💰🔥 Inflation Came in H-O-T

Happy Hump Day everyone,

CPI data came in HOT at 9.1% in the 12 months ended June, the fastest pace since November 1981 showing the inflation has not yet peaked. We’ll have a video breakdown on what all this means on YouTube at the end of this week.

Last week we saw the Euro reach parity against the U.S. dollar, Twitter sued Elon Musk to enforce their $44B merger, S&P 500 companies paid out a record $140.6B in dividends in Q2, the DoJ is investigating the PGA Tour over antitrust violations, Biden is scheduled to visit the Middle East, and leaked documents revealed that Uber broke laws, duped police and secretly lobbied governments.

Enjoy this week’s Hump Days!

- Humphrey, Rickie & Tim

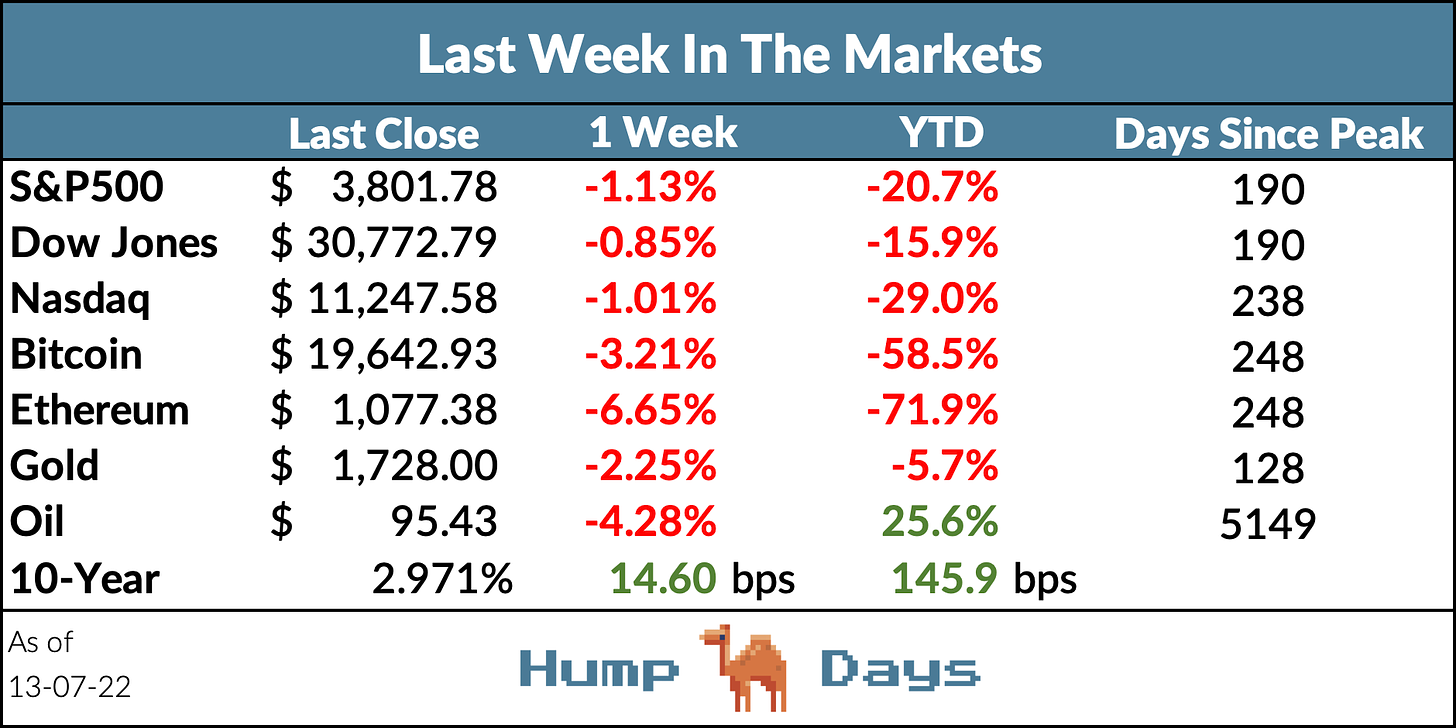

In the Markets

Featured Story

In a surprising turn of events, tens of thousands of Americans are canceling their deals to buy homes, a trend that we are seeing at the highest rate since the start of the Covid pandemic. Just under 15% of all homes that went under contract were eventually canceled in June, the highest since 2020 when home-buying came to a screeching halt because of Covid related lockdowns.

Homebuilders are also seeing higher cancellation rates with June’s data (11.8%) surpassing May’s 9.3% cancellation rate in a survey of builders by John Burns Real Estate Consulting.

