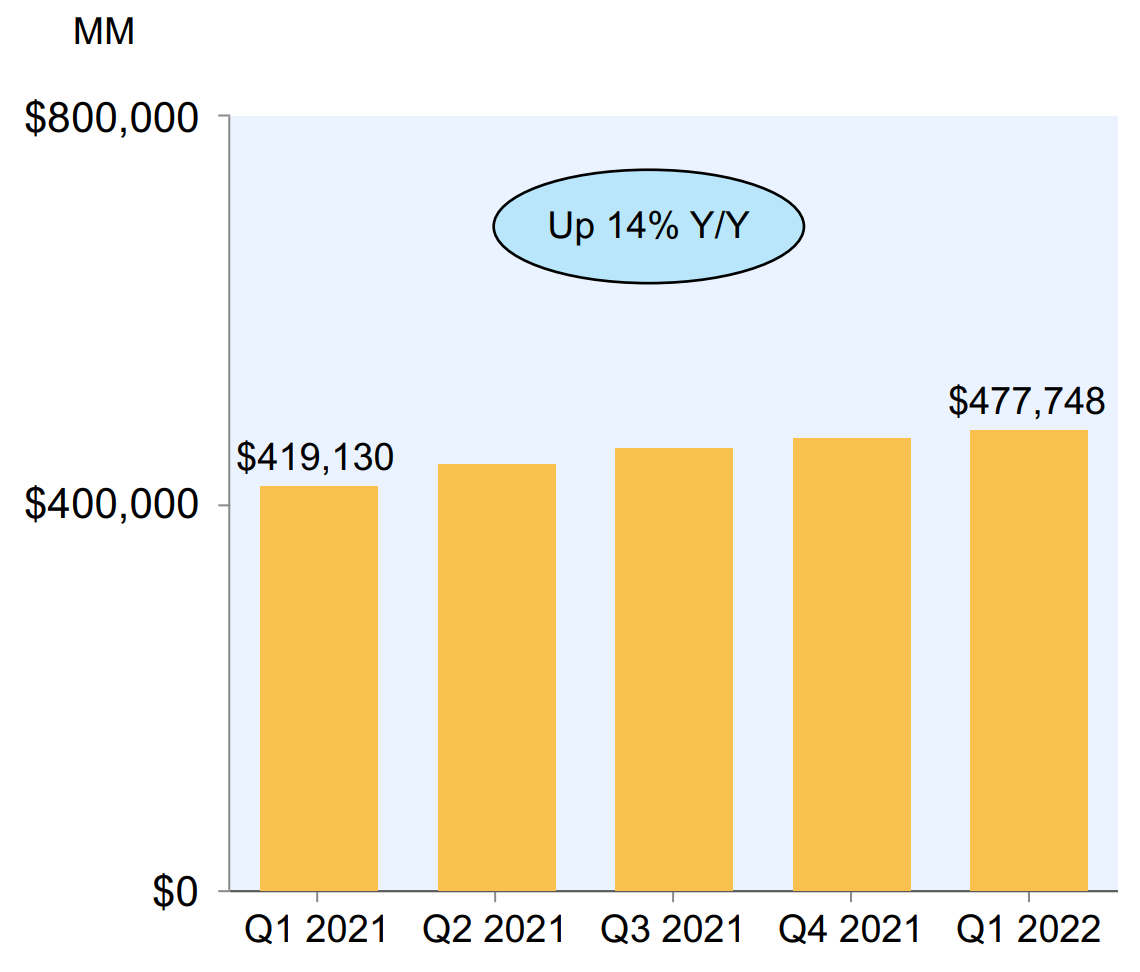

While Amazon’s expenses have increased dramatically, demand is still strong. As seen above, Amazon grew net sales 14% over the year.

So what now? Is it time to buy Amazon on the dip?

After Amazon’s ~10% drop, it’s now trading at a valuation well below its 10-year average and median valuation.

While Amazon Web Services will continue to be a strong business, the big question surrounds Amazon’s e-commerce business, especially as we enter a potential recessionary period.

Right now, consumer spending remains strong, but we still don’t know how consumers will respond to prolonged inflation.

Ultimately, investing is a long term game. All the talks of recessions, supply chain, inflation are intermediate-term issues. Ten years from now, we likely won’t be continuing to face these current challenges.