Some potential catalysts for the uptick in cancellations are higher mortgage rates and surging inflation. A 30-year mortgage averaged at ~3% at the beginning of this year and has since settled around 5.75% after it briefly shot up above 6% in mid-June. These higher mortgage rates have caused many borrowers to no longer qualify for the loans they originally wanted. Lenders target a debt-to-income ratio of around 28% on the high end, however, the costs of owning a median-priced home in the 2nd quarter required 31.5% of the average U.S. wage (the highest since 2007).

On the ground however, buyers are also seeing a slowdown from the once red-hot market and the decline in competition is giving way for buyers to negotiate. Instead of waiving contingencies and inspections, buyers are standing their ground and will call off deals if issues arise in the process. On top of that, the least-affordable housing market in decades is giving buyers more reason to back out of contracts.

The Fed has a big role to play in housing prices as they set the rates at which banks lend to each other. With inflation expected to rise to another 40-year high, the Fed’s policy rate is likely to keep rising and mortgage rates could continue to be elevated. In the 1980s, the average mortgage rate was 13% and while that may dwarf the current 5.7% rate, combined with expensive house prices, it has pushed homeownership out of the question for many.

Last week, St Louis Fed President James Bullard suggested that housing price adjustments would be natural:

“It wouldn’t surprise me if we have to cool off some in the housing market. I mean that was a boom - an absolute boom in the last two years - in housing,”

For the foreseeable future, it seems that the trends we are seeing will persist as the Fed continues to try and reel in inflation.

Weekly News Roundup

Fed Sees ‘More Restrictive’ Rates Possible If Inflation Persists (BBG)

According to the FOMC meeting minutes from June 14-15 that were released last week, Fed officials solidified their resolve to keep raising interest rates for longer to prevent higher inflation from becoming entrenched, even if that slowed the U.S. economy. Officials “recognized that policy firming could slow the pace of economic growth, but they saw the return of inflation to 2% as critical to achieving maximum employment on a sustained basis.”

RH: 2% inflation sounds amazing doesn’t it?

HY: Yes Rick, 2% would be ideal right now. Unfortunately, because there’s a delay between raising Interest Rates and the effect it has on Inflation, the Fed won’t know how much is “too much” when it comes to raising rates. That’s the ultimate danger.

TC: 2% seems like a dream at this point. Like Humphrey said, the ultimate danger is the Fed raising rates too much going into a recession.

Homebuyers Are Cancelling Deals at the Highest Rate Since Start of Pandemic (CNBC)

The share of sale agreements on existing home canceled in June was just under 15% of all homes that went under contract. Higher mortgage rates and surging inflation are suspected to be causing many potential homebuyers to reconsider their purchases. Mortgage rates started this year ~3% and have now settled around 5.75%, according to Mortgage News Daily.

HY: Covered this in the latest main channel YouTube video that will be linked at the end of this newsletter!

Twitter Assembles Legal Team to Sue Musk Over Dropped Takeover (BBG)

Twitter has hired merger law heavyweight Wachtell, Lipton, Rosen & Katz as they race to sue Elon Musk for trying to walk away from his $44B takeover of the company. By hiring Wachtell, Twitter gains access to Bill Savitt and Leo Strine who both have extensive experience litigating in Delaware courts where the case will be heard. Strine in particular spent 20 years working in Delaware courts and was most recently the Chief Justice of the Delaware Supreme Court.

RH: Wachtell, the closest thing we have to a real life Pearson Hardman (for all you Suits fans out there) and Leo Strine are no joke. Twitter is coming in with their big guns to get this deal done.

HY: Will be interesting to see this play out over the next few weeks (months? years?) and get a good look at what are the ramifications of such a pull out.

TC: Getting my popcorn ready…

Charts of the Week

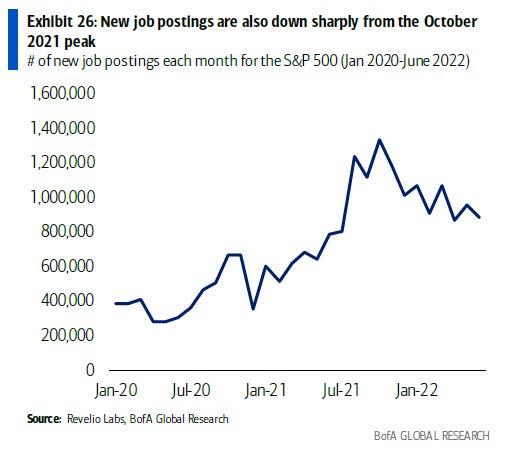

Looks like the job market is slowly starting to cool down…