Charts of the Week

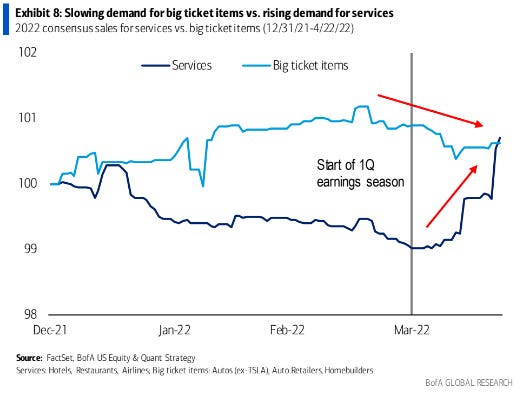

Shift from Goods to Services?

“While the service sector is benefiting from pent-up demand, demand for goods are starting to cool, particularly in big ticket items. The shift from goods to services should accelerate this year, especially if big ticket item demand slows.

Services spend is a bigger tailwind for the economy (70% services/20% goods) than for the S&P 500 (50% goods).” - Bank of America Global Research

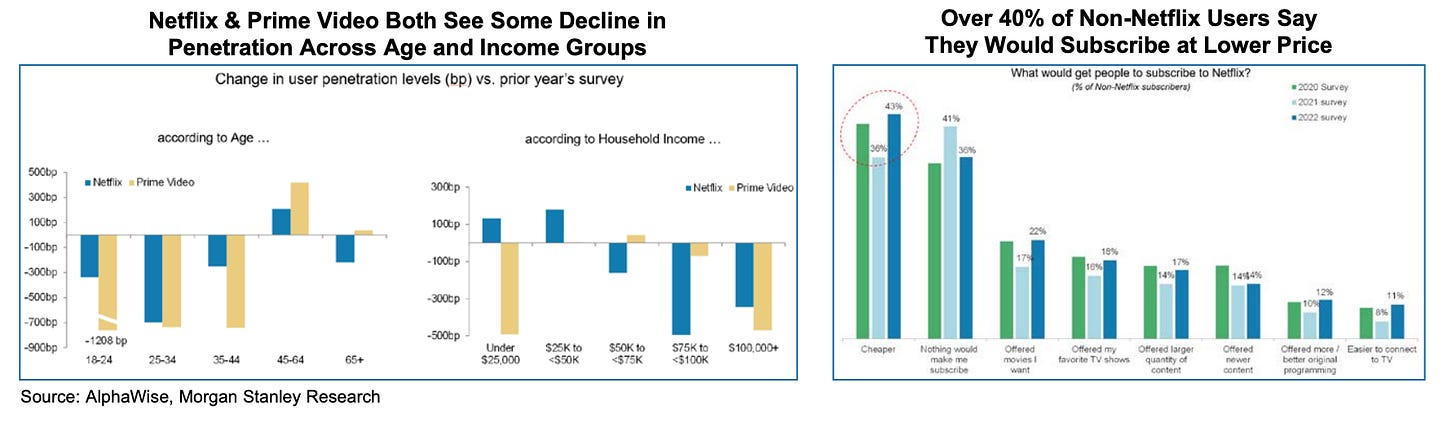

Increased Competition Eating Away at Netflix and Prime Video?

“Netflix and Amazon’s Prime Video, the #1 and #2 most-used paid services, saw their first ever year-over-year reported decline in user penetration (albeit modest).

What might re-charge growth? Perhaps lower prices: Over 40% of non-Netflix users say they would subscribe at lower price.” - Morgan Stanley Research

Upcoming Notable Earnings:

Monday: Berkshire Hathaway, Chegg Inc, Clorox Co

Tuesday: KKR & Co, Pfizer, AMD, Lyft, Microstrategy, Starbucks

Wednesday: CVS Health, Marriott, Moderna, Oatly, Wingstop, Etsy, Fastly, Reality Income, Twilio

Thursday: Anheuser-Busch, Crocs, Kellogg, Nikola, Papa John’s, Shopify, Block, Cloudflare, Corsair, Doordash, Opendoor, Zillow

Friday: Draftkings, Under Armour

E-mail Us!

If you have any questions you want us to answer, reply to this e-mail and we’ll put it in next Sunday’s edition of Hump Days